A Bitcoin analyst, known as Bitfinex’ed, released a report this week arguing that a new trading bot named Picasso manipulates Bitcoin prices on Coinbase, GDAX, and Bitfinex.

Bitfinex’ed analysed order book data from GDAX, Bitfinex, and Coinbase for the past year. He watches out for suspicious activity and concludes that a known bot named Spoofy has evolved tactics to become what he calls the Picasso bot. Bitfinex’ed named the bot after the famous painter Pablo Picasso while also alluding to the market manipulation term ‘painting the tape’.

Bitfinex’ed believes Picasso may have evolved from Spoofy, a previously identified trade bot, as a way to evade detection. He wanted to differentiate the two because they use different strategies. Bitfinex’ed, however, concedes that Picasso may be controlled by a different trader to that of Spoofy.

Painting the tape achieves market manipulation by emulating trade by buying and selling between the same trader. The word ‘tape’ refers to the stock ticker tape which was once used to record stock prices. Market manipulators have evolved strategies over the years and Bitcoin offers new opportunities and challenges for such people.

The painting escalated when Coinbase suspended trading on December 7th 2017 when coincidentally Picasso was running amuck, driving up prices by trading with empty orderbooks. Picasso boosted Coinbase prices by thousands of dollars above other exchanges during this period.

Bitfinex’ed noticed that Picasso’s activity was most pronounced when Bitcoin Cash was introduced. The bot drove the currency up by 200% higher than other exchanges through the use of empty order books and ‘ask walls’. Bitfinex’ed believes that a core function of Picasso is to manipulate buy and sell orders to mimic a healthy demand.

Picasso manipulates price volatility by emulating market demand. Bitfinex’ed believes that he can spot patterns in Picasso that are non-human and suggest market manipulation.

A key component of Picasso’s trading strategy is the use of arbitrage to cash-in on demand that was manipulated. Picasso creates arbitrage by buying Bitcoin on one exchange and then selling on another, taking advantage of the thousands of dollars in difference between exchanges.

Bitfinex’ed collected his own order data going back an entire year because such data cannot be extracted from available chart data. He claims that order data is essential for detecting market manipulation because one can detect patterns re-emerging throughout the year. Such an approach allowed Bitfinex’ed to detect a change in strategy between Spoofy and Picasso.

Picasso trading bot manipulates Bitcoin price on Coinbase, GDAX, and Bitfinex according to report

An Unknown Investor Bets $1 Million On Bitcoin Price To Reach $50,000 In 2018

Currently, volatility is Bitcoin’s second name. Concerning price swings, no other commodity does it better than the world’s most famous cryptocurrency. Bitcoin showed its volatility, when it hit $20,000 earlier this week, from just trading below $1000 at the end of 2016.

However, the bitcoin experienced a massive correction that sent the bitcoin price back to the $10,000 price are yesterday. At the time of writing this report, Bitcoin has started showing signs of recovery, and the bitcoin price is now at the $14k price region as recorded on Coinmarketcap.

Unknown Investor Bets $1 Million On Bitcoin

While bitcoin haters are continually predicting the downfall of the most valuable cryptocurrency, there is a bitcoiner that has surprised the global crypto ecosystem by placing a $1 million bet on the probability bitcoin price reaching $50,000 by the end of December 2018. For even the most enthusiastic bitcoin investors, this is the bravest endeavor of the year.

As reported by Jeff John of Fortune.com, a person or people, purchased the options contracts of nearly $1 million, on the LedgerX derivatives exchange.

An official of the LedgerX exchange who witnessed the transaction has noted that:”the trade wagering on the move to $50,000 was the first of its kind on LedgerX…Just under $1 million was paid for the options in one or more trades that took place during the 24-hour period ending at 4 p.m.

Eastern Time on Wednesday, the records show. It is unclear from LedgerX’s data who the buyer or buyers were or whether the purchasing was done in multiple transactions or just one. If bitcoin is below $50,000 on Dec.28, 2018, the options will expire worthless, and the $1 million will be lost. If bitcoin rises above that level, the options will give their owners the right to buy 275 Bitcoin for $50,000 apiece-a transaction that would cost about $13.8 million.”

It remains to be seen if this move is a wise one or a stupid uncalculated risk. The only thing that is certain right now is that Bitcoin and other cryptocurrencies will gain more magnificent grounds in future, but no one can really pinpoint where the Bitcoin price will get to. These are exciting times indeed in the crypto world.

Christmas Sale on BTC! Bitcoin prices lower making it a great time to buy!

Introduction

Bitcoin and a bunch of other cryptocurrencies are on sale! Bitcoin prices have dropped dramatically! On December 21st of 2017 the prices of Bitcoin has dropped from the high 19 thousand to the mid 14 thousand, although this could be bad for some investors that invested late near the 16 thousand to the 19 thousand, it is mostly a good thing. It encourages investors to buy a lot more Bitcoins for the high rise. This is surely a Christmas sale investors will never forget.

Why or How is Bitcoin So Low?

Well, it is simple, there’s a huge amount of consumers that are spending their money because of the holidays. This is causing the supply to get lower thus making the currency lower. An altcoin overload could also be the reason for the drop in Bitcoin. Possibly still cause by holidays.

The bubble could also be real and the support for Bitcoin could well be done for life. The United States (US) also want taxes to be implemented on Crypto. If so then BTC may never rise again.

What should you do now?

Since almost all Cryptos has been affected than it would be a great time to buy! It is possible that by next Christmas Bitcoins may rise even higher! If you have bought any Bitcoins when it was in the 20 thousand zone than you should sell them and buy them when Bitcoin becomes lower. Other cryptos became lower to the point where you can get 20 times more than what you have invested, you could go in for those like ARK, MANA and Ripple (XRP).

If you do this things then you will definitely get a great investment! We wish you a merry Christmas and hope you make the right investments!

This Article is an opinion from The Author and is not an investment advice, You’re Advised to Always do your own independent Research, Merry Xmas and a blissful New year.

Bitcoin tax passes both houses of congress making altcoin exchange a taxable event

A new Bitcoin tax has been introduced in America that will make “like kind” exchanges between cryptocurrencies a taxable event.

The transfer of currency, say between Bitcoin and Ethereum, used to be a “like kind” exchange similar to trading property or works of art. The tax change, however, makes the exchange limited to “real property” excluding cryptocurrency from the ‘tax loophole’.

Both houses of congress passed the new tax bill with nothing but the President’s signature to introduce the new tax reform. The new bill comes as tensions rise about the rising price of Bitcoin and unexplored loopholes of tax minimization.

The proposed change suggested that “the tax act in Sec 13303 amends IRC Section 1031 (a) (1) to delete “property” and replace it with “real property”. This means that a currency trader cannot claim Section 1031 to defer tax charges while exchanging say Bitcoin for Ethereum.

Section 1031 of the Internal Revenue Code originally defined “like kind” exchange as being of property rather than merely ‘real property’. The change to the tax code limits “like kind” exchange to real estate deals only. A property investor, for example, would not pay tax on their property until selling it. They could perform renovations on the property and increase its value but not be expected to pay tax on each change.

Republican Jared Polis proposed alternate tax codes that would lighten the burden for cryptocurrency traders. His changes, however, did not make the final amendments made in congress.

The changes come as the IRS continues to increase its scrutiny on Blockchain transactions. The IRS has continued to develop software for chain analysis. Such changes make tax evasion through Bitcoin exchange more difficult. The IRS, additionally, has performed studies on Bitcoin users to understand the market more thoroughly. One study found that only a limited amount of Coinbase customers reach a tax bracket high enough to be tracked.

Islamic State Terrorists Use Bitcoin to Fund Military Operations in Syria

A former CIA analyst in counter-terrorism, Yaya Fanusie, has published a report warning that Islamic State terrorists are using Bitcoin to fund operations and that such a trend may worsen if more advanced exchanges are used to fund terrorism.

Mr Fanusie, having a background in counter-terrorism with the CIA, now works for the Foundation for the Defense of Democracies advising on national security issues relating to terrorism. He currently focuses on issues of illicit finance and serves as a director for the foundation.

A report was released this week by Mr Fanusie outlining a recent security threat where Islamic State was using Bitcoin more frequently to fund terrorist operations. The report was published on the website Cipher Brief and outlined some recent activities of Islamic State financial activities.

The report sourced its material from various terrorist websites including those of Al Queda and Islamic State. It also made reference to the observations of various groups that monitor the activities of terrorist organisations.

The largest Bitcoin activity noticed was that of an Islamic State group funding a Syrian military facility. The group al-Sadaqah advertised funding for the facility in November this year and used the social media platform Telegram to spread the propaganda. The campaign requested $750 of funds to build a military facility in the Latakia province of Syria.

On 30th November 0.075 bitcoin was sent to the al-Sadaqah address and the funds were sent to another address soon after. The funds were initially worth $685 but when they were transferred again they were now worth $803 due to Bitcoin’s rapid price rise at the time.

Fanusie noted that a downside for terrorists transfering funds over Bitcoin is that the Blockchain can be seen by all and funds can be tracked. Chain analysis can be used by counter-terrorism experts and law enforcement to disrupt Islamic State operations. Despite the transparency of Blockchain, an Islamic State campaign was still active on 20th December requesting Bitcoin funds to support Syrian operations.

Terrorist organisation like Al Queda and Islamic State often use social media platforms like Facebook and Telegram to disseminate propaganda. The social media platforms have regularly removed propaganda when notified of them. The terrorists, however, have created new accounts in response to these actions.

Fanusie suggests that despite the limitations of Bitcoin technology in terms of privacy for terrorists, more advanced exchanges could make terrorist operations difficult to trace. He also suggests that regulation is a key to stopping the spread of terrorist funded Bitcoin and says key areas of Africa and the Middle East are at risk because Bitcoin can be traded there with little regulation.

Perth Company Set To Create An Australian National Cryptocurrency Exchange

Even with the unending volatility Bitcoin, many firms are joining the ‘Bitcoin jet to the moon. With each passing day, brand new companies are starting up in the cryptocurrency arena. Startups and large corporations who in the past were nowhere near the Blockchain route are now re-strategizing their operations to cut across Bitcoin, and the Blockchain technology.

Somewhere in Perth, Western Australia, a new technology company has caught the Blockchain fever and is making serious arrangements to bring positive change to the Australian Bitcoin and cryptocurrency market by creating a national cryptocurrency exchange.

The Australian National Currency Exchange (NCX)

The NCX is poised to start up an Australia cryptocurrency exchange in the coming year. When the project gets started, the exchange will focus on the two most popular cryptocurrencies- Bitcoin and Ethereum Altcoin but will add many other significant cryptocurrencies and even initial coin offerings (ICO).

Going by reports of Daniel Newell www.thewest.com.au/business/money/perth-tech-firm-to-open-australias-first-cryptocurrency-exchange-ng-b88697655z the CEO of NCX, Tommy Shin has noted that $750,000 has been successfully gathered through private investors who are interested in the huge Australian bitcoin exchange project.

The CEO has assured stakeholders that the exchange will follow all government regulation and security standards accordingly, and would work in line with the provisions of the Australian Digital Commerce Association. The NCX chief executive has declared that:”We will also be adhering to best practice and industry standards used in the verification of users’ ID as part of Know Your Customer. We have also implemented real-time reconciliation and best practice accounting processes in place to ensure transparency.”

NCX significant support comes from Subiaco Lateral, a technology company whose area of specialization is in the provision of expert service in the security and optimum management of infrastructure and building of customer engaging mobile apps.

According to reports, in addition to creating an Australian national Cryptocurrency exchange, the firm would also create similar Bitcoin exchanges in countries like Singapore, Malaysia, Indonesia, Croatia, and other Asian countries, in the next two years.

The NCX establishment of Bitcoin exchanges in the Asian continent is an excellent development in the cryptocurrency world especially at a time when the Chinese government have put a blanket ban on ICOs and Bitcoin exchanges in China. At the time of writing this report, the bitcoin price is in a bloodbath.

According to coinmarketcap, the Bitcoin price has gone down to the $13,000 price area. Developments like the NCX government supported bitcoin exchange will massively contribute in a positive way to the price of the world’s pioneer cryptocurrency.

Crypto Hedge Fund Sued for Defrauding Investors

A class action has been filed against a Delaware-based cryptocurrency hedge fund for defrauding millions of dollars from investors during what was meant to be an Initial Coin Offering (ICO).

David Miller, partner of Silver Miller, filed a lawsuit on behalf of five applicants against Mr Harrison and his company Monkey Capital. The applicants claim that Mr Harrison defrauded them of $3.8 million worth of cryptocurrency by failing to abide by his financial contract.

Mr Harison, a wealthy financier and heir to printing company Harrison & Sons, used the initial funds to invest in other companies and did not primarily use the funds for creating the company Monkey Capital. The funds were initially collected in July this year but it didn’t take long for things to turn sour.

Alarm bells rang for the applicants when the website for Monkey Capital was taken down in early August without explanation. Harrison had liquidated their investments and devalued their initial currency days before business was meant to start. The investment was meant to acts as a decentralized hedge fund with its own functioning cryptocurrency.

The ICO was meant to operate with an initial currency called Coeval that would eventually be traded with tokens called Monkey Coins. The investors expected to eventually trade their Coeval tokens for Monkey Coins when the Monkey Capital Market was finally completed.

The lawyer filing the class action, David Miller, is no stranger to cryptocurrency lawsuits and currently is pursuing actions against Coinbase, Kraken, and Cryptsy exchanges. He is also credited with the first federal suit against an ICO with the case of Tezos, a billion dollar crypto start-up.

The applicants wish to have their cryptocurrency funds returned and to further have funds returned to all investors of Monkey Capital. Their lawyer David Miller wishes to have Mr Harrison charged with abandoning the unregistered ICO.

The applicants were of the impression that Monkey Capital would be a source of “perpetuated wealth creation” and did not foresee the abrupt abandonment of the hedge fund. Monkey Capital had a white paper that outlined that perpetuated wealth would be created by using the ICO as capital for further investments.

David Silver claims that the applicants clearly expected profits from the agreements with Mr Harrison and that these constituted a financial contract. He also stressed the need for regulation of cryptocurrencies to avoid such pitfalls with such an emerging market. Mr Silver also encourages other people affected by the Monkey Capital fallout to contact Silver Miller partners for advice on the class action lawsuit.

Mr Harrison denies the charges and claims that he will be vindicated in the end because he is innocent of any wrongdoing.

Bitcoin Investor Predicts Bitcoin Price To Drop Further Next Week

The Bitcoin price has seen a significant correction from well over $19,000 to a present price of $16,800 as recorded on coinmarketcap , Some believe the Bitcoin bloodbath is due to the upcoming festivities as many bitcoin investors are selling bitcoin to have money for the celebration of Christmas.

Dan Morehead Says Bitcoin Price Will Fall Lower

Dan Morehead – CEO and founder of Pantera Capital, a San Francisco based investment company which focuses on Blockchain technologies, has said that the Bitcoin price could drop 50 percent in the coming week and could reach last month’s lowest levels. But in the long run, the bitcoin price will exceed its current all-time high.

Morehead, a bitcoin investor and enthusiast himself, has said that Blockchain based cryptocurrencies like Bitcoin, Ethereum and Ripple are still young because the cryptocurrency ecosystem would be here for many decades to come. He further noted that there would be massive gains and minor loses for all cryptocurrencies soon.

Morehead had the foresight of buying his first bitcoin when the price was just $72. The CEO believes the price of Bitcoin will surpass by far its current rate of less than $20k by 2018.

A Financial Juggernaut

Dan Morehead began his financial career at Goldman Sachs as a mortgage-backed security trader. Morehead was a one-time financial officer at Tiger Management, a hedge fund created by Julian Robertson.

Pantera capital was built in 2003 by Dan Morehead as an institutional investor focused solely on digital currencies. However, it was not until after 10years that the company started its cryptocurrency fund.

The fund made skyrocketed by 60% in November and December and had seen a massive 12,000% rise in four years. The CEO has said cryptocurrency mining is growing at a voracious pace, and at some point, it was doubling miners capital every six weeks just like “Moore’s Law on crack.”

However, mining difficulty has increased in recent times, making the mining ecosystem more competitive.

Morehead remains optimistic about bitcoin, Altcoins and cryptocurrencies in general.

The Morehead Token Sales

Back in June, Dan Morehead said he had the ambition of raising $100 million by the end of summer, to focus more on Initial Coin Offerings. The fund had already raised $35 million in June.

Pantera capital was created to buy tokens before the public sale and also at the auction. The new cryptocurrencies have different characteristics and report to different regulatory agencies.

Pantera sees each project differently and has invested in Ox, FunFair, Omise and Civic.

The fund prefers token based networks in contrast to ICOs.

Dan Morehead Image Via CNBC

An Open Letter To Satoshi Nakamoto

Dear Satoshi,

I, my family, friends and fellow Bitcoiners are grateful to you for this life changing decentralised money; you have created for the good of humanity.

Whoever you are, wherever you might be, may God and Karma keep bringing you good tidings. Since what goes around comes around, as the law of karma states, may positive energy and inspiration keep hovering around you and your family forever, because you’re a good man.

Bitcoin, your excellent creation has changed my life and the lives of many. Although I joined the Bitcoin plane to the moon pretty late, I am happy because, since 2016 when I bought my first Bitcoin and became a diehard fan of bitcoin, the value of my bitcoin against the U.S dollar has risen a thousand times higher.

Now, I no longer struggle to take care of my family bills and general upkeep of the home.

Your brainchild has created numerous employment for people all over the world, like Bitcoin mining, bitcoin trading, and more. Even companies like eBay who sell Bitcoin mining machines and also the manufacturers of ASICs Bitcoin mining machines have made huge profits from the trade.

Also, I would like to let you know that your choice to stay anonymous since 2008 is a good thing because some world governments and central banks are feeling threatened by Bitcoin. If they had known where you reside, they would have kidnapped or even killed you by now.

Satoshi, because of your Bitcoin inspiration, the world has now woken up to the possibility of deploying Blockchain technology to various aspects of life. If not for you, the powers of Blockchain would still be untapped.

My good friend Satoshi, I could go on and on talking about the countless good things that bitcoin has done for many other people in the world and me. However, I know you might be rushed thinking about more important ideas.

Please Satoshi, just one last thing. I need you to do me a little favor.

Right now, there is a bit of confusion in the world as to what the real bitcoin should be. I hope you are aware that back in August there was a hardfork on the bitcoin network. This hardfork gave birth to Bitcoin Cash. Roger Ver and his colleagues are going around town, telling the world that his Bitcoin Cash is the real Bitcoin just because it is faster and cheaper.

Satoshi, it appears Segwit cannot solve the scaling issues of the Bitcoin network, and now Bitcoin transactions have become slower than even a snail. I am terrified of what this slowness might lead to because many more people are using Ethereum and all the Altcoins just to send super fast payments with very cheap transaction fees.

Satoshi, I know our Bitcoin is the real one that is why the value keeps going up, but I would love it if you can find a solution to this slowness because a lot of people are coming up with different forks to our Bitcoin network. There is even one man that says he will bring Bitcoin God fork on December 25. Please man, you need to act fast before these guys turn our world upside down.

Also, I would like you to tell the miners to reduce the fees they charge Bitcoin users when sending payments.

Just yesterday, I tried to send $20 worth of Bitcoin to my Mother in Africa, and I paid almost $12 for transaction fees. If not for the love I have for bitcoin, I would have bought Ethereum or even Ripple and sent to her just like my best friend who was charged almost $30 for sending less than $200 Bitcoin, and he got angry and threw Ethereum instead.

Please Satoshi, my birthday comes up on December 25. For my birthday present all I want is for you and your team to make the Bitcoin miners fees as low as possible and enable faster transaction confirmation time so that my friends from all over the world can send me Bitcoin as Birthday presents.

Lastly, please do not bother revealing your true identity anymore because Bitcoin has removed powers from traditional financial institutions and now they are looking to assassinate you since many people no longer need them to transfer money. Please remain healthy and safe.

We will always love you!

Signed

Osaemezu.

Blockchain-Based Jobs Are Helping The World End Poverty And Unemployment

Since Bitcoin created in 2009 by Satoshi Nakamoto, the world’s first cryptocurrency in 2009 the cryptocurrency ecosystem has been on a forward match since then.

In the beginning, just a handful of people especially computer programmers and technology enthusiasts had interest in Bitcoin and Altcoins. However, more people began to notice Bitcoin and cryptos since the latter parts of 2016 when the massive bullish Bitcoin trend set-in. Bitcoin has also made the demand, and investments in cryptocurrencies to skyrocket, creating various job vacancies for Blockchain experts.

Keen Interest In Cryptocurrency Jobs

Lately, job postings relating to Blockchain and cryptocurrencies have become a commonplace. As noted by a job search website www.indeed.com, the number of job vacancy postings associated with Blockchain, and cryptocurrencies have risen by nearly 621% since November 2015.

Some companies like Uber, eBay, Capital One, Match.com, and GEICO are few examples of companies that have searched for and interviewed job seekers who have listed “Bitcoin” or “Blockchain” in their curriculum vitae.

Jobs based on cryptocurrencies and Blockchain are often found on social media apps like Reddit, with subReddits like r/forhire, r/Jobs4bitcoin and many more, often displaying job postings related to Blockchain technology.

It is essential to note that there has been a 1,065% rise in job searches on indeed.com related to cryptocurrency and Blockchain. There is also an array of websites that Blockchain experts can find suitable employment on a freelance basis and full-time work. Websites like www.xbtfreelancers is an excellent place to find crypto jobs, with employers posting new vacancies almost every day.

This new trend points to the truth that employers and workers in Bitcoin and Blockchain space are on the rise and if this trend persists, within five to ten years time, Bitcoin and Blockchain technology would have gained a widespread adoption all over the world.

Some Examples of In Demand Blockchain-Related Jobs

Some of the hot jobs in Blockchain environment include Blockchain app development, project managers, cryptocurrency miners and technicians, data scientists, crypto news writing and reporting and many more job titles could be found on cryptocurrencyjobs.com, Xbtfreelancer.com and a host of other sites. In the crypto workspace, employees get paid in Bitcoin and their preferred Altcoins, and if it’s an ICO project, workers would usually receive the new coins or tokens being created, in addition to getting paid in fiat or cryptocurrency.

The first point of call in securing a Blockchain based job is to fire up your passion and enthusiasm for Blockchain and then to move on to learn any aspect of the Blockchain technology that suits you. Most Universities are yet to start offering Blockchain courses, but you could start learning about Blockchain technology by taking Princeton’s Bitcoin and cryptocurrency Technologies courses via Coursera, at www.cousera.org/learn/cryptocurrency.

In addition, it is often a good move to have prior background in the area of Blockchain endeavor you see you feel like pursuing a career. For example, if you want to build Blockchain based applications, it becomes more comfortable for you if you had a prior understanding of programming.

With the continuous integration of Blockchain and cryptocurrency by small firms and established corporations into their operations, the need for talents in the Blockchain technology field is expected to rise further in soon. Why not join the Blockchain revolution today and secure your future.

The Old/New Bitcoin Hard Fork. Segwit2X

Block No. 501451, which is planned to be produced roughly speaking on December 28, 2017, will be decisive for the old/new fork Segwit2X, and a Christmas present for the entire crypto-community. An experienced team of developers declares that it will resume activity based on the launch of the suspended project on its website.

“Commission and transaction speed within the Bitcoin network reached inconceivable values. In the last month, the average commission of the network was 15-20 US dollars, and the confirmation rate could reach several days. It is simply impossible to use it as a means of payment.

General information about the new Bitcoin Segwit2X

- Estimated fork date: 12.28.2017

- Total issue: 21 million

- Protection against repeated transactions: Yes

- Block extraction speed: 2.5 minutes

- Mining: X11

- Block size: increased to 4 mb

- Recalculation of complexity: after each block

- Unique address format: Yes

In addition, the Roadmap project has the following positive changes:

- Offline codes

- Support for Lightning Network, instant transactions

- ZkSnark

- Smart contracts

- Anonymous transactions

Our team will carry out the Bitcoin hard fork – Segwit2X, which was expected in mid-November. At the same time, its futures trading is conducted on some exchanges, including HitBTC.

We promise that all BTC holders will receive, not only B2X in the ratio of 1:1, but also as a reward for your commitment to progress, the proportional number of Bitcoin of Satoshi Nakamoto who mined it in the first year of the network’s existence,” commented Jaap Terlouw, the project CEO.

The new fork will appear as a result of the revival of Segwit2X, initiated by a group of professional developers. The idea is to resume and refine the suspended project, to create a really anonymous and instant Bitcoin. At the same time, the goal of this work is not the replacement of the original network, but the effective coexistence of two networks with different purposes.

Follow the news of the project on the website: http://b2x-segwit.io/

Telegram chat: https://t.me/Segwit2_X

Ukrainian Security Officials Raid Forklog Cryptocurrency News Office Over Money Laundering Allegations.

With the ever-rising price of Bitcoin cryptocurrency, some governments have become quite wary of Bitcoin and are always on the lookout for hints of fraud and illegalities involved in the operations of citizens. While Bitcoin and all other Altcoins provide a cheap, fast and secure way of carrying out payment transactions, some bad actors have used cryptocurrencies to aid their criminal activities in recent times.

The Forklog Raid

In the early hours of December 15, officials of the Ukrainian security service (SSU) with two other civilian witnesses invaded the residence of Forklog’s founder, Anatoly Kaplan. Kaplan is famous in the Ukrainian crypto space because of his Forklog media, which is a highly reputable name in Bitcoin, Blockchain and cryptocurrencies reporting in Ukraine.

The search team alleged that a group of Ukrainian and US nationals had carried out fraudulent exchange of Bitcoin to hryvna using bank cards via the Forklog online platform.

However, officials of Cryptomedia have expressed surprise over the issue, reiterating that neither Forklog nor websites associated with it have the capability of carrying out such transactions. The officials further stated that none of the suspects has any connection with Forklog or its founder.

The officials have claimed that several of Kaplan’s belongings were seized during the search. The CEO has also claimed that the security officials tried transferring his Bitcoin to another address, but he swiftly called his lawyer, who in turn called the police notifying them of an ongoing robbery attack.

Kaplan further claimed that a vast sum of the Ethereum Altcoin was transferred from his ether wallet to a newly created one and that’s not all, Kaplan has also reported a failed attempt by an anonymous person to withdraw 3000 hryvna (about $110) using his bank card.

Mr. Kaplan has expressed his disappointment saying:”I believe that this strange situation perfectly illustrates one of the possible scenarios for the state-crypto community relationship. That is why we decided to make it public. It’s not as much about protecting my interest as it is about the interest of the entire community. This sends a warning to everyone who is in any way connected to Blockchain technologies. It does not matter if you are a public figure.

Right now we are trying to return what we believe was unlawfully seized from us. We find the attempts to transfer cryptocurrencies to wallets controlled by SSU agents to be an extremely strange practice. Other than ETH, large sums in several other cryptocurrencies were moved to freshly created wallets. As to Bitcoin wallets, the situation is not quite clear yet. During the search, my lawyer has detected a score of other procedural violations, including turning off the camera.”

As observed by various sources, the information technology sector in Ukraine lost almost $40 million in 2017, due to unlawful law enforcement pressure. These officials have reportedly seised and even damaged expensive equipment worth of approximately $9 million.

These unlawful attacks have risen due to the exponential growth of the Ukraine Cryptoindustry in 2017. SSU officials have started attacking Bitcoin mining farms even though mining is a legal activity in Ukraine.

Judging by the statement of Kaplan, it appears this is another case of an illegal raid. It is entirely heartbreaking to know that security officials who are supposed to carry out their duties lawfully thereby leading by example are the ones even perpetuating acts of indiscipline and fraud.

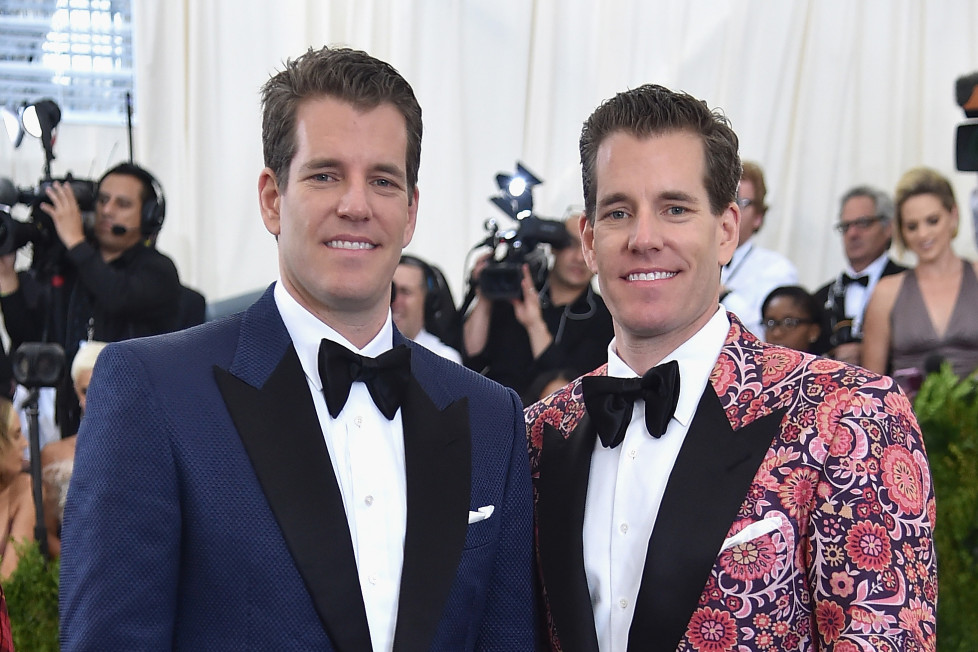

Jamie Dimon Cannot Short Bitcoin- Says Billionaire Winklevoss Twins

The world’s number one Bitcoin skeptic, Jamie Dimon has been challenged by billionaire Winklevoss twins to short Bitcoin if he thinks Bitcoin is a fraud and a bubble.

In recent months, the JP Morgan CEO has not ceased making downgrading comments about the world’s pioneer cryptocurrency. Jamie Dimon really can’t stand Bitcoin and has made it clear enough that he will not hesitate to lay off his employees who invest in Bitcoin. The CEO has also said Bitcoin investors are stupid because Bitcoin is worse than tulip mania bubbles.

Jamie Dimon Challenged

The billionaire Winklevoss brothers have challenged Jamie Dimon to demonstrate he truly hates Bitcoin by going short on Bitcoin in the futures market. In an interview with Fox Business, the wealthy twins urged the JP Morgan Chase CEO to lead by example and put a large chunk of his company’s money into a bearish Bitcoin market that he believes will happen in the long run.

One of the twins, Cameron said:

“we’ve been working really hard to give Jamie Dimon an opportunity to short Bitcoin, and anybody who says that you know, it’s a fraud or a bubble, you can go now [and] put your money where your mouth is, and bet against it.”

Jamie Thinks Bitcoin Is A Big Threat

One of the advantages of the recently launched Bitcoin futures market by the Chicago Board Options Exchange and the CME is that they give Bitcoin skeptics like Jamie Dimon who believe the market would ultimately fall to ground zero, the chance to invest on a Bitcoin bear market. Cameron one of the billionaire twins has dared Dimon to short Bitcoin and invest against the long-term performance of the cryptocurrency.

While Dimon has publicly demonstrated his dislike for the cryptocurrency by continually badmouthing Bitcoin, some Bitcoin analysts and cryptocurrency enthusiasts see Dimon from another perspective.

The co-founder of Blocktower, Ari Paul is of the opinion that Dimon has a solid understanding of Bitcoin, but he is purposely badmouthing Bitcoin because he sees Bitcoin as a threat to their dominance over the offshore banking industry. Ari Paul stated that:”So most of the financial luminaries, I think genuinely don’t’ understand what it’s trying to be. Jamie Dimon’s an exception.

By all accounts, I know people who spoke to him about cryptocurrencies four years ago. He gets it, he understands it, probably better than me and he views it, I think as a brand new competitor to JP Morgan. So he understands that JP Morgan collects a lot of fees for providing storage of wealth in a secure way that’s judgment resistant to clients and Bitcoin does it an order of magnitude better.”

The Bitcoin enthusiast believes the JP Morgan Chief has been criticizing and condemning Bitcoin, not because of its structural, technical and conceptual flaws but because Dimon sees the world’s number one cryptocurrency as a competitor for the majority of JP Morgan’s profits.

At press time, the price of Bitcoin has experienced a minor pullback to the $18,000 price region. It remains to be seen if this is the beginning of a Bitcoin bloodbath or if it’s just another pause for a tremendous bullish rally.

Breaking: $500K Bitcoin Of Dark Web Drug Dealer Now Worth Over $8.5Million; Officials Rush To Sell.

The dark web is the underworld of the internet. Websites on the dark web can only be seen from darknets. The dark web is part of the deep web, is a part of the internet that is not indexed on traditional search engines. To access the darknet, specific software must be added to your computer or device, with extra configurations and authorizations.

The darknet offers its users a higher level of encryption and anonymity; this is why it is home to gangsters, illegal drug dealers, and sellers of all kinds of restricted products.

Bitcoin Has Skyrocketed

Bitcoin has seen an exponential rise in its market value since early 2017 when the Bitcoin price first reached a record high of $2000 for the first time in its life. Bitcoin, created in 2009 by a Japanese cryptographer, offers its users a fast and secure form of sending and receiving money.

Aaron Shamo, a 27-year-old U.S man, was arrested in November 2016 in connection with the illegal sales of hard drugs on the dark web.

Back on November 3, 2016, the price of Bitcoin on Bitstamp was about $727, and approximately $500,000 worth of Bitcoin was seized from Shamo. Now in 2017, at press time, the Bitcoin price has reached the $18,000 price area as recorded on CoinMarketCap, taking the accused seized Bitcoin value to over $8.5 million.

Officials In A Rush To Sell Seized Bitcoin

The U.S officials prosecuting the hard drugs case are planning to sell-off the over 8.5 million worth of Bitcoin seized from the accused Shamo. An official of the Utah Law office, Melodie Rydalch has said that: “For federal prosecutors in Utah, sales of seized assets like cars are routine, but bitcoin is new territory.

The proceeds of the bitcoin sale will be held until the case is resolved, and then decisions will be made about where the money goes.” In the U.S, it is the norm for the proceeds from seized asset to go to the agency that championed the investigation, in this case, The Drug Enforcement Administration.

This $500,000 drug bust is ranked among the most significant drug busts in the United States in recent times. In addition to the Seized Bitcoin, a lump sum of $1 million was also seized from the accused, which he stuffed into trash bags.

Aaron Shamo has pleaded not guilty to a dozen charges which include money laundering, possession of Fentanyl amongst other charges.