September 24 will remain a mystery in the eyes of Bitcoin fans. That’s after the crypto’s network shed off a whole 40% in network transaction processing power – or hash rate, as commonly termed.

Hash Rate Explained

Basically, the hash rate is referred to as the number of calculations a network can complete in one second. In the crypto world, a high hash rate for a crypto network means better security, credibility, and efficiency.

The higher the hash rate, the harder it becomes for any aggressive party to conduct a 51% attack on the network. Also, a high hash rate increases competition among crypto miners and puts more pressure on the resources needed for mining.

Still A Mystery

The sudden drop in the Bitcoin network’s processing power is still a mystery as no one has come up with any credible explanation about why and how it happened. Just a few days ago, Bitcoin’s network hash rate had peaked to an all-time high of 102 quintillion hashes. That makes the sudden drop all the more mysterious.

Before the drop, Bitcoin’s hash rate had reached 98 million TH/s. After the drop, the hash rate stood at just around 57.7 million TH/s, making a 40% drop within a short period. However, the drop was followed by a period of recovery. At the time of this writing, the hash rate had gone up to around 88.3 million TH/s.

Any Price Correlation?

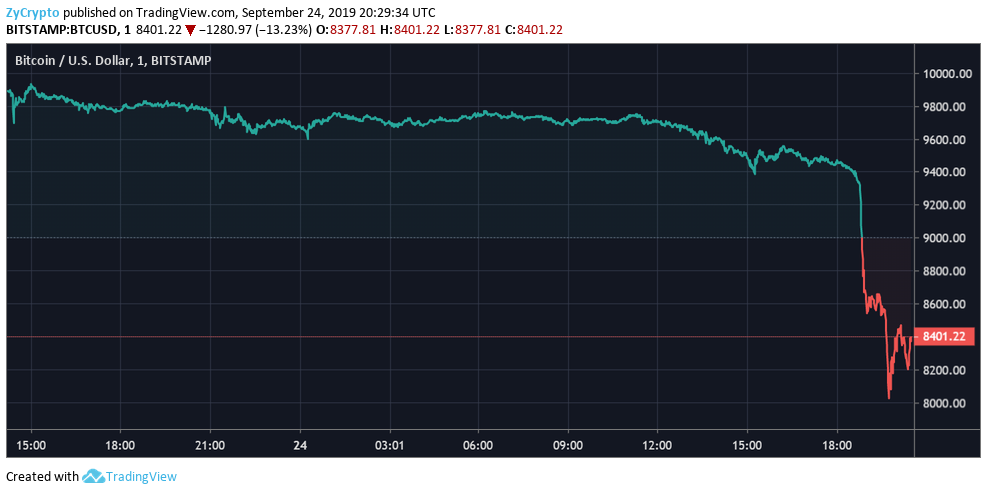

The hash rate drop has left many pondering on whether it has anything to do with the drop in Bitcoin’s price. It’s to be noted that Bakkt, a Bitcoin futures trading platform, commenced its full operations yesterday (23rd September 2019).

While this happened, Bitcoin’s price dropped below the $9k mark. To many, Bakkt’s entry into the Bitcoin market would have been expected to bring out some good tidings in terms of Bitcoin’s price action. Still, it’s not yet clear whether the price drop was a result of the hash rate drop or Bakkt’s launch.

Still, there those like Max Keiser who have already linked Bitcoin’s hash rate to corresponding price action. Back in August, Max tweeted that Bitcoin was following a –year bull market and that its increasing hash rate would lead to a bullish move in price.

Whether this assertion can be used to explain the link between the mentioned fall in hash rate to the fall in price is still unclear. If it’s true, then Bitcoin can be expected to move in price especially now that the hash rate is dropping.