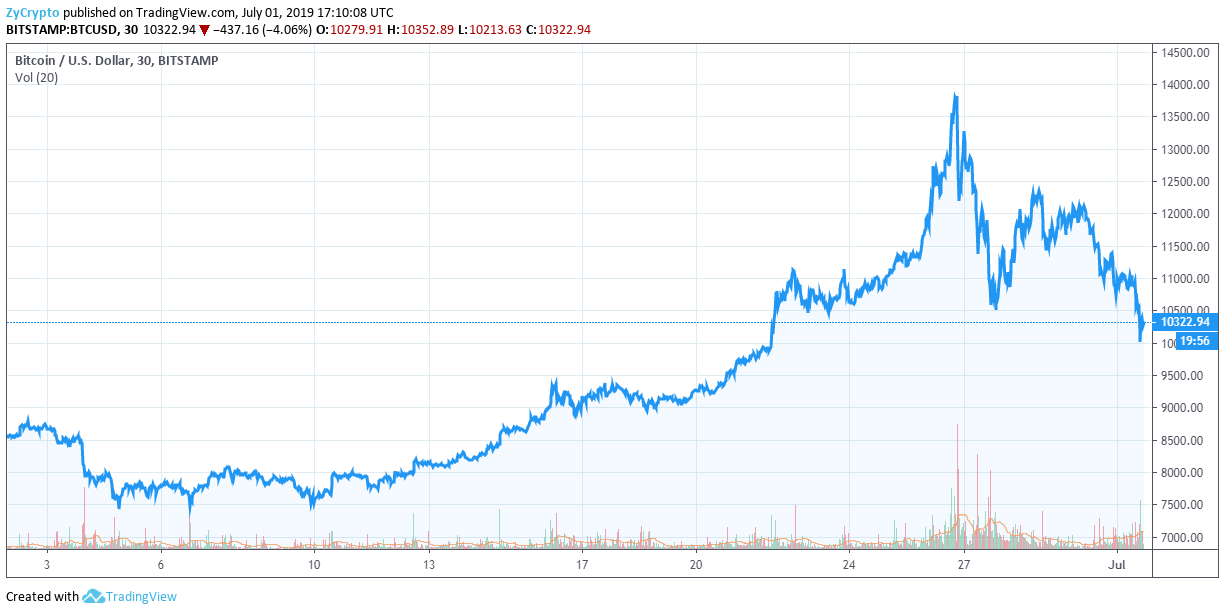

The bitcoin downtrend that started last week has continued in this new week. In the past few days, bitcoin (BTC) has witnessed a more than 20% decline from its 2019 all-year high.

Bitcoin is trying to recover lost ground but the bulls are unable to push the price upwards. According to CoinGecko, bitcoin has shed 8.71% in the last 24-hr period and is trading at $10,297.75 at press time.

Analysts’ Take

This week, bitcoin remains volatile and continues on a downswing as altcoins bite the dust. In a recent tweet, Josh Rager, popular crypto trader, and investor expressed that bitcoin was about to take a break from the recently witnessed bull run before resuming to a price rally. He argued that this correction would mean more opportunities to accumulate bitcoin.

“Weekly close looks ugly, you’ll likely see this shooting star type of doji all over CT which is typically a sign for reversal & we could see a couple of down weeks for bitcoin but be happy as that would mean prime buying opportunities ahead,” said Josh in his tweet.

As we reported a few weeks ago, many people were talking about a dip of over 30% which has not yet been realized. As aforementioned, bitcoin is down 20% as of now. A further 10% plunge would take bitcoin to mid $9,000s where analysts believe it would find support.

DonAlt, another crypto trader and investor, also agrees that bitcoin price retraces deep in bull markets most times. He tweeted, “This chat looks like ass. Not necessarily a bad thing though, BTC likes to retrace deep in bull markets. The only way it can do so is by looking terrible. Waiting for support or resistance to get hit to make a move.”

Regardless of the current downtrend, bitcoin is seeing impressive technical factors. Among these factors is its hash rate hitting an all-time high level. Also, bitcoin continues to dominate over 60% of the total market capitalization.

Bitcoin Hash Rate Surge

Despite last week’s pullback, bitcoin’s hash rate has been on an impressive upswing. This uptrend has been witnessed since early 2019 and seems unstoppable so far. The bitcoin rally witnessed in the last couple of months could have further contributed to the increase in the number of mining hardware coming online.

According to BitInfoCharts, bitcoin’s hash rate hit 69 exohashes/second, a new ATH. Although the hash rate doesn’t have a direct impact on bitcoin’s price, the upsurge is a good sign for the bitcoin community and implies that everything behind the scenes is going accordingly.

It also shows that mining bitcoin is still a lucrative activity. As the hash rate continues to surge, enthusiasts are positive there will be no real hurdles such as delayed bitcoin transactions in the future.