Many investors and market watchers are scratching their heads trying to work out why cryptocurrency markets have tumbled from $800 Billion in December 2017 to $300 Billion today. This article will examine if the cryptocurrency market bubble has already popped and how you can protect yourself from another speculative bubble.

What Are Bubbles?

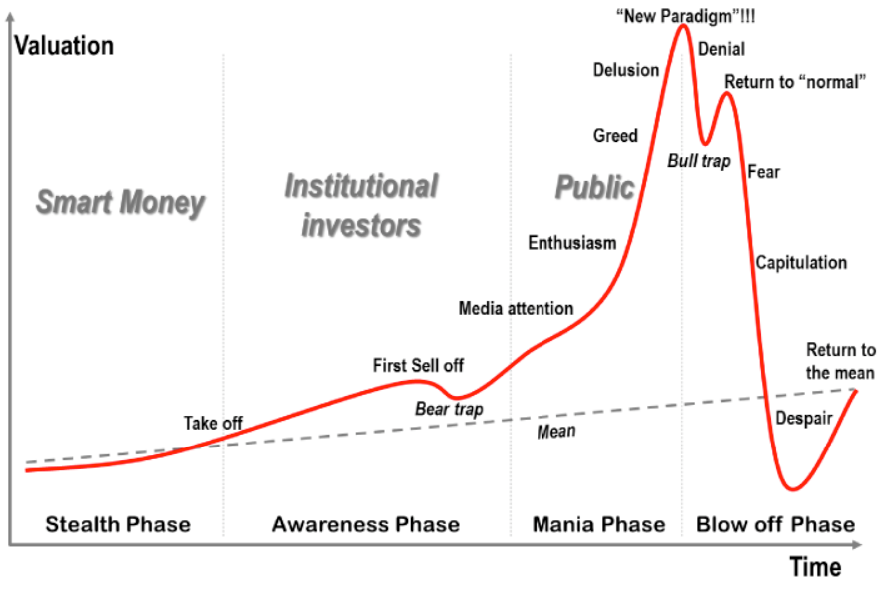

Bubbles are the point in a market cycle were rational investing is replaced by exuberance and emotional investing. Everyone is making money and getting drunk at the punch bowl. Naturally, many of people see the party taking place and join in. At this stage in a market cycle, the price of an asset is driven purely by emotion, rather than underlying fundamentals. After all, no one wants to miss out on a great party and when the money is easily made, greed sets in. The Fear Of Missing Out is sometimes called FOMO.

The great cryptocurrency bubble of December 2017 formed due to a massive surge in the demand for cryptocurrencies. Crypto was ‘hot’ and the next biggest thing. This led to an explosion in mainstream media coverage, which increased public awareness and the numbers of investors joining the cryptoparty. At its peak, Bitcoin managed to hit $20,000 a coin and posted a record all-time high.

Since January 2018, the euphoria has subsided and has been replaced by fear, capitulation and despair. The crypto market deflation has not only impacted on investors, but also YouTube cryptocurrency content creators like CryptoDaily. After reaching 100,000 subscribers, Crypto Daily went off the grid for weeks during the market dip in April 2018. With key social influencers seemingly giving up on the cryptocurrency markets, it is not surprising that so many in the cryptocurrency community were feeling despair.

The thing to know about bubbles is that they occur in every market. It’s not a phenomenon solely reserved for cryptocurrency markets.

Is There A Cryptocurrency Bubble?

There is little doubt that the cryptocurrency market was in a bubble in December 2017. Since then we gave seen a 65% pull back in cryptocurrency market valuations. Most people will look at that single statistic and conclude the bubble is over. We disagree. Even after a substantial cryptocurrency market crash there are cryptocurrencies like Cardano that have no working product and are valued at $4.6 billion. IOTA is another cryptocurrency with a product but no sales at all, yet the cryptocurrency market values them at $3.9 billion. The thing to take away from this is that cryptocurrencies are still valued on the expectations of what they might achieve in the future.

Yes, there is still a massive gap between valuations and the actual underlying technology. It is for this reason that we believe cryptocurrency is still in a bubble, despite the price correction in crypto markets this year.

Bubbles are generally viewed negatively. However, we must consider that cryptocurrencies and blockchain technology are still new. It should not come as a surprise that many of these cryptocurrencies don’t have a working product yet or sales. Indeed, if you took the view that working products and revenue are all that mattered, then you would value every new technology at zero.

Could There Be An Even Bigger Cryptocurrency Bubble?

The answer is yes, there could be a even bigger crypto bubble on the horizon. The reason is that the December 2017 run up in cryptocurrency prices was almost entirely retail investor driven. The truth is that large corporate institutions that play the biggest role in financial markets. Despite widespread interest in cryptocurrencies from institutions, there are a few things preventing them from entering the market en masse:

- A lack of viable custody solutions.

- Regulatory clarity.

The good news is that these roadblocks are likely to be solved in 2018. Fund management firm Fidelity manages over $2 trillion of client funds and has recently posted job ads for people to help them build a cryptocurrency exchange and run a crypto fund. It seems clear that major financial institutions are gearing up to enter the cryptocurrency market soon. The truth is that the ‘fear of missing out’ (FOMO) demonstrated by retail investors in December, could happen amongst financial institutions. The difference is that these financial institutions will be pouring a lot more money into the cryptocurrency markets. Former Goldman Sachs partner Mike Novogratz puts it well:

“It won’t go there ($20 trillion) right away. What is going to happen is, one of these intrepid pension funds, somebody who is a market leader, is going to say, you know what? We’ve got custody, Goldman Sachs is involved, Bloomberg has an index I can track my performance against, and they’re going to buy. And all of the sudden, the second guy buys. The same FOMO that you saw in retail [will be demonstrated by institutional investors].”

How Could You Protect Yourself From A Bubble?

Conventional cryptocurrency wisdom says that you should HODL or ‘hold on for dear life’. This strategy posits that you should buy cryptocurrency and simply hold it for the long term. Sure, this strategy sounds all well and good. However, most investors simply cannot stomach a 70% paper loss in their investments and are likely to sell before the long term is realised.

The scary thing about the cryptocurrency price run up in November / December of 2017, was the massive spike in Google searches for ‘buying bitcoin with a credit card’. As we all know, credit card companies demand monthly payments and high levels of interest. So anyone buying cryptocurrency with a credit card could not HODL. Instead credit card repayments probably forced many buying Bitcoin this way, to sell at a loss and incur credit card fees. The first way to protect yourself from a crypto bubble is: don’t buy cryptocurrency on credit.

Is The Cryptocurrency Market At An All-Time High? Then Do Not Buy

The truth is that bubbles tend to form when everyone is scrambling to enter a single market at the same time. This usually results in new all-time high market prices being set. The best investors in the world do not buy when prices are sky high. Instead, they buy low and sell high. It’s a very simple concept to understand in principle, in practice it’s much harder to execute than you think. The next time Bitcoin is over $20,000 it is probably not the best time to buy. In fact this is probably a good time to consider slowly selling off your positions.

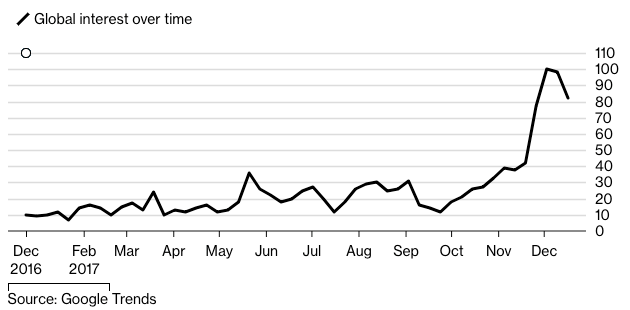

There are other methods you can use to help determine if the cryptocurrency market is entering bubble territory. The first is to do a simple google news search for ‘Bitcoin’ or ‘cryptocurrency’. If the search results seem to be exceptionally positive about Bitcoin, then it might be a good idea to consider selling. Conversely, if you see news articles about how ‘Bitcoin is dead’ then it is likely that now it a good time to enter the market.

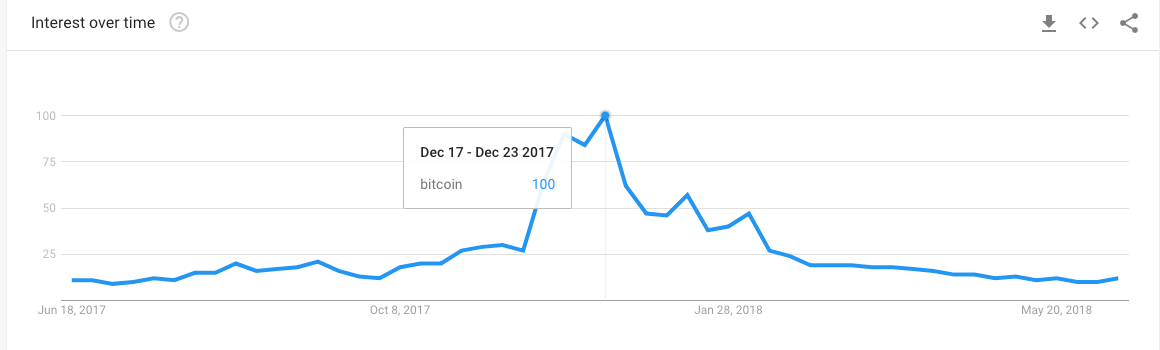

The second method involves using Google trends. You can see in the week of the 17th December to the 23rd, that Bitcoin reached its highest levels of interest on Google.

Guess what? The Bitcoin price topped out on the 17th of December. Potentially this makes Google trends a useful tool to help you know when is a good time to sell. If you are considering buying, well you want the Google interest to be as low as possible.

A Simple Strategy To Protect Yourself From The Crypto Bubble

No strategy is perfect. One way you could use to protect yourself from a cryptocurrency bubble is to only buy when all 3 criteria are met:

- Google news headlines are very negative on Bitcoin and cryptocurrencies.

- Google interest for Bitcoin and cryptocurrencies is exceptionally low.

- There is a significant discount between the all time high and current prices.

Investing on a credit card is never a good idea. Doing so opens you up to a lot of risk, fees and stress. When it comes to buying cryptocurrency most people just decide how much they want to invest and go all-in. A better strategy is called dollar cost averaging. This strategy says that you break your investment into a certain number of chunks and invest a portion every 2 weeks, month or quarter. This means if the cryptocurrency price goes down, you can buy more coins with your next investment. This means that if the market crashes, you get a much better average price for your cryptocurrency than if you just went all-in to start with.

Exit Strategy: Taking Profit

Cryptocurrency is like any market, in the sense that there are market cycles. It basically impossible for cryptocurrency to go up infinitely and in a straight line. Before taking a position in cryptocurrency, it is worthwhile planning how you are going to exit the market. Today you might buy Bitcoin at $7,000 and look to sell 25% of it at the following price points:

- $19,000

- $21,000

- $23,000

- $25,000

It’s also worth checking Google trends and the news headlines. If the news around cryptocurrency is really positive and Google trends is clocking in at 100, then you might want to sell all your cryptocurrency straight away.

The thing with cryptocurrency is that you only have paper dollar gains until you sell. One thing many cryptocurrency investors regret is not taking profit in December 2017. By taking profit you not only realise your gains, but you could buy more cryptocurrency when the market crashes again. By doing this you are buying low and selling high. Usually that’s a pretty profitable strategy and it should help you profit from bubbles.

Conclusion

Cryptocurrency is going to be in a bubble until it either becomes a technological dead end or it’s adopted widely. It’s a very volatile market, but it is this volatility that can make it such a potentially profitable market to be invested in. We do hope you have learnt a few tips and tricks to protect yourself from the next cryptocurrency bubble. Although an overall market trend might be upwards, just remember that what goes up, must come down. Despite all this, cryptocurrency can be a positive force in years to come, with many projects aiming to solve unique social problems.