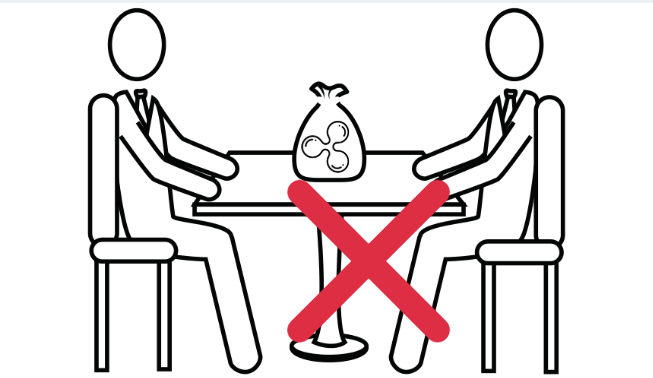

The Society for Worldwide Interbank Financial Telecommunication, SWIFT, which has been a giant global payment network for years, denies that it had any plans of collaborating with Ripple or integrate with the fintech company by utilizing any of its financial tools.

Recently, there have been a lot of speculations that the two payment processing networks were planning to come together. Some believe that SWIFT could overtake Ripple by updating its system to compete with the fintech.

The likes of MoneyGram, Mercury FX, Western Union, Currencies Direct which partner with SWIFT, see Ripple platform as a threat to the global payment network.

What has given strength to the ongoing speculation is the fact that, SWIFT is currently upgrading its protocol standards. They have urged all their clients to upgrade to the new platform, Swift GPI.

This upgrade brought about rumors that Swift gpi would enable RippleNet and xRapid to be available to banks and so many other payment processors on the SWIFT network.

Another incident which ignited the rumors is that Ripple attended the SWIFT Sibos Conference in Sydney, Australia. Speculations were also triggered off with such news that former SWIFT member joined Ripple team.

Such comment as was made by the Chief Marketing Strategist at Ripple, Croy Johnson, that bank and other big payment processors would soon be joining Ripple platform. This made Ripple enthusiast to start speculating that the duo was up for collaboration.

In an interview with finance magnates.com, SWIFT spokesperson vehemently denied these rumors saying they have no right sources:

“I’m not sure where those rumors are coming from but the upcoming standards release … is entirely unrelated to RippleNet. Its primary purpose is to ensure all payments include a tracking reference (UETR, Unique End-to-end Transaction Reference) which will allow banks to track their GPI payments end-to-end in real time.”

SWIFT had been a giant payment system for years dominating the global payment network. The emergence of blockchain based fintech like Ripple has been a threat to the payment giant. Now SWIFT has responded to the threat by upgrading its service, launching the ‘Global Payment Innovation’ gpi, which is used by 165 banks.

According to a report by Financial Times, SWIFT GPI is used in four out of every ten transactions done from US-China. Every transaction done through the GPI service is expected to reach the beneficiary within 30 minutes of its initiation.

From all these findings, SWIFT is not ready to collaborate with Ripple or lose any ground.