- Binance CEO, Changpeng Zhao has revealed the inner workings of the world’s largest cryptocurrency exchange.

- He goes on to list some lesser-known milestones achieved by the exchange and the keys to its success.

- Binance has suffered from regulatory challenges in the past but Zhao is confident in his blueprint to solve the nagging problem.

Binance didn’t rise to the top by chance. It was a carefully calculated effort made up of interesting innovations and a culture of focusing on the product.

Binance Is 10x Bigger Than Competitors

Changpeng Zhao, Binance CEO revealed the exchange’s journey to the top with Forbes in a recent interview. The CEO of the largest cryptocurrency exchange noted that at its launch in 2017, Coinbase and Kraken controlled the bulk of the US markets while Poloniex and Bittrex topped the charts for their large volumes but they had a narrow focus. CZ commented that at that time, no exchange catered to the needs of a global audience and so, he decided to tweak the formula.

“We had support for 31 languages on the day we launched and nine languages within a month. Today we support 31 languages on our interfaces. Our customer support is in 16 different languages” said Zhao. “So I think listing a high number of tokens was an advantage, but being more international was also the first thing we did.”

Apart from offering multiple languages and listing many tokens, Binance pioneered one full-screen trading that has now been adopted by other exchanges. Given the exchange’s innovativeness, it has risen to be the largest in terms of trading volumes for both spot and futures markets. It also holds the record of being the largest peer-to-peer marketplace in the world with the additional perks of crypto escrow.

“Most of the time, we’re 10x bigger than the second biggest players. We also have the largest fiat-to-crypto exchange most people don’t know about.” Zhao told Forbes. “We support 50 something fiat currencies all over the world, and nobody has this coverage.”

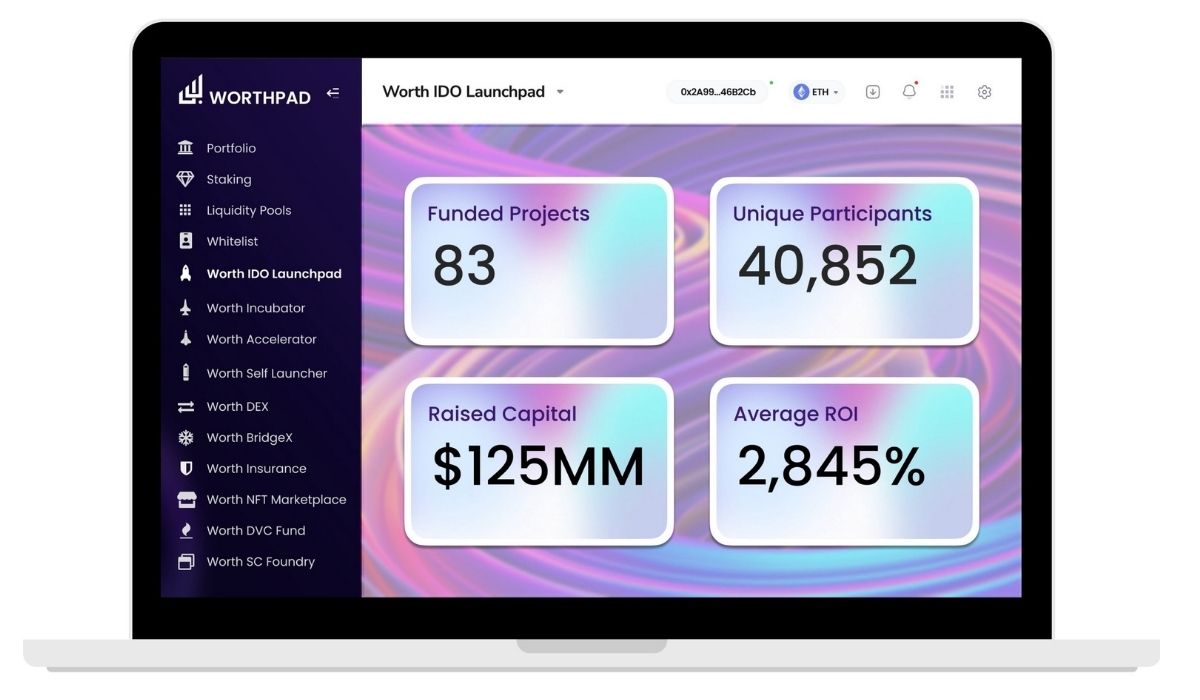

He told Forbes that Binance owns Trust Wallet, the most downloaded crypto wallet, and owns one of the most visited websites in crypto – CoinMarketCap.com. He added that Binance’s NFT platform is closing in on OpenSea and the Binance Smart Chain now has an 80% market share in DeFi with a growing number of daily users.

The Regulatory Brouhaha

Binance’s sheer size makes it an easy target for regulators and as expected the exchange has run into trouble with regulators from the UK, the US, Japan, and Germany. Answering questions about how it intends to resolve the regulatory challenges, Zhao replied that the exchange was already transitioning from a decentralized structure to a centralized structure.

He added that the exchange is shopping for a new global headquarters and is in the process of setting up “local entities, local office, and board governance structures”. Binance has hinted that France could be the spot for the new global headquarters but was previously quoted to have hinted towards Ireland.

Zhao fielded questions about the exit of Brian Brooks, the former CEO of Binance.US stating that “if people come in and they’re not a strong fit, then we part ways as quickly as possible.” He added that new CEO Brian Schroder has a “game plan” on how to ensure the success of Binance.US over big spenders, FTX, and Crypto.com.