Crypto investors holding between 100-1000 Bitcoin Units have started a new phase of the digital asset accumulation. According to a report by Kraken, a US-based cryptocurrency exchange, the Bitcoin whales have started piling up more Bitcoins into their wallets.

Details of Kraken’s Report

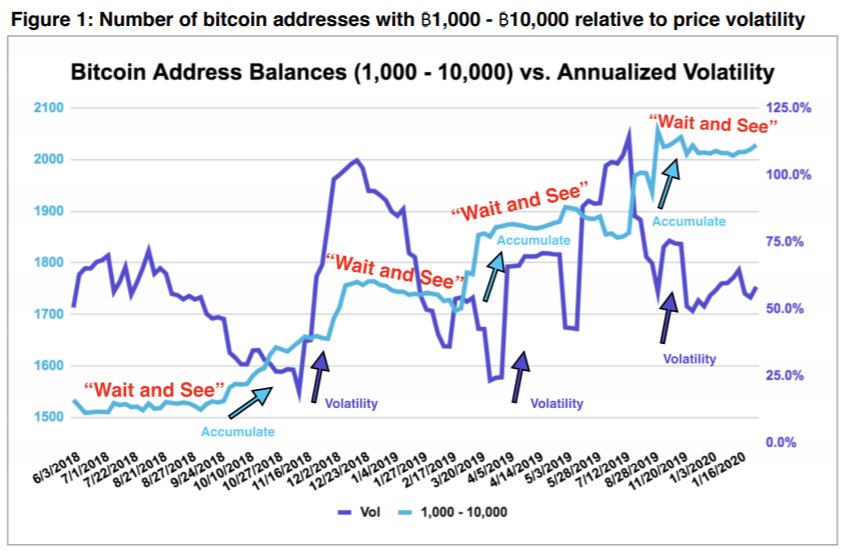

In the report analysis was a graph showing the relationship between Bitcoin Address Balances (1,000-10,000) against Annualized Volatility from June 3, 2018, up to January 16, 2020. From the chart, it shows that every time there was high volatility in Bitcoin’s market price, it was preceded by a “wait and see” pattern from huge investors.

Prior to that, there was another phase of Bitcoin accumulation from the big-time investors, who in essence just held the crypto asset to wait for the price to rally up and bag profits from it.

The report also noted that there was a steady growth in the number of Bitcoin addresses holding a large number of crypto assets as of January 3, 2020. According to Kraken’s data, the recent crypto bull rally has progressed to Bitcoin investors holding between 100-1,000 BTC.

Kraken is anticipating a huge collection of Bitcoin to diminish in the coming weeks or months, which will result in the re-emergence of high volatility in the market. The report continued to explain that the phenomenon of “accumulation pending volatility” is due to the absorption of market liquidity which then reciprocates to a tight supply to demand ratio imbalance.

In Conclusion

Kraken noted in the report that the high accumulation might be the leading factor in Bitcoin’s recent bull rally. With the accumulation increasing and the halving event coming close, the demand for BTC is bound to skyrocket in the near future and therefore result in Bitcoin hitting a new all-time high.

From the report, Kraken deduced that the recent social and economic crisis has been a major contributing factor to Bitcoin hitting $10,000 and showing the tenacity to surpass the all-time high.

Events like the China coronavirus outbreak that has ravaged the social fabric of the Chinese welfare, to the Chinese Central Bank injecting more than $170 billion into the market as a measure to counter the failing economy have all contributed to the crypto bull rally.

With such fundamental aspects, Bitcoin traders and investors can make an informed decision that is not based on sentiments.