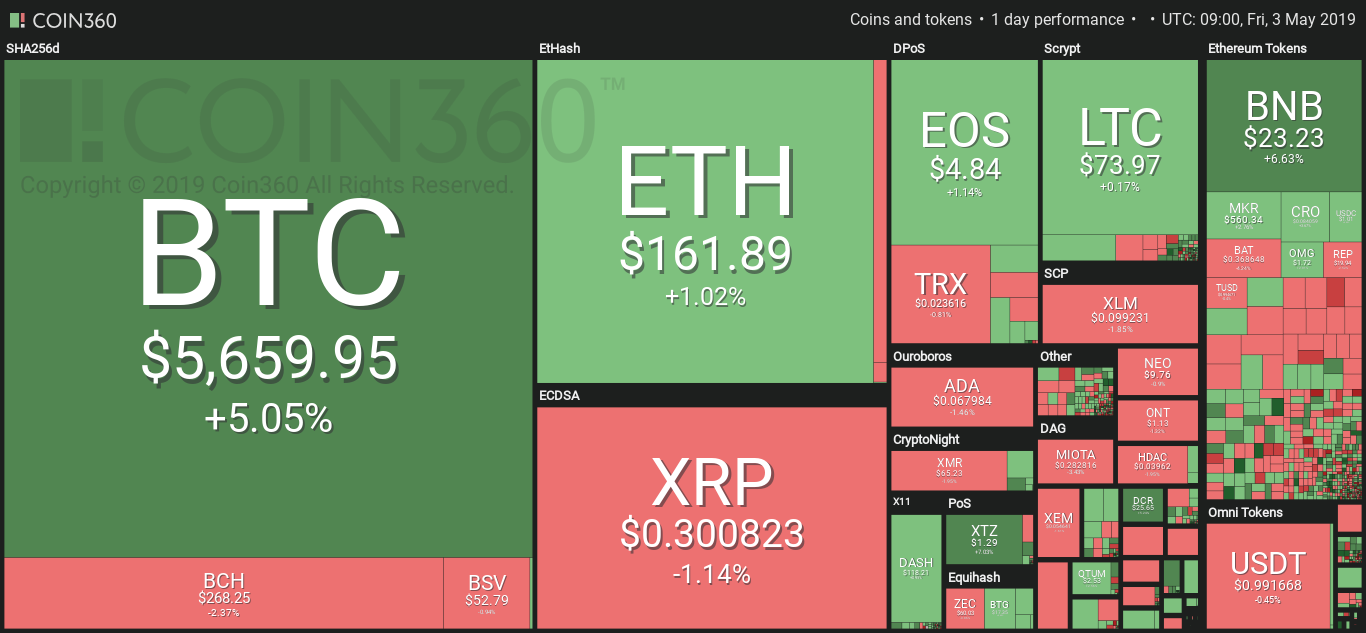

As the waves of the bulls stretch through the cryptocurrency market once again, Bitcoin and many other altcoins are taking a major upclimb as the market makes yet another correction.

The week which had initially begun with a fair share of gains and losses is now stabilizing surprisingly through the weekend. With the structure of the current market, tokens and coins are likely to make a breakout in price if the market continues to take this route.

While some cryptocurrencies are still managing to rake in gains between 2% and 3%, Bitcoin is fast heading to the breakout end as gains sweep in swiftly.

The bull had previously lost its momentum on the 24th of April shortly after moving all the way up to $5642 on that very same day. Although the coin later recounted gains that pushed it back up to the $5500 mark the next day, the effects of the bearish trends set in shortly after and send Bitcoin even further down to the $5100 mark. Bitcoin which has now rallied its way up above the $5500 mark within the last 24hrs is now trading at a price of $5677 at press time.

In terms of gains, BTC has increased by 4.73% at the time of this writing. It becomes even more impressive to note that BTC is amongst the top gainers at present, and with the constant increase in trading volume, BTC is more than likely to hit $5700 in a few hours time and head further to the $5750 and $5800 mark.

Traders have continued to HODL in anticipation for the next bull run, which in this case seems to be around the corner. In fact, with trading price only $400 away from $6000, the bull run is indeed not farther into the year.

Meanwhile, altcoins are not losing their grip. With the arrival of the slight bearish trends, a sizeable number of altcoins have attained impressive gains, well enough to set trading price out on a breakout.