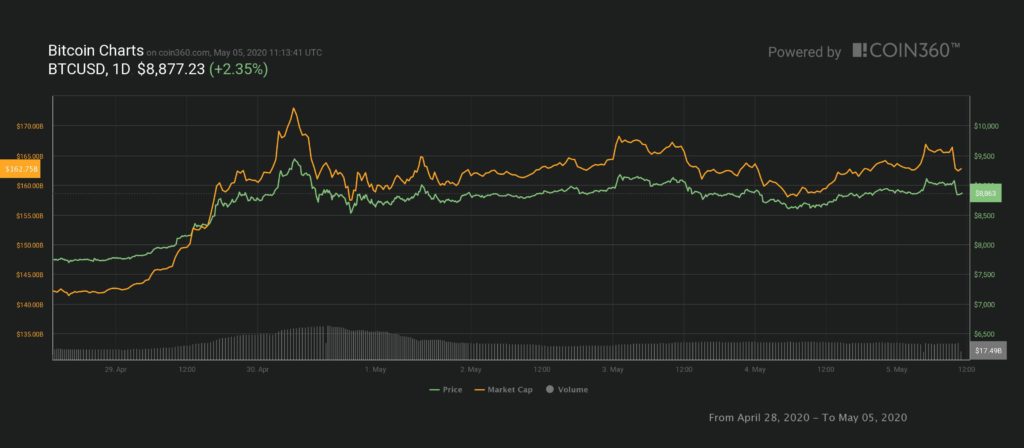

Bitcoin has climbed back above $9K. This marks the tenth time it has done this in its history. Its return is a quick turnaround after visiting its supports on Monday. Yesterday Bitcoin reached for its lower support of $8,600. For most seasoned traders, they capitalized on this drop by reaccumulating.

As Bitcoin approaches its recent high of $9.4K, a bullish pattern suggests that a break above this resistance could see Bitcoin shoot straight to $10.5K. The bullish pennant pattern shows that there’s potential for Bitcoin to gain around $1,000 in a short time.

As witnessed last week, Bitcoin easily gained $1,000 in less than 24 hours. With many already predicting Bitcoin will reach over $10K by the halving expected next week, we could witness a scenario where Bitcoin gains over $1,500 in the next couple of days.

Although Bitcoin has struggled to stay above $10K in the long term for the last 2 years, its first break above this key resistance has led to record highs. When Bitcoin broke above $10K early this year, it was unable to rally hard only reaching $10.3K before meeting resistance and falling back to mid $9K.

This time, the crypto community expects Bitcoin to continue riding on the halving event long enough to test 2019’s high of $14K. Others expect the same momentum to propel the digital asset to its all-time high of $20K. With Bitcoin halving searches reaching ATHs this week, it’s clear that this, the third Bitcoin halving, is the most significant one.

With most buyers right now believed to be speculators, there is continued fear that prices might crash after the halving as most take profits. Additionally, the COVID-19 pandemic continues to weaken investors’ spending, limiting the number of buyers and the amount they purchase. Because of this, some investors are approaching the halving with caution.