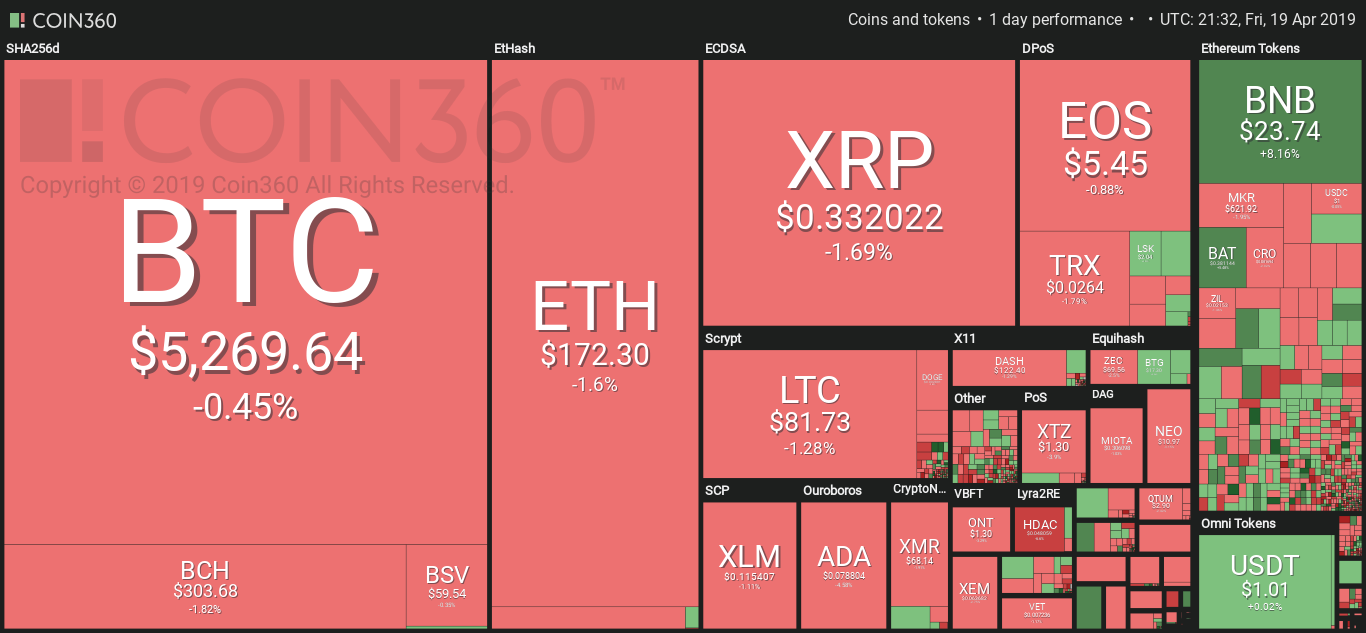

The Binance Coin (BNB) is creating a major buzz within the crypto community as what many see as a major feat it just achieved. For one, BNB has risen exponentially over a short period since its debut into the crypto market. The coin is now among the top 10 largest and most popular cryptos by market cap.

Not long ago, BNB was nowhere near the top 10 and traded at below $10. Today, it’s a different story, a baffling development that has attracted the attention of crypto bigwigs like Justin Sun.

Justin Sun is the founder and CEO of Tron foundation, the creator of TRX. In a tweet, Justin made a point to congratulate the Binance exchange and its CEO, Changpeng Zhao, for BNB’s current success. While congratulating the Binance team, Justin mentioned that BNB has surpassed its previous All-Time-High (ATH) value.

Huge congrats to @binance & @cz_binance on breaking the ATH! No matter bull or bear, eventually, our value depends on what we buidl. pic.twitter.com/KWfjBJ0nIa

— Justin Sun (@justinsuntron) April 20, 2019

BNB At $100?

Justin’s tweet didn’t go unnoticed, especially given that he has quite a sizable social media following. Various online characters came in to share their take on BNB’s current market standing. To some, this is just the beginning. Someone even opined that by Christmas Eve, BNB will have clocked $100 in market value per coin. Interestingly, Binance CEO Zhao responded by saying he would bookmark that prediction.

Is TRX Next?

In light of the news of BNB’s success and Justin Sun’s recognition of it, some members of the Tron community are now speculating on the possibility of TRX breaking its ATH too. Tron has been making huge efforts in expanding its network.

It migrated to the MainNet and acquired BitTorrent. Whether these efforts will finally pay off to push up the market price of TRX is yet to be seen. However, the majority of the Tron community seem to be optimistic.

Time To Accumulate?

When a cryptocurrency looks like it’s about to break out in a big way, people tend to go all in to accumulate as much as they can. In that sense, a peculiar tweet by a character with a twitter handle, Cryptron, is now urging crypto fans and investors to start accumulating BNB before the price shoots up further. According to Cryptron, BNB shot up from $10.9 to $26+ within 2 months, an impressive 200% gain, and this trend is likely going to continue.