New mining platform means anyone from professional to novice miners get access to the most advanced and easiest-to-use platform available as Week-long comparison testing shows Cudo Miner is currently more than twice as profitable as competing miners.

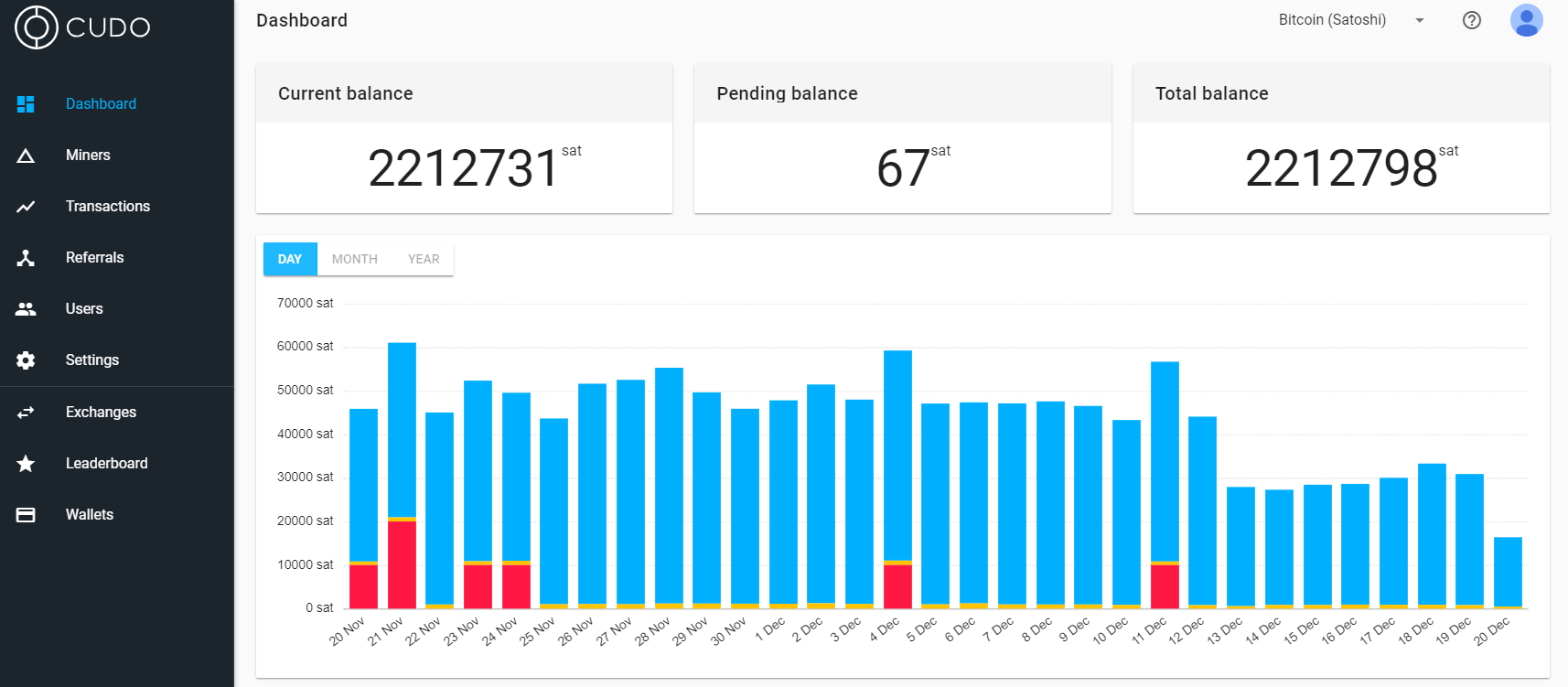

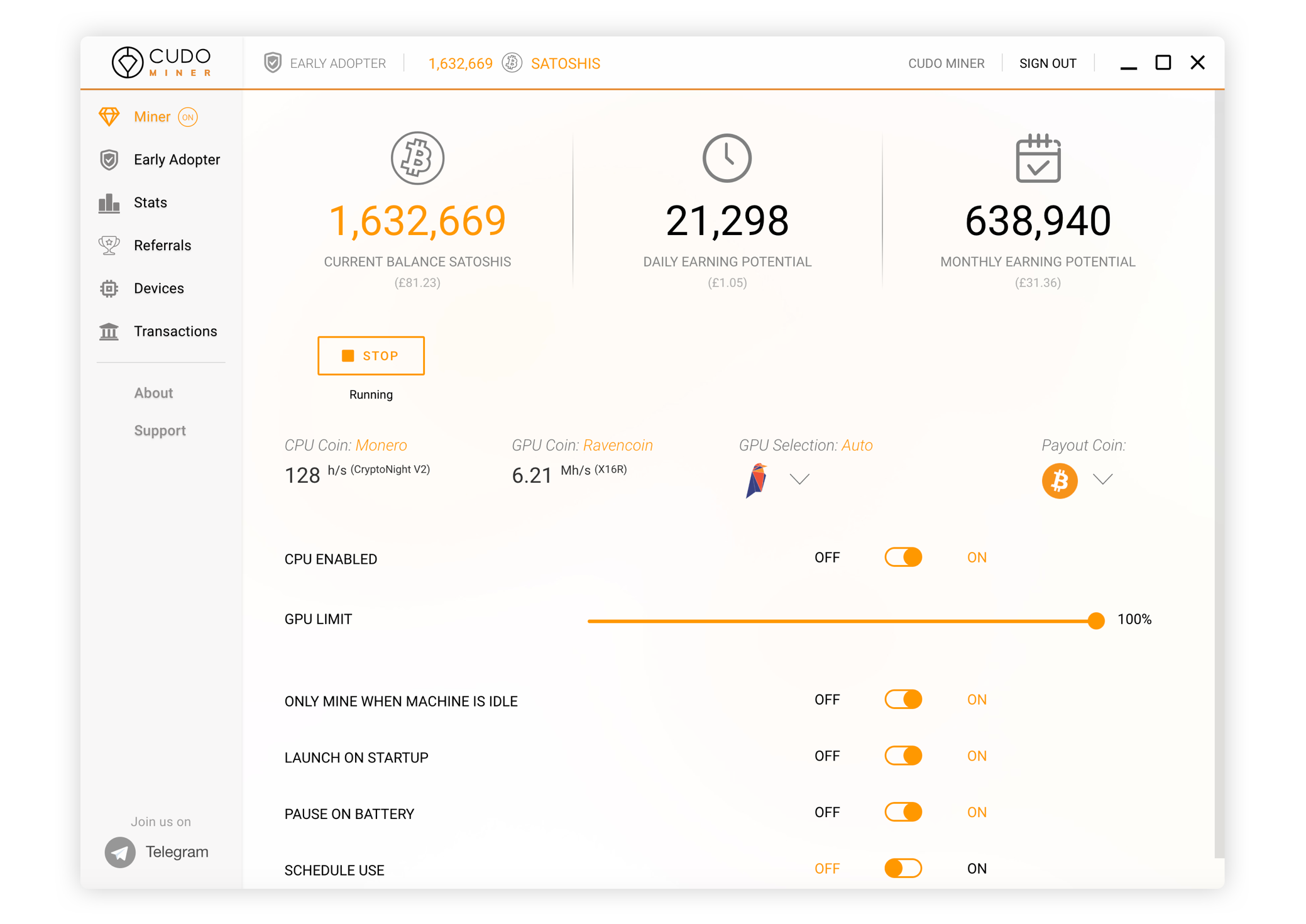

Cryptocurrency mining startup Cudo, today announces the open beta launch of its crypto-mining platform: Cudo Miner. Cudo Miner is a intelligent GUI miner with in-built multi-algo switching technology enabling professional miners through to inexperienced or novice miners to install and sit back whilst the software automates everything else. Since launching a closed-beta two months ago, Cudo Miner has attracted thousands of users in more than 130 countries.

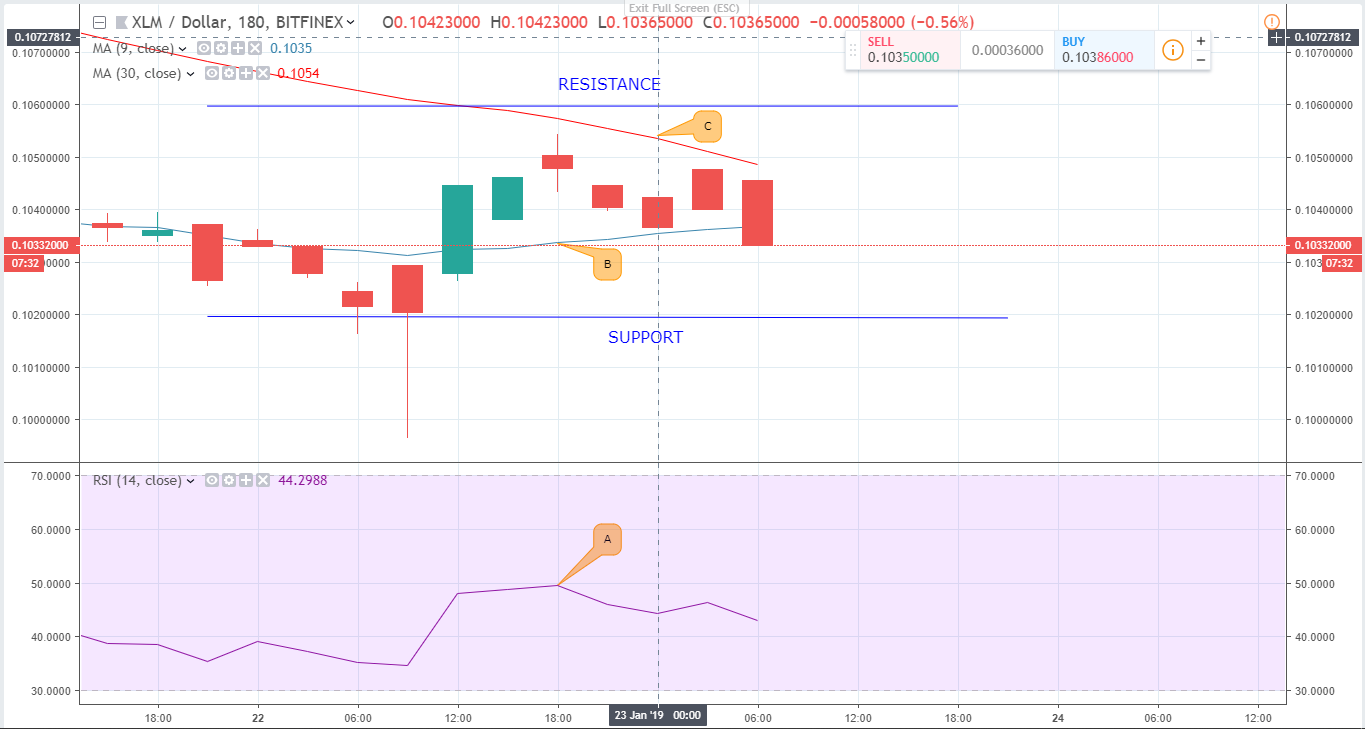

Not only does Cudo Miner provide a smart layer within the software that ensures that the most profitable coin is mined, based on a user’s hardware and fluctuations in the markets, what really sets them apart is that for the more experienced GPU and rig miners, Cudo Miner is starting to bridge the gap between GUI miners and traditional command line miners with an advanced settings page to preset optimizations on both, a per algo and per GPU basis. This will provide rig miners with the confidence to select ‘Auto’ mode should they wish, knowing that Cudo will change preset configs based on the most profitable coin to mine, without surrendering any mining performance.

The key features of Cudo Miner include:

-

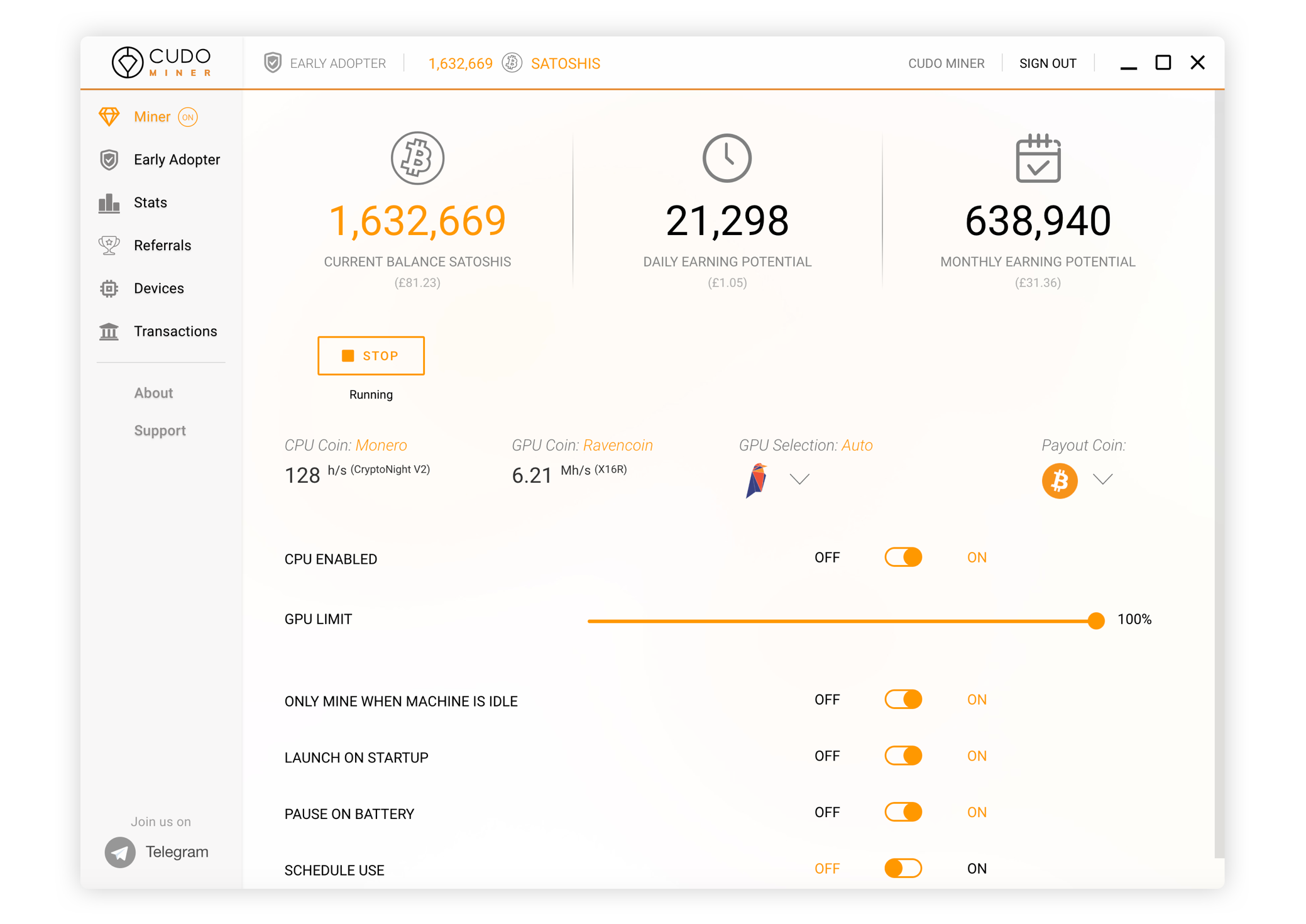

- USER-FRIENDLY INTERFACE – accessible for experts and novices. Download Cudo Miner and relax as the software automates the entire set-up for miners.

-

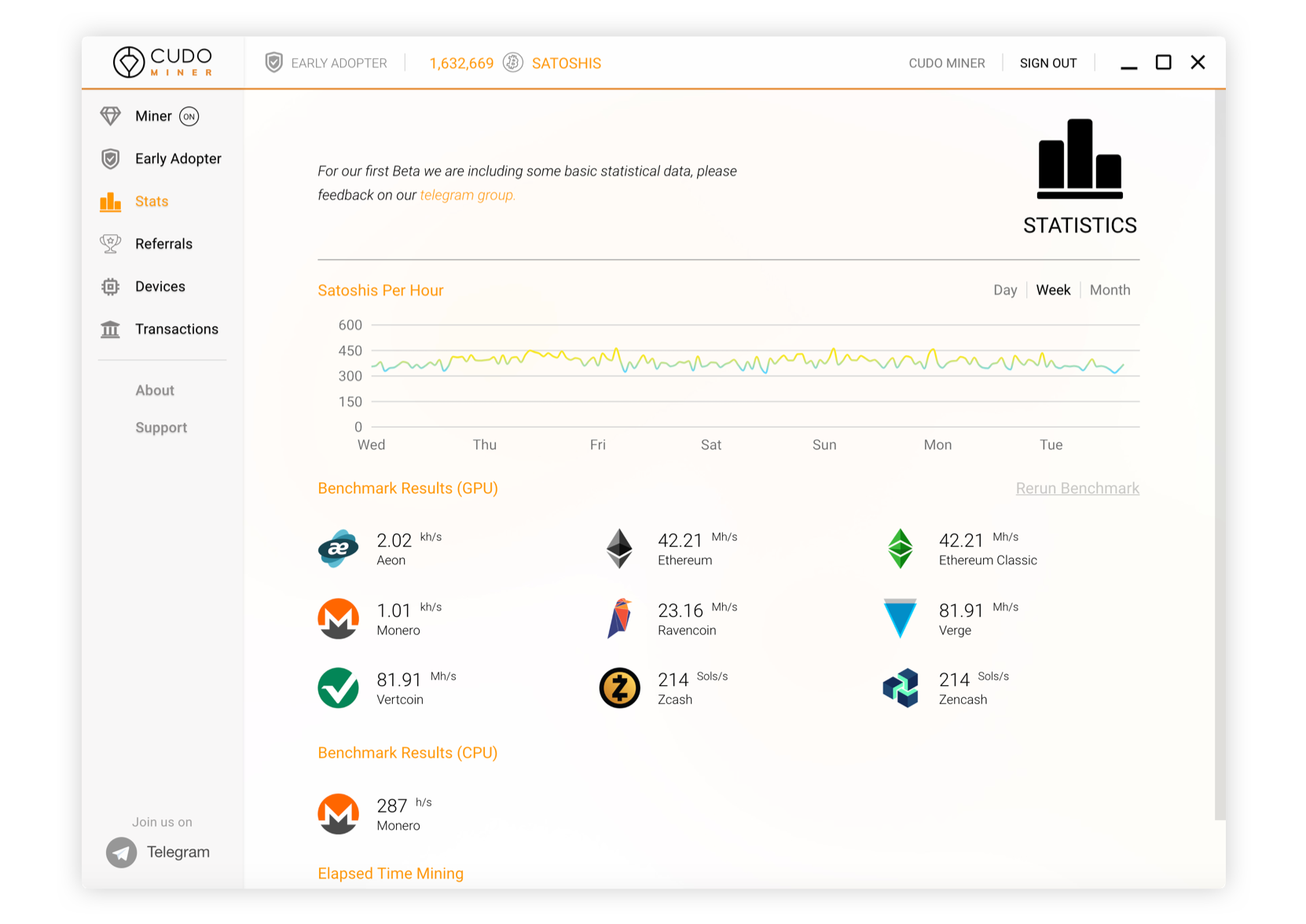

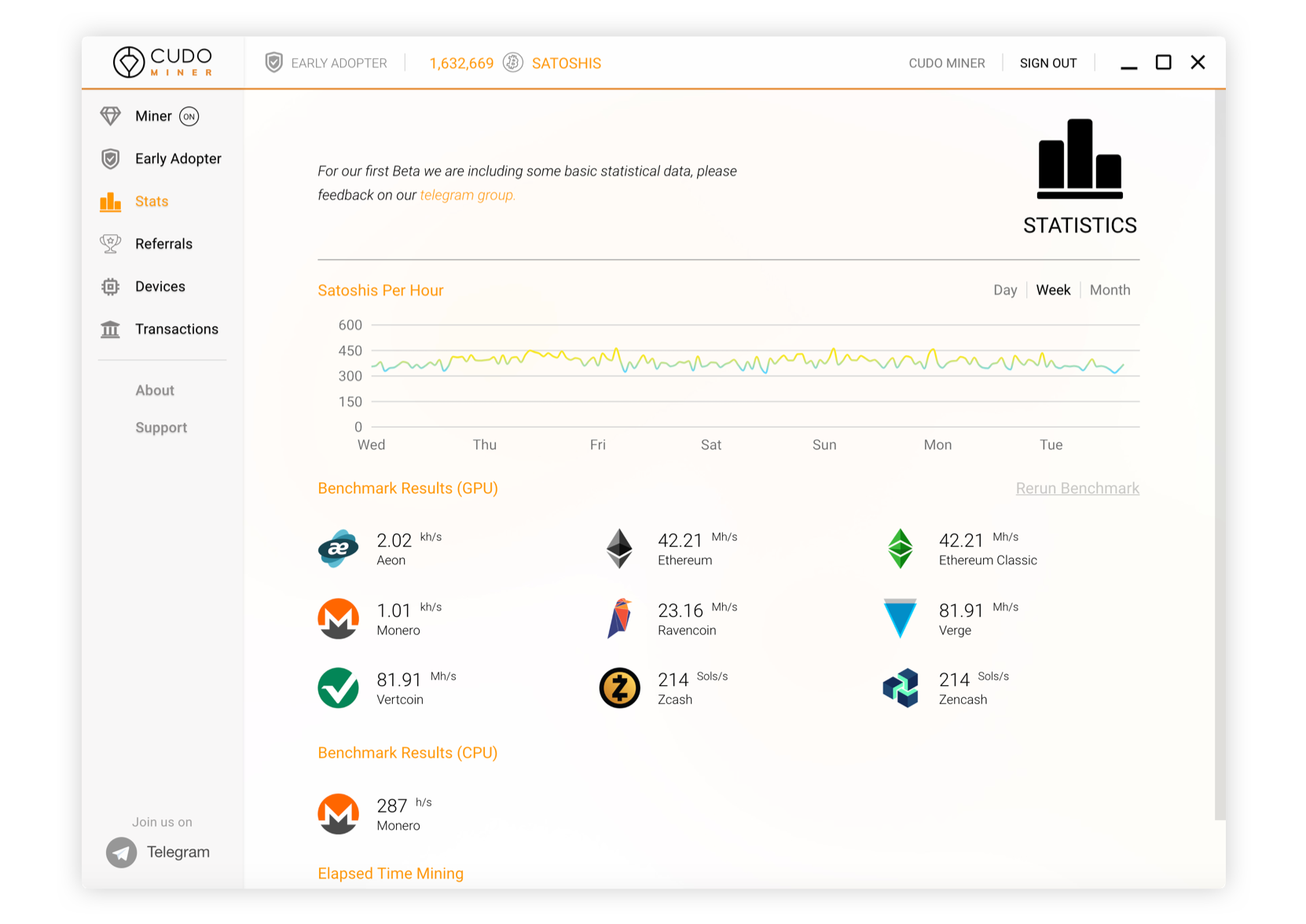

- ADVANCED SETTINGS – Crypto enthusiasts with dedicated mining rigs can maximize earnings by tweaking algorithms on the “advanced settings” page, where they can also see the results of all their benchmarks. This is currently a time consuming manual task run via other mining software.

-

- GPU OVERCLOCKING – built-in GPU overclocking and other features designed to boost profitability, further bridging the gap between traditional command line and GUI miners.

- THIRD PARTY MINERS – Enable third-party miners such as Z-enemy for Ravencoin and EWBF for Bitcoin Gold to increase your mining performance. New miners will be added regularly.

- TWICE AS PROFITABLE – Week long comparison testing (28/12/18-3/1/19) shows Cudo Miner is more than twice as profitable as competing miners.

- MULTIPLE COIN SUPPORT – able to mine multiple coins and switch between them based on which one is the most profitable at any given moment.

- CHOICE OF PAYMENT – users also have a choice of how they get paid – they can receive compensation through Ethereum or Bitcoin and additional coins will be included on the list in the future.

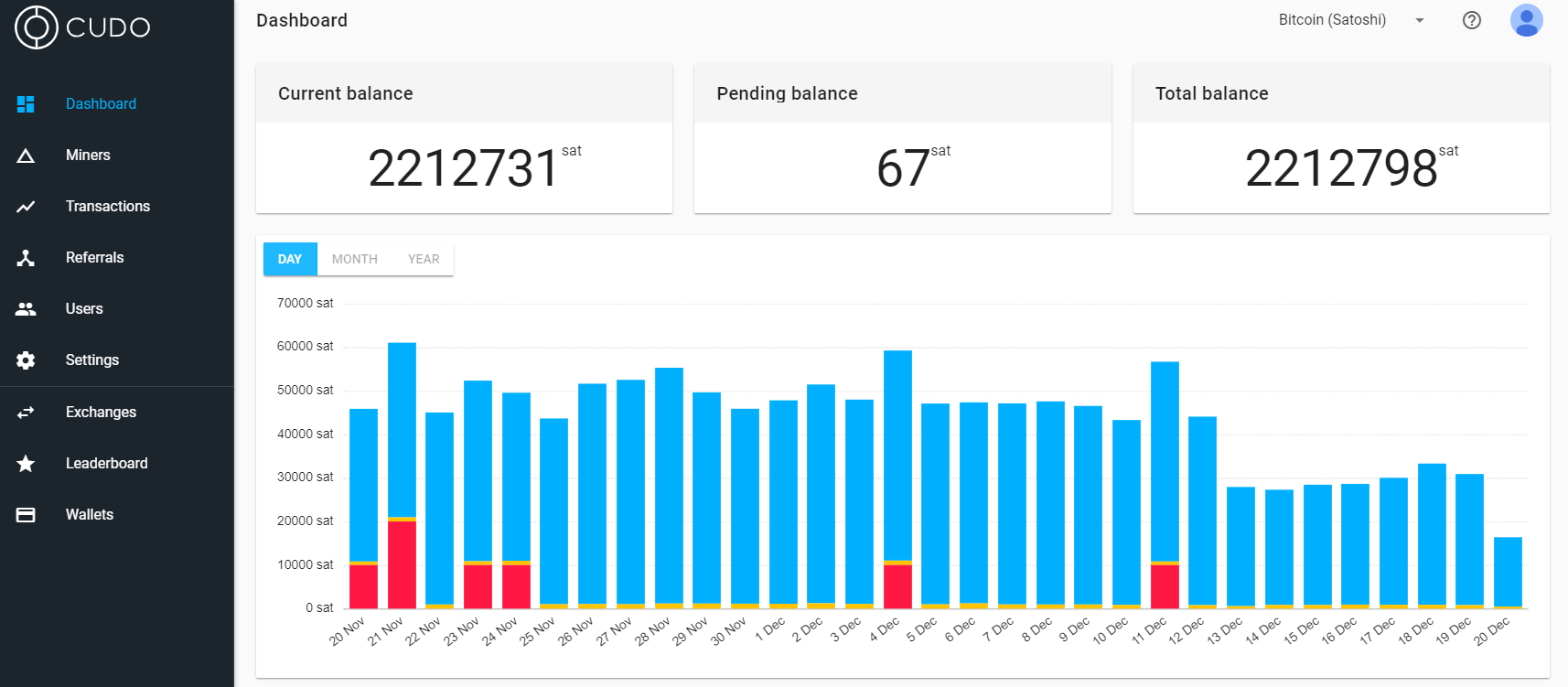

- POWERFUL WEB CONSOLE – miners can examine data related to their mining performance, look at historical earnings, view hardware information and power levels, as well as keep a close eye on the health of their devices.

- IDLE MINING – casual miners can leave Cudo Miner working in the background while they use their PC, ensuring that it does not interfere with their computer’s performance.

Overall, the crypto mining world has been suffering a crisis of confidence over the past few months – but with Bitcoin miners alone already generating $4.7 billion in revenue for the first nine months of 2018, there is still a lot to play for.

“GPU mining is definitely alive and kicking, but some of the strategies being adopted by some professional miners are diminishing their chances of making a decent profit. Altcoins are often the most profitable but only for a few minutes or hours, so you need to mine during this period to maximize gain,” said Matt Hawkins, CEO, Cudo. “The emphasis needs to move away from focusing on a single coin or algorithm in favor of chopping and changing between an array of cryptocurrencies as well as choosing optimal settings – elevating their chances of making it worthwhile. This is why we have created Cudo Miner.”

The company’s founders, Hawkins, and Duncan Cook, were motivated to find an accessible mining solution when they discovered the huge amounts of computing power on laptops, PCs and servers – with hardware often idle 60 percent of the time. As a result, they sought to develop a solution that killed two birds with one stone: stopping resources from being underutilized while maximizing profitability from mining by removing the barriers to entry.

The two serial entrepreneurs have also established a charitable arm called Cudo Donate, whereby miners can convert their spare computing power into cash for good causes. This project has the goal of raising $1 billion in funding and computing resources for charities in the coming years.

“This for us isn’t just about making money – we want Cudo and our mining platforms to become a force for good. Part of the Cudo vision is to build towards a distributed computing model, which has the potential to help a number of good causes, including cancer research, protein folding, and seismic imaging,” added Hawkins.

For further information and to get going with Cudo Miner, please go to: www.cudominer.com.

Conclusion

About Cudo

Cudo is a team of miners, techs, and entrepreneurs. We’re passionate about creating good with technology and we see blockchain and cryptocurrency as an amazing opportunity to do this. Our aim is to make a positive impact in the world for good and for technical change.

We want our technology to be a sustainable and ethical solution.

For further, press information, please contact:

Dan Walsh

dan@mustardpr.com

+44 (0) 1753 656 661

Advertisement