One of the biggest players in the cryptocurrency exchange Bitfinex decided to halt wired deposit of US Dollar, EURO, Pound Sterling, Japanese Yen. This happened on Thursday when screenshots from customers accounts were circulated on the social media. But the exchange promised to resume operations next week.

No explanation has been given so far by Bitfinex, but there are so many speculations concerning what could have been the cause.

Banking Challenges

A report last week showed that Bitfinex, a crypto exchange giant, which operates from Hong-Kong has been holding funds with the noble bank in Puerto Rico. But Bitfinex recently closed the account, due to press coverage. Currently, the noble bank is looking for buyers because it has lost its two major clients, Bitfitnex and an affiliate, Tether.

According to another report from The Blocks research, Bitfinex opened another account with HSBC, a banking giant based in London, under the name ‘Global Trading Solutions.’ Apparently, the HSBC might not have known that the account belongs to Bitfitnex since it was opened in a different name.

Bitfinex Opened a New Account With HSBC in a Different Name

A report from a reliable crypto website stated that the sudden halt in fiat wire deposit could be that, HSBC closed the account when they found out it belongs to Bitfinex. Unfortunately, the exchange has no other account to receive fiat deposit while they settle issues with HSBC.

A lot of issues are lined up against Bitfinex, one of which is a conflict with Taiwanese banks, which is documented. The exchange initiated a lawsuit against another US giant bank Wells Fargo for blocking deposit to its account and interrupting its business operations.

All these issues led to a speculation that the crypto exchange is insolvent. But as reported by Cointelegraph, the exchange has officially responded to the rumors going on online. They stated that the present challenges are not unusual, but peculiar to their domain of operations, and a regular occurrence to any crypto-related organizations.

The Recent Decline in Bitcoin Prices

Despite all these reported issues relating to bank dealings, it cannot be overlooked that the challenge faced by Bitfinex, might also be connected with the recent fall in bitcoin price.

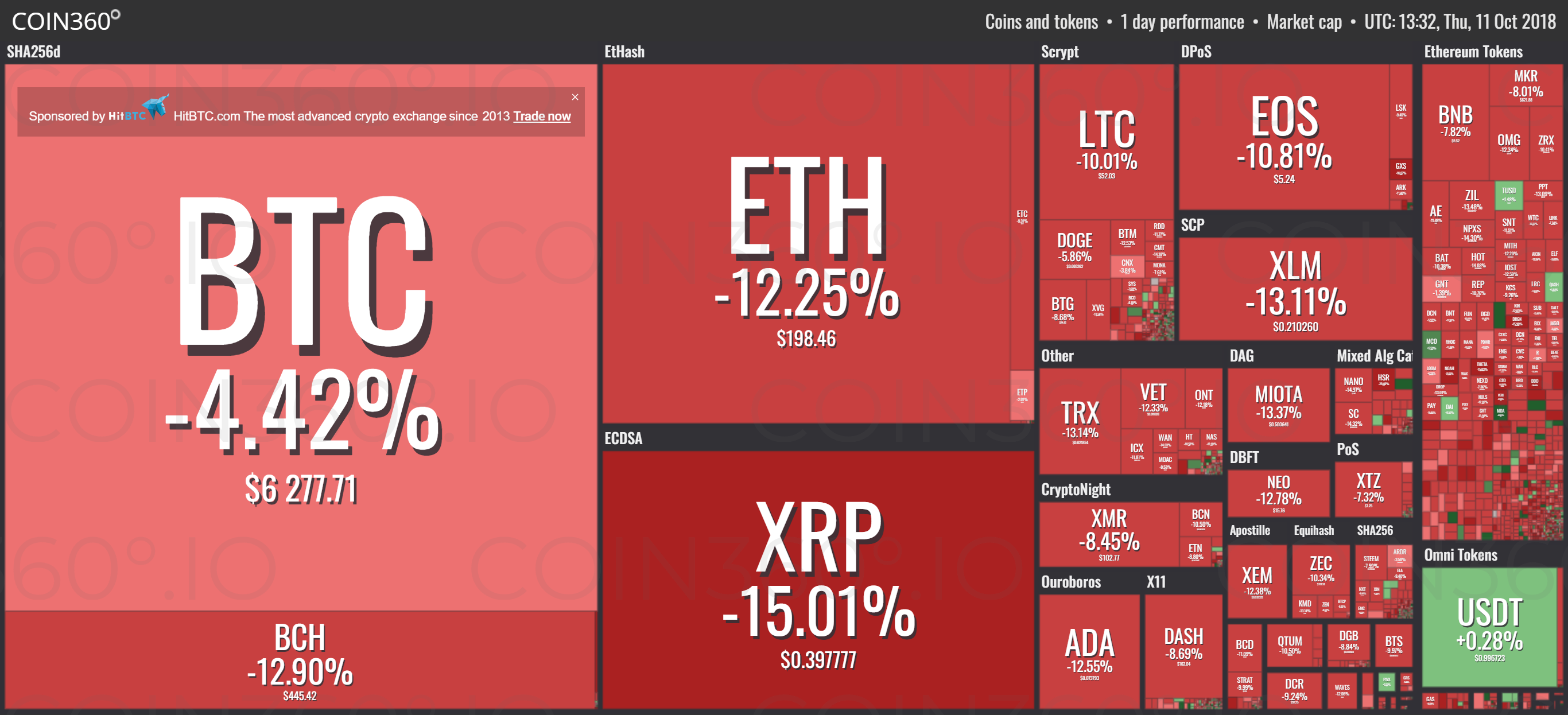

Though Bitcoin has been stable for some months now, the sudden fall in price resulted in over 5% loss in value. This fall also affected other leading cryptocurrencies like; ripple (XRP), ethereum, stellar, litecoin, EOS, and bitcoin cash.

Fall in Bitcoin price and Other Leading Currencies.

The price of bitcoin was at the region of $6,500 earlier this week but has dropped to $6,200. This downward movement is sudden with multiple effects, resulting in loss of millions of dollars valued in bitcoin.

A report from Coindesk data indicates that the digital currency was earlier trading on Thursday at $6500, the price it has been for months. But a sudden change brought it down to $6,125, the coin was able to recover some lost ground when it clawed back to $6,200, with $13billion lost in 30 minutes.

The effect of this fall was even harder on other leading cryptocurrencies which went down, losing 10 to 12 percent in value.

Bitcoin, which started an upward movement in December 2017, going at $20,000, got to its peak in January 2018. After which it took another slide to $5,800, in July with a loss of $6,000 value in bitcoin.

Another report from Forbes, states that the sudden up and down movement in bitcoin price can be traced to trading ‘bots’ which can cause a total change by initiating prices. Big players in the cryptocurrency market known as the ‘Whales’ who control a huge amount of money can also influence the general market prices since they can buy and sell at will, below or above the prevailing market price.

A report from Chainalysis defines bitcoin whales as;

“These whales regularly engage with exchanges to buy and sell bitcoin. With nine wallets controlling over 332,000 coins, worth just over $2 billion, whales who actively trade make up the largest category, but only about a third of total whale holdings. Traders are also relatively recent arrivals in the Bitcoin universe: most got into the market in 2017.”

Bithumb bought for $354 million by Kim Byung-gum BK Global Consortium

Bithumb is one of the South Korea’s cryptocurrency exchanges that has passed through a lot of government scrutiny and auditing since it was affected by a recent security breach at the end of the second quarter of this year which saw about $31.5 million worth of cryptocurrencies hacked.

Ever since then, South korea’s financial regulatory authority has placed their eyes on the activities of the world’s second largest cryptocurrency exchange in terms of trading volume according to the information available on Coinmarketcap.

According to reports the largest cryptocurrency exchange and crypto trading platform in South korea Bithumb was sold for 400 billion won ($353.64) to BK Global Consortium, led by Kim Byung-gun, plastic surgeon and blockchain platform investor.

Major Sell by big stakeholders can affect the general market Prices

These trading whales, are a group of diverse traders, who have the ability to do the transactions that can affect the market price.

However, the Chain analysis further explained that the ‘Whales’ are not always the cause of swing in bitcoin price but they still have a major influence. This is because they control a huge chunk of money that can easily influence the market price.

Stock Sell-off Effects on Bitcoin and Leading Crypto Prices.

Cryptocurrency analysts have attributed the swing in bitcoin price and other leading digital currencies to the largest stock sell-off since February.

As reported by the Independent, on Wednesday, the US experienced the worst stock market sell-off since February.

President Trump blamed the Fed for this unreasonable market sell-off and hikes in interest rates. In an interview with Fox News, he argues that the recent market fall is not because of his trade issues with China but a fault from the US Central Bank.

This largest US market sell-off saw S&P 500 to the lowest level since July. Dow Jones Industrial Average dropped as much as 836 points, the Nasdaq 100 Index slid down to 4 percent lower than it had for seven years.

This sell-off came just after IMF had warned that the World Economy is shaking, blaming it on the tension and stresses from emerging markets, like cryptocurrency.

The global financial system is shaking and there are multiple effects, not only on the financial markets but other key industries. Businesses are shutting down and companies are forced to lay down their staff. Experts forecast that digital assets have a potential downward slide trend.

According to express.co.uk, UK CEO at finder.com Jon Ostler said: “Cryptocurrency is currently a bearish market, with our BTC predictions for the end of 2018 decreasing for the third consecutive month in a row.”

Digital assets are yet to be recognized by Official government bodies before it could be regulated on a universal agreement.

Mr. Ostler has the opinion that this pending decision is the reason for the short performance of digital assets. And will continue affecting the market in the short term.

David Sapper, Block bid COO, told express.co.uk that he foresees bitcoin and other cryptocurrencies being recognized in the future by the SEC and EU Securities Commission.

Apparently, the effect of fluctuation in the prices of digital assets is more on the cryptocurrency exchanges like Bitfinex that just closed down business, after so many challenges.