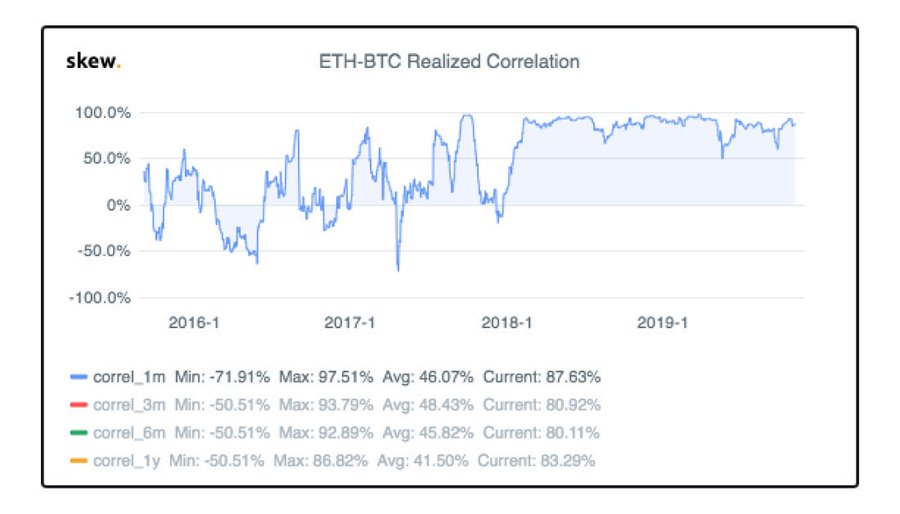

According to a recent report made by Skew, the correlation between BTC and ETH has been around 90% for the past two years. The report included a short statement, ‘not bullish’. Does a high correlation between the two most popular cryptocurrencies imply the market is not bullish?

Not necessarily, Bitcoin has always been the leader as most cryptocurrencies hold a BTC pair, which means that anyone who wishes to buy that specific crypto, will need to buy BTC first. It’s easy to see why the price of Bitcoin is really important for the rest of the market.

Now, Ethereum does have its own fiat pairs, people don’t necessarily need to buy BTC in order to buy ETH, however, the correlation is still there, why? There are still a lot of BTC/ETH pairs which hold a lot of trading volume, for instance, the top 8 ETH/BTC pairs hold an average 24h trading volume of more than $100 million, according to Coinmarketcap.

This correlation shouldn’t imply that the market is not bullish as it could simply mean, most investors think both ETH and BTC are the most valuable coins.

When we look at the price, Bitcoin is actually doing quite well this year. BTC was trading at a low of $3349 in January and has reached a peak of $13970, 6 months later. It is currently trading lower at $9285 but that’s still more than twice the price as in January.

Ethereum also had a good year starting at $100.9 and reaching $364.49 later on. It’s currently trading at $186.48 almost twice the price at the beginning of the year.

It’s clear both cryptocurrencies have been doing quite well this 2019 and according to technical indicators, they are set to do even better in 2020.

The hash rate of Bitcoin, for example, is still at record highs as the hash rate has been increasing throughout the year. There is also an important event coming up next year, the Bitcoin halving, an event that has been historically good for Bitcoin’s price.

So, is this correlation really important for the market? Or does it simply mean that both cryptocurrencies are doing good?