One of the most significant crypto exchanges, Coinbase, has stated that there was no insider trading of Bitcoin cash in December 2017 after the firm thoroughly investigated the matter.

According to a credible source who pleaded anonymity, Coinbase conducted a brainstorming meeting last week to deliberate the result of an internal investigation that has been dragging for a while.

Speaking to newsmen, a spokesperson of coinbase said that” independent internal investigation” has been completed and the company is “determined to take no disciplinary action,” following a comprehensive probe by two national law firms.

A representative of the leading exchange also said ” we would not hesitate to terminate an employee or contractor and take appropriate legal action if evidence showed our policies were Violated.

We can report that the voluntary independent internal investigation has come to a close, and we are determined to take no disciplinary action.”

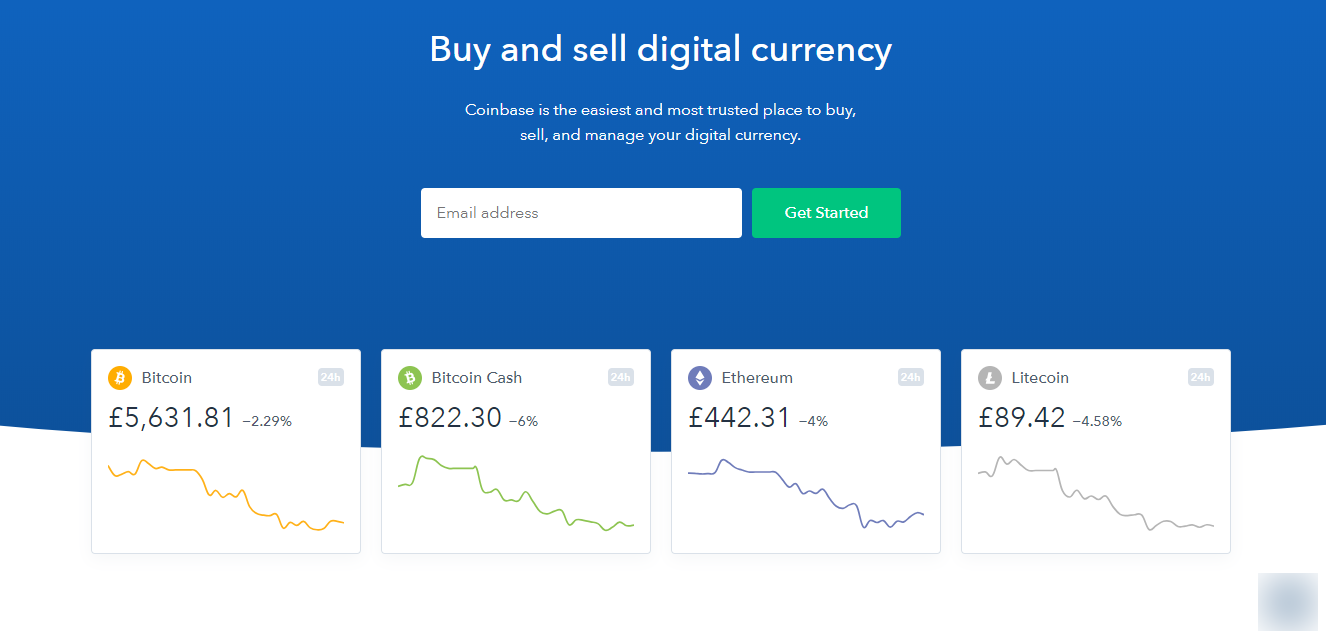

In the beginning, Coinbase was not really in support of bitcoin cash, but later changed its stance and announced that the coin would be listed on Jan 1.

Rumors started to fly that insider trading was occurring Dec 19, when Coinbase listed BHC on its platform, almost a month ahead of schedule and the price of the coin surged above $3000, with the bitcoin community accusing Coinbase staff of illegal trading activities

The chief executive and senior manager at Coinbase Brian Armstrong said on the day of the launch of BCH that the employees of the exchange are held to strict standards on the matter of insider trading.

The senior executive stressed that the exchange would conduct an internal investigation on all allegations on the surge in the price of BCH.

Tough the investigation has affirmed that there was no insider trading, a pending lawsuit by customers is still in progress. The plaintiffs are demanding damages for negligence and violation of customer protection law.

Their lawyer Lynda Grant said the CFTC is investigating the case. Coinbase has been slapped with several lawsuits in recent times.

In April, Coinbase was criticised by the customers of a defunct cryptocurrency, Cryptsy. They argued that the exchange did not do enough, to prevent Cryptsy’s chief executive from absconding with customers money. Coinbase lost the appeal and the case proceeded to the jury.

Advertisement