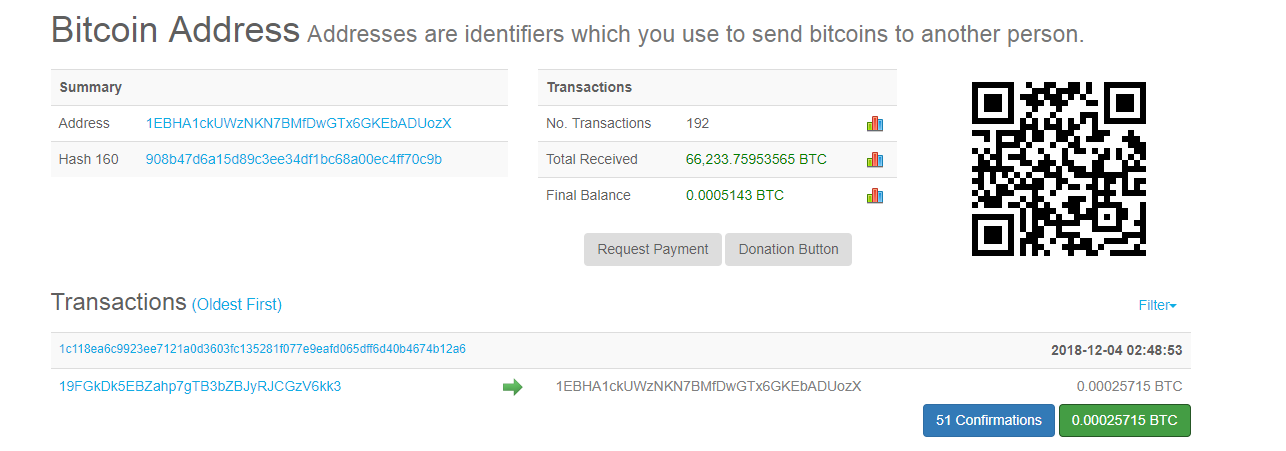

The Bitcoin market is buzzing with speculations after the latest rumors that a long-dormant mega Bitcoin wallet has come to life. The wallet, one that has been touted as one of the wealthiest BTC addresses in the crypto space, recorded an eye-catching movement of a cool 66,233 Bitcoins from it.

Very Large Volume

At the current market value, the coins moved are estimated to be worth around $257 million, a really significant figure as compared to the recent market volumes. In fact, this volume is even higher than daily transaction volumes of some of the world’s largest crypto exchanges.

The last daily trading volume on Binance recorded $205 million while Bitfinex handled $155 million. Now you can see why this latest BTC whale activity is causing a stir in the market. Interestingly, this address hasn’t been active since 2014, and its current activity leaves cryptoanalysts and enthusiasts with more questions than answers.

Astonishing Transaction Fee

Time and time again, cryptocurrencies have been famed as the world’s cheapest means of doing business, especially when it comes to transaction fees. With traditional banks, you could find yourself forking out upwards of 2% of your total funds moved in transaction fees. With cryptos, the cost is thousands of times cheaper.

For example, the transaction mentioned here moved a whole $257 million at a cost of less than $50 in transaction fees. Calculating in terms of fee percentages charged by banks, the amount payable if these funds were to be moved through a bank would be spine-breaking. Even the cost of just 1% puts the figure way over $2 million.

What’s The Impact?

However, it’s not the cost of the transaction that’s causing noises within the Bitcoin community, but rather the speculations as to where these coins were headed and how their movement could impact the market. If they were transferred to an exchange, the repercussions would be severe for the market as its impact would be akin to a dump. BTC price would take a dip and the whole crypto market would follow.

However, it’s possible that the transfer was made to an OTC market space, in which case the secondary market on the exchanges wouldn’t be impacted. Crypto analysts have had a hard time discerning which way the movement was made because the sender made sure to use various SegWit (Segregated Witness) addresses to make the transaction harder to track.