Most of you have already heard about the most famous cryptocurrencies, such as Bitcoin or Ethereum. You are also probably aware that there are more than 1,500 others. And this number will continue to grow as more and more companies or people decide to create their own cryptocurrency.

But exactly, how do you create a cryptocurrency? What skills are required to create your cryptocurrency?

On paper, to create a cryptocurrency, you have to fulfill these 3 conditions:

- Have a good idea. If you just want to create a crypto-currency to say that it’s crypto, then your project is directly doomed to failure. You need to have a solid blockchain-based project for that to happen.

- Gain the trust of users. To gain the trust of people, you have to create a community behind your crypto and make sure to always communicate well with your users. Many crypto-currencies with a very strong project behind have never taken off because the creators have never bothered to create a good community behind.

- Know the programming and how crypto-security works. Of course, you can employ people to do it for you. But it is still important to know at least in the main how the technology works that allows everything to work properly and securely.

Now that you have in mind the very big lines to follow, let’s see in more detail how it all works.

The technological choice

The real start begins with your idea. But before talking about your idea, let’s start by talking about the technology needed to make your idea a reality. One of the technologies that’s not mentioned below but deserves a special mention is Binary Options Review that helps companies by fulfilling the basic requirement while creating a cryptocurrency.

Binary options trading is a way of making money for some. For those of you, who don’t know what is binary options trading?

Let me explain.

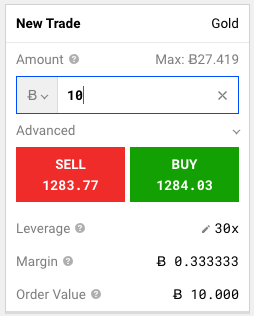

A binary option is a type of trading. Here you just have to predict whether the share price of the “ABC” company will go high or not on a given date and time. And you need to bet on it with an investment.

So suppose you say yes, the price will go up and if it goes up then you make money on your invested money. And if the price goes down, then you lose your invested money.

That’s all you need to do.

How Binary Options Review can help you?

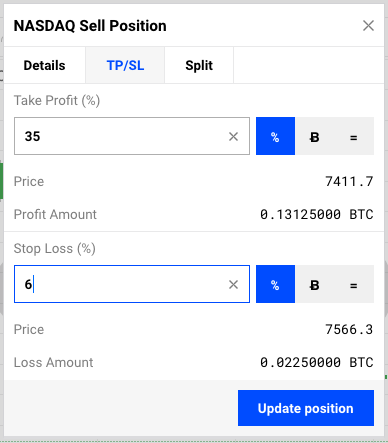

Binary options review provides you the best binary options broker’s reviews like IQoption, Empire Option, 24 Option, Option Robot, and lots more like them.

So that you stay ahead in the game of binary options trading. Binary options review is visited by thousands of people every month.

You will find so many important resources and data which will help you to lift your binary options trading game.

Binary options review is one of the best sources to get news and data about binary options trading.

There are two ways to think about creating your cryptocurrency:

- Create your own blockchain. In this case, you will create what is called a “coin”.

- Use an existing blockchain. In this case, your cryptocurrency will be called “token”.

So, you will have to decide if you want to create a coin or a token. Do you prefer to create something from 0 that will fit exactly what you want? Or do you prefer to use existing and proven technology?

The first option will require a lot more work but you can do exactly what you want. The second option already offers an existing working system but could limit you in your future development.

It’s up to you to see what’s best for you according to your ultimate goals:

- Creating a coin will require you significantly more money and will require much more time. In addition, you will need a large developer team for you to carry out this project. In addition, it will be harder to get people’s confidence in the quality of your blockchain.

- If you do not really need to have a specific blockchain, then opt for a token will be the most interesting solution from a point of view speed, cost and user confidence.

The best choice for creating a token

If you decide to create a token, then you will probably point to tokens based on the blockchain Ethereum or Neo. In any case, this is what decides to do most of the creators of a new token.

When you create a token based on the Ethereum blockchain, it will be a token that we call ERC-20. Ethereum is popular for creating new tokens because it’s the first blockchain that made it possible. In addition, people have a great deal of confidence in Ethereum.

Neo is also quite popular. Its characteristics are globally similar to Ethereum, but the tokens created on this blockchain are qualified as standard NEP-5.

The choice between one or the other of these blockchains will depend only on your preferences. Ethereum has the advantage of popularity and trust, but only allows coding in the computer language that is specific to this blockchain, the Solidity. You will have to start by learning this programming language. On Neo, you can use several different programming languages, such as C ++ or Java for example.

The launch of an ICO

When a company decides to go public, it practices what is called an IPO means “Initial Public Offer” and allows people to buy shares of the company.

In the world of cryptocurrencies, we will have to resort to what is called an ICO of “Initial Coin Offer”. Instead of receiving shares of the company, the user will receive cryptocurrencies, which will have exactly the same utility as a stock market action.

Creating a cryptocurrency takes time and requires a lot of resources. Using an ICO is a great way to raise money for your project.

However, that will not be easy either. You will need to earn the trust of your future investors.

The most successful ICOs have in general always fulfilled the following conditions:

- A strong team that has proven itself. For example, a Harvard computer science doctor as a chief programmer, a former Microsoft marketing executive, and so on.

- Realistic plans for the future. All expenses must be planned and explained, dates must be announced for the realization of the different stages of the project, etc.

Well, that’s it from us on part of how to create an ICO and creating a Cryptocurrency.

Advertisement