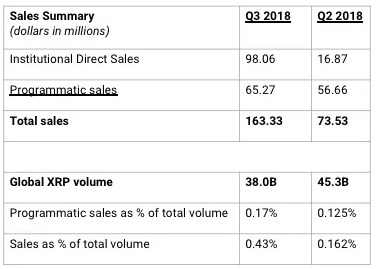

Ripple market progression update shows, a higher performance this quarter. The financial technology company reported double revenue in sales of its XRP token more than last quarter.

According to a report published by the digital asset company, this week, the crypto firm sold $163 million in XRP against $73.53 sold last quarter, irrespective on the rising volatility. This market report represents 0.43 percent of the annual XRP global trade volume.

Ripple Foundation’s outstanding growth is triggered by its aim to create a seamless, faster and cheaper transfer of funds across borders using decentralized financial tools.

The foundation has been promoting its initiative to create the Internet of Value, which will enable money and value to be processed and transferred across the globe just like information is today.

Out of the $163 million sales revenue, Ripple subsidiary XRP II, LLC, registered and licensed to carry out monetary business services, sold $96.06 million equivalent of XRP in direct sales. The remaining $65.27 equivalent of XRP transacted equals about 0.172 percent of the XRP global trade volume.

Out the $3 million released by the digital firm into an escrow account, $2.6 million worth of XRP was returned. This will keep the foundation secure in the fourth quarter, with 55 billion XRP locked in an escrow account. It will enable a seamless and faster flow of XRP digital asset.

This week’s market report shows that XRP has performed higher than other cryptos, the price was steady for some days, but later rose up to 3.3 percent trading at $0.47.

Ripple XRP performance is likely to go higher as a result of the awareness being created about the Internet of Value. They have indicated their intention to lead a group of cryptocurrency startups named the Securing America’s Internet of Value Coalition to influence lawmakers and financial regulators in D.C. This group intends to influence the government’s position in other to support new ideas and stir up competition in the crypto community.

Ripple would need to lobby a bipartisan lobby group named Klein/Johnson Group to assist the cryptocurrency and blockchain community and influence regulators to get government support.

This lobby group will get from the coalition, $25,000 a month and 10,000 in XRP.

In the just concluded Money, 20/20 in Sydney, Ripple CEO Chris Larsen said that the global liquidity problem can only be solved by an efficient digital asset.

“10 years out on the financial crisis we still don’t have the infrastructure perhaps to prevent the next one,” says @chrislarsensf, Executive Chairman & Co-Founder, @Ripple, continuing “an efficient digital asset can really solve some of the key problems in global liquidity”.

This move will likely strengthen Ripple and increase the market performance of their token, XRP.