In the last couple of hours, Ethereum has undergone an accelerated decline. This decline has led to yet another shake-up in the market ranking, seeing Ethereum be overtaken yet again by XRP.

It remains unclear what has triggered the dip with traders now taking great concern over the upcoming Constantinople hard fork. Although many were expecting to see prices climb as we approach this event, things seem to be taking a different turn. There are still a couple more days to go before the hard fork takes place and plenty of time for Ethereum prices to recover.

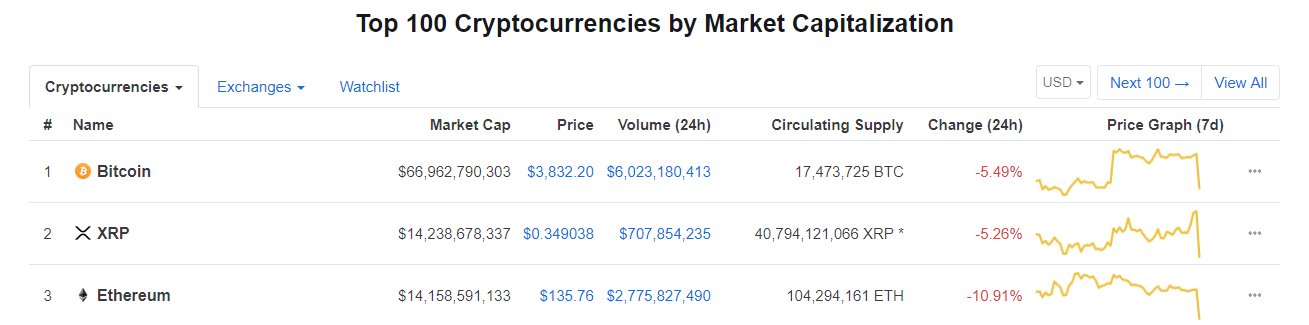

One speculative reason why prices have taken a dip is the growing frustration in indecisive movement and the lack of coins to break key resistance levels. Ethereum has not been the only coin in a stalemate in the past couple of days but rather the wider market. Bitcoin BTC has not been spared in the price dip and at the time of press has fallen below the $4,000 mark. At the time of press, bitcoin has dropped by 5%, dragging prices back to the $3,800 position.

Ethereum, at the time of press, has dropped by over 10% and is now trading for a little over $135. So far, the wider market has lost over $8 billion with the total market now standing at a little over $130 billion. Prices around the market don’t seem to have a recovery in sight and hence prices are expected to continue falling in the next couple of hours.

A recovery should, however, get underway in the next couple of days, as so is the case with any dramatic change. Could this be the 2018 habits coming back?

New Year, Old Habits

It certainly looks so. Many were hoping that this trend was left behind in 2018 following the positive start to 2018 but hardly 10 days into the new year and the old habits are coming back. It will be interesting to see how fast the bulls can conjure a recovery and get prices back up again. The recovery could well set the tone where the market is moving towards for the foreseeable future.

If prices are to get stuck in their current lows, this could see the year slow down and investors moving away from the market. On the other hand, should the market soon find support and rally, this will boost investor confidence over the coming days.