BTC/USD

The top cryptocurrency by market cap saw a lot of movements yesterday (Nov 4) as was the case with most other top 20 cryptos. The pair closed at a high of $6493 before taking a 0.36% loss this morning (on 4h charts). Currently, the 7-day moving average is the support for the pair’s price, which stands at $6457.

This is perhaps an indication that a bullish trend may be incoming. Currently, however, the coin has lost in excess of 2% over the last 7 days which has diminished its market dominance slightly from 53.5% to 52%.

Additionally, the pair’s trading volume decreased today as was the case with the price. This was informed by an advisory opinion given by the Securities and Exchange Commission (SEC) to traders.

SEC had rejected 9 Bitcoin ETFs; including 5 from Direxion, 2 from GraniteShares and 2 from ProShares. The SEC had set a November 5 deadline for reviewing the rejections. This led traders to hold back as they await SEC’s decision. Consequently, Bitcoin prices against the dollar dipped and so was the trading volume.

ETH/USD

The pair, which saw a robust 3.5% growth, is today dipping slowly. If the bears are to persist, the $204 major support level is likely to be tested. Resistance is at the $211 mark with the price rally facing a hurdle at the $221 mark.

Currently, the 7-day moving average acts as the price base which is at $206. Were the bears to up their momentum, the $204 will be breached and a new support level of $200 may be achieved.

XRP/USD

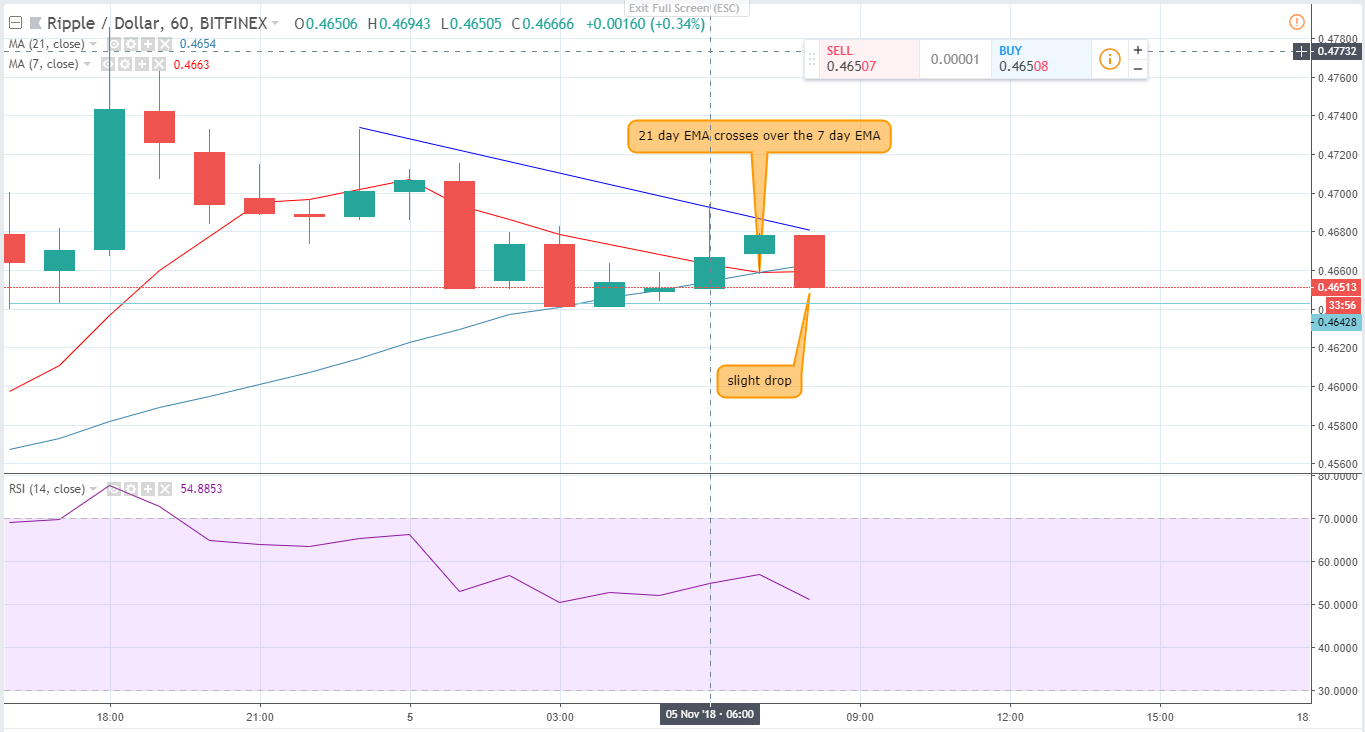

Ripple, the third top cryptocurrency by market capitalization has been on a slow upward surge for some time. The pair has been on a slow consolidation trend since October, gaining around 1.3% and currently trading at $0.46.

The trading volume for the pair has been ranging around the 50 mark. On November 4, a noticeable increase in trading volume occurred. This can perhaps be attributed to an imminent November 5 deadline by the SEC for reviewing proposed rule changes related to a series of top applications to list and trade various EFTs.

Today, however, trading activity has dropped, perhaps due to the above deadline. At 0700h, the 21-day moving average crossed over the 7 days moving average signaling a bearish trend.