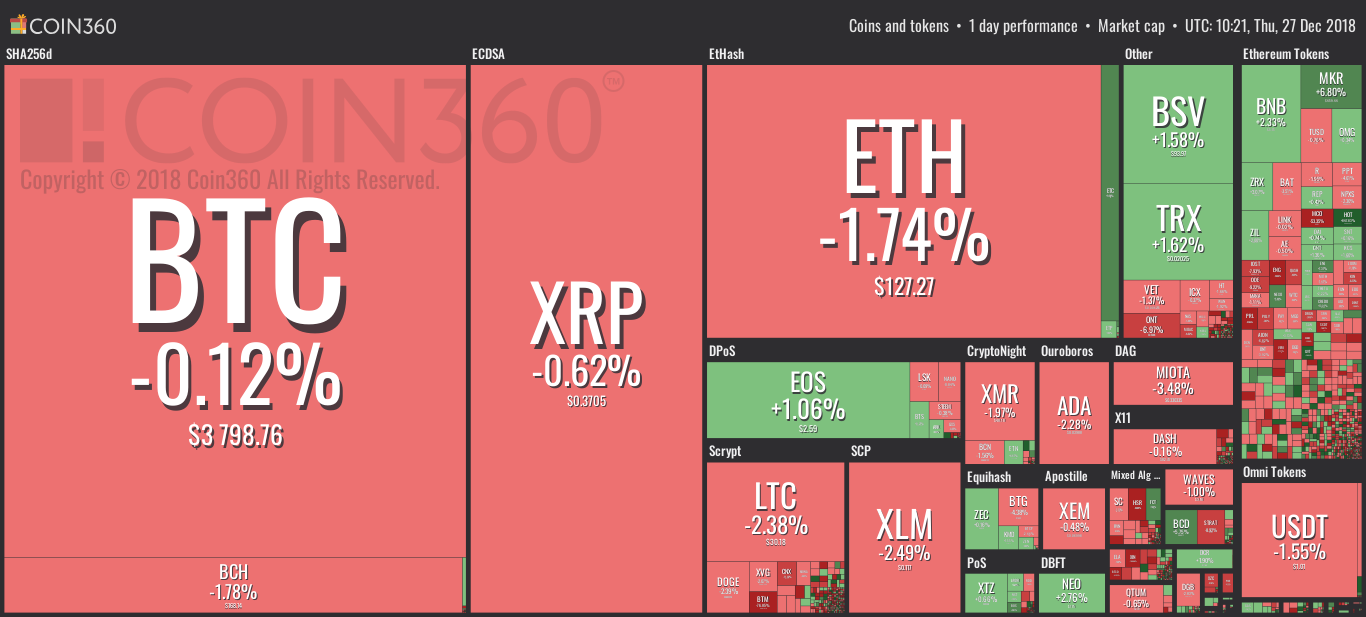

Yesterday, ZyCrypto reported on the state of the cryptocurrency market revealing that it was threading fairly with slight gains and losses. Top dogs like BTC, Ether and the likes were dwindling by less than 3% when the day began. However, since the past 24hrs, the bears have shown themselves strong and ready to lead the pack. With losses ranging from 5 to 7%, today’s market may not be the one to birth the best of trades as more and more tokens/coins continue to bend into the grip of the bears.

It is interesting to note that although the market is blinking in red lights, most tokens and coins are still maintaining their breakout prices. The likes of BCH has managed to maintain stability and settle above the $100 mark. Despite losses reaching 3.24%, BCH still trades at $167.93 as of this writing.

The effects of the bears have also been more profound on some coins/tokens than others. For example, Ether had been on its way to tie with Ripple XRP in market capitalization as it brought itself closer to XRP by $1 billion, making XRP only $2 billion away from it, but that was until the bears kicked in fully.

Meanwhile, altcoins like Bitcoin Diamond BCD have attained as much as 10% in gains, keeping its trading price at $1.01. Others like Maker MKR is also shedding green lights as it manages to stay afloat while trading at $452.77.

Traders are not fully calling in the bottom as they perceive a bull run in 2019, which is in less than a week. As traders anticipate the effects of institutional investors, exchanges have also reaffirmed that they are prepared for the year. With Coinbase signing in new institutional investors, the cryptocurrency space is expected to be flooded with a galore of gains in both trading volume, market cap and trading price.

The level of adaptation expected to come with 2019 has managed to keep traders sane throughout the unsteady market patterns.