In 2009, when Satoshi Nakamoto invented a new age digital currency by writing the code for the first ever cryptocurrency termed as Bitcoin, the entire world was perplexed of its acceptance. Followed by the emergence of many other new cryptocurrencies since last 10 years, this form of digital money has witnessed diverse eye-popping incidents including drastic price fluctuations, growth and development, and hacks among others.

The Talking Points

- With Bitcoin and Ethereum as the most popular and globally recognized cryptocurrencies, this digital money is also referred to as peer to peer cash. Also used in pet industry now.

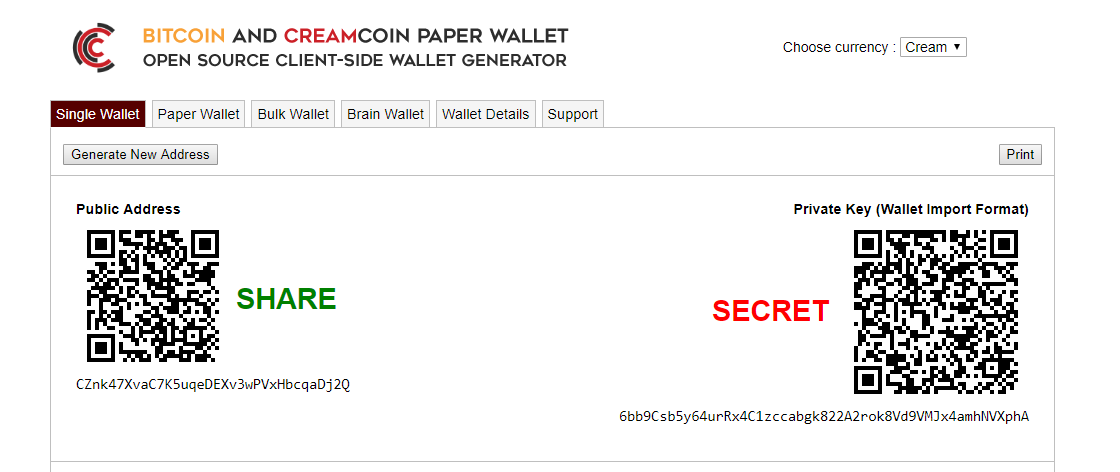

- Such P2P currencies are not created by any central banking authority but distributed consensus and use a specific blockchain technology for validation. Cryptocurrencies are traded virtually and electronically exchanged by the parties.

- Transacting with cryptocurrencies cannot be undone and is immutable and irreversible. Such transactions get recorded on the blockchain that requires most nodes to be altered in order to modify which is not possible. This helps in preventing fraudulent transactions.

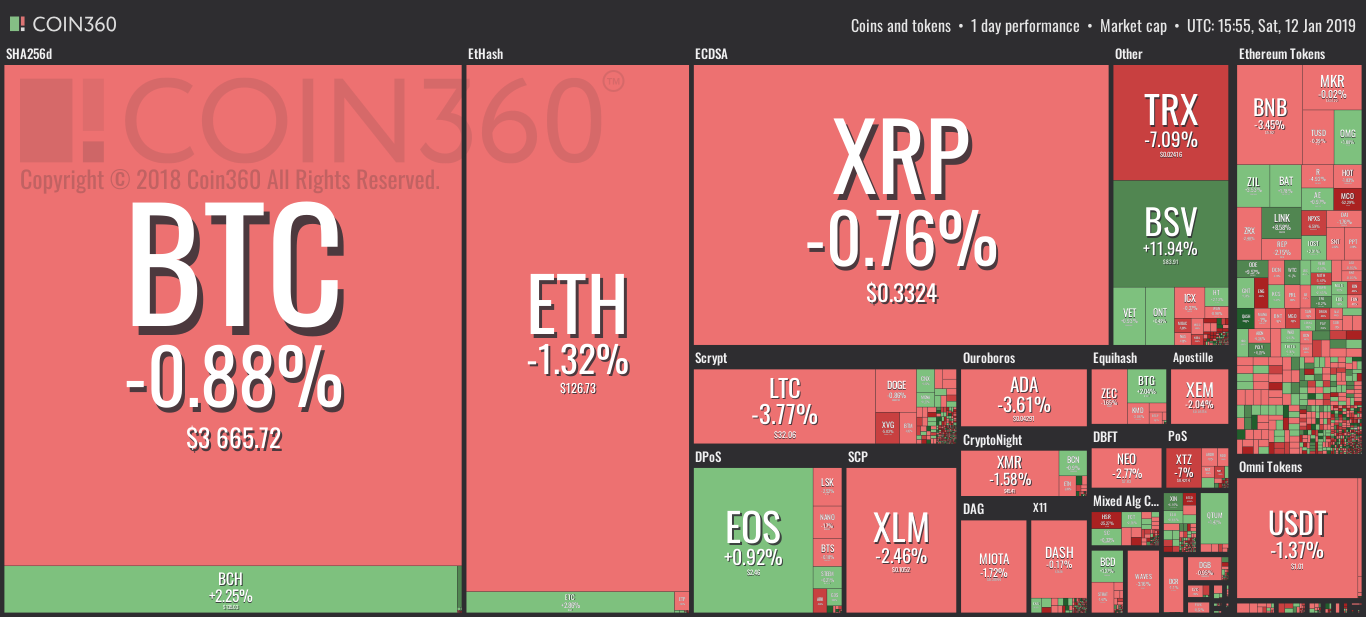

- No cryptocurrency accounts and transactions are connected to any real-world entity. Hence they are pseudonymous.

- Cryptocurrency is permission-less virtual cash as it is not controlled by any central authority. All you need to have is a specific software and start receiving or sending cryptocurrencies like bitcoin (BTC), Litecoin (LTC), XRP (XRP), Ether (ETH), EOS (EOS), Cardano (ADA), Stellar Lumens (XLM), TRON (TRX), Dogecoin (DOGE), Monero (XMR), NEO (NEO) etc.

The Cryptocurrency Trends

After creating huge waves worldwide, the cryptocurrency is one of the most talked areas as it depicts the development of the entire market. The two major trends that can be related to the cryptocurrencies include:

- Bullish trend predicts that the markets will be conquered by the Crypto bulls prices will significantly rise with global adoption.

- Bearish trend predicts the downfall of this market as bears are expected to overcome their rivals due to governmental and financial restrictions.

Major highlights of the 2019 predictions for this new age virtual currency constitute:

- Accelerated Blockchain implementations

According to a report from the PricewaterhouseCoopers (PwC) that works in association with giant businesses in the world, several customers have started considering the blockchain initiatives for spending a huge sum of money. The trend is expected to grow enormously. The PwC observed a demand for blockchain advisory services has been valued around $1.7 billion and may continue to accelerate.

- The ETF Acceptance

After lots of stirring up during the past 2 years, 2019 is highly expected to witness the Exchange-Traded Fund (ETF) accepting the cryptocurrencies to be used in institutional transactions and huge investments broadening the trading platforms.

- The DEXs Augmentation

With significant acceptance to the decentralized cryptocurrencies, appropriate marketplaces are also likely to augment. The decentralized exchanges (DEXs) were restricted to small numbers due to expensive development. 2019 may bring ease to the cryptocurrency users with the expansion of DEXs allowing users to freeze the deals using their wallets eliminating the role of third parties.

- The Developing dApps

dApps are smart decentralized applications that connect the users and the providers directly and run on P2P networks. dApps may find wide adoption worldwide the current year and provide an intuitive ground for the crypto projects and games.

- The ICOs Replacement

Soaring costs of compliance and legal holding of the ICOs are encouraging the STOs’ (Security Token Offerings) adoptions in 2019. It is predicted that soon STOs will be accepted as the standard model for the deployment of most crypto-based projects.

- Improved Scalability with Lightning Network

The most widely known cryptocurrency, Bitcoin has kicked off this new year with not only momentous price rise to over $4,000, but also an escalated capacity of the Bitcoin’s lightning network has been recorded. An eminent Bitcoin analytics provider 1ML observed a rise of 23% in the capacity of the lightning network during last month. Experts are predicting high scalability to be rendered by Bitcoin’s off-chain technology.

Predictions for Top Cryptocurrencies

As some specific cryptocurrencies are likely to derive the market tendencies, some predictions have been made by the industry experts on these large P2P currencies:

- Bitcoin: Bitcoin has been the initial trendsetter and has been a most popular type of cryptocurrency. The bitcoin’s price is expected to soar high but the actual BTC usage is expected to advance in the coming year. Bitcoin may gain broader acceptance in case its lightening network contributes to improved scalability. International Data Corporation has projected that by 2022, the annual blockchain spending will reach $12 billion.

- Ethereum: Ethereum is the second cryptocurrency that outshines the rest with its practical value. Adversely affected by the scalability issues, Ethereum may witness a massive growth if they get sorted out. Despite many other concerns, several businesses have already started implementing Ethereum’s innovations pro-actively.

- Ripple: The Ripple is all set to lead the cryptocurrency market by cooperating with banks efficiently. With the launch of xRapid in September 2018, an integrating platform to establish a connection between various currencies and rendering quick transactions, many banks are expected to adopt Ripple in 2019.

- Litecoin: It is the best fit to perform daily routine tasks due to its comparatively low cost than Bitcoin. LTC is gradually capturing the market as the primary payment system with its debit cards launch as the action plan.

Conclusion

Other than the abovementioned predictions and trends for a range of cryptocurrencies, the Eos (also known as the ‘Killer of Ethereum’), Neo, and Stellar (XLM) are other niche cryptocurrencies that are expected to gain popularity due to their security token offerings.

The extreme volatility of the cryptocurrencies cannot be denied and without any stabilization of compliance on the same, the predictions and trends may encounter a shift in numbers. The bullish and the bearish trends drastically impact the predicted trends and have the ability to drive the cryptocurrencies in any direction. As this is the first month of 2019, the time is to wait and watch as the year 2019 goes through to the end of its first quarter to have a clearer picture of the trends and projected scenarios.