The overall forecast for the coming 10-days is one of stabilization with many of the top coins finding a floor that gains support from the Valentine’s day price at February 14.

Bitcoin (BTC)

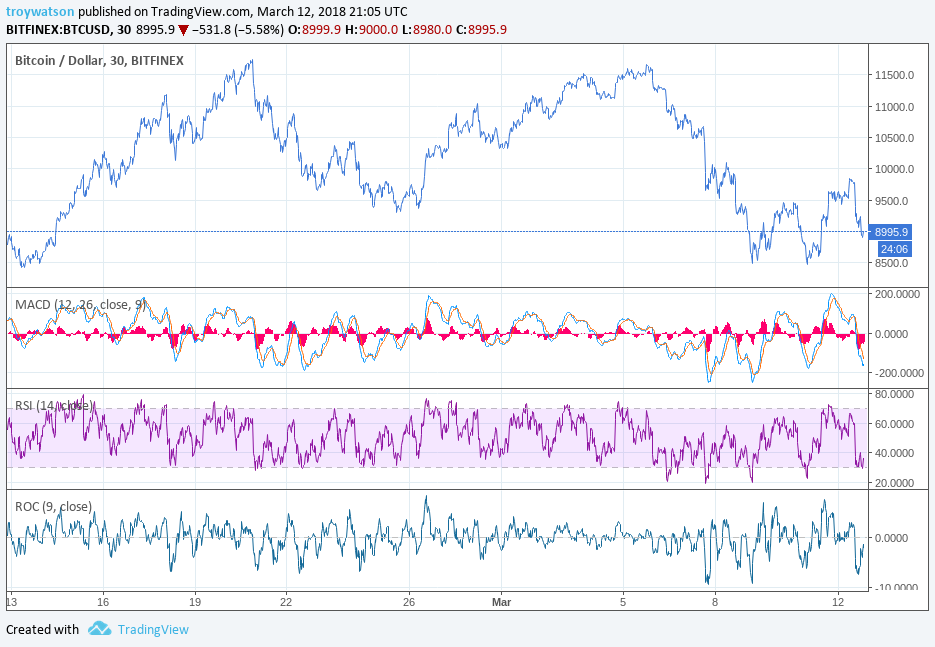

BTC has seen massive drops in the past week that corrected the price back to its floor on Valentine’s day. The chart shows in the past week that the price has dropped down to this floor of around $8,500 which is very close to the price of $8,600 on Valentine’s day February 14.

The price also has seen resistance from the $9,500 mark which was an average around late February. This ceiling for the current price may act as a break through point which when broken will see the price move through the $10,000 levels once again.

The MACD shows a trend of improvement with the the SMA and EMA overlapping to form a sell signal at this point in time. The trend is only slightly improving and so one would expect a flooring effect with the BTC price settling at around the $9,000 mark rather than shooting up to the $10,000 mark at this stage.

The RSI has a current average of around 45-50 which is a big difference from the average of around 35 during the past week of lows. The price doesn’t indicate bullish behavior at the moment and supports a mere flooring effect as did the MACD.

The ROC has shown significant improvements since the dwindling movement before the BTC drop. The indicator, however, does not show any consistent movement to suggest a correction back to the $10,000 levels and so we would expect to see a flooring effect around the $9,000 mark.

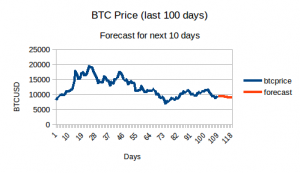

We used a linear regression model to make a 10-day forecast of BTC prices and found an effect of the price flooring at around the $9,000 mark. We may see a pattern where the price starts to stabilize before entering a bull run period.

| BTC 10-day Forecast using Regression Model | ||

| Day | Date (UTC time) | Predicted Price (Close price) |

| 1 | Mon, 12 Mar 18 | 9433.61 |

| 2 | Tue, 13 Mar 18 | 9471.5 |

| 3 | Wed, 14 Mar 18 | 9439.74 |

| 4 | Thu, 15 Mar 18 | 9429.36 |

| 5 | Fri, 16 Mar 18 | 9324.84 |

| 6 | Sat, 17 Mar 18 | 9266.53 |

| 7 | Sun, 18 Mar 18 | 9238.94 |

| 8 | Mon, 19 Mar 18 | 9238.94 |

| 9 | Tue, 20 Mar 18 | 9020.72 |

| 10 | Wed, 21 Mar 18 | 9000.61 |