A new finding which is likely birth skepticism amongst prospective investors and possibly affect the future of the recently launched Coinbase broker-dealer known as Coinbase custody has been discovered after some in depth research.

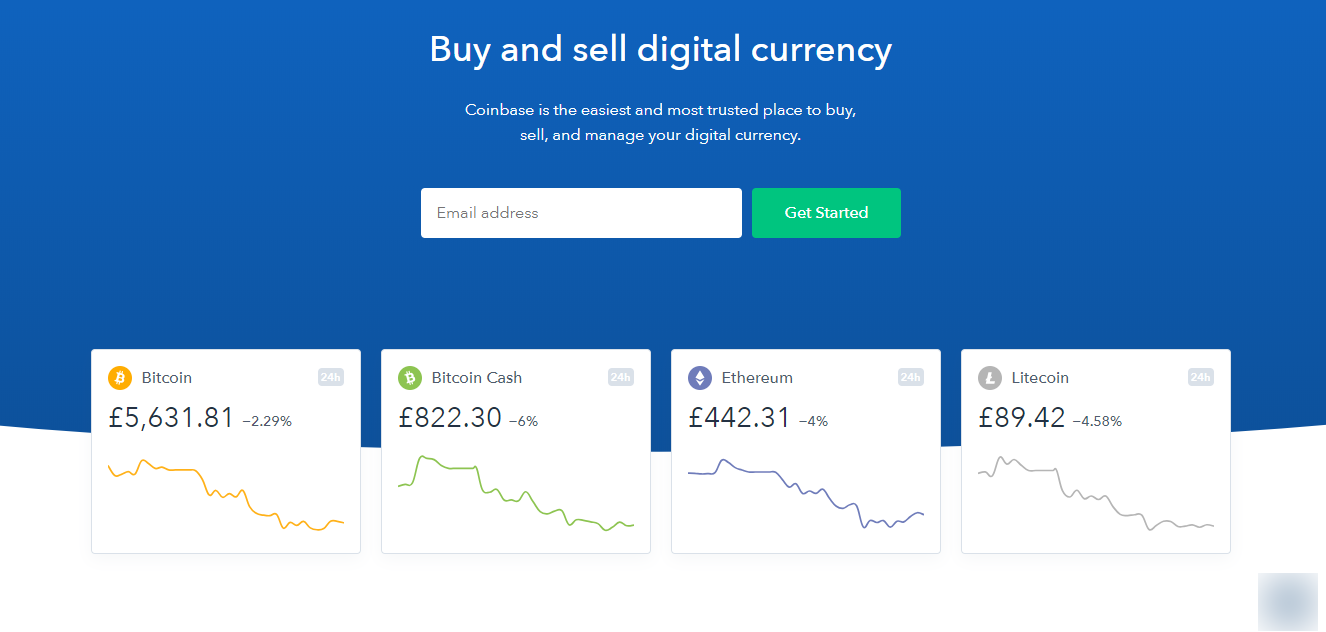

The Cryptocurrency exchange platform Coinbase whose headquarter is located in San Francisco, California can boast of over 30,000,000 and has been a leading Crypto trading platform since October 2012.

However its newly launched broker-dealer is partnering with the Electronic Transaction Clearing (ETC) was in the news for customer fund mismanagement due to the Securities Exchange Act violation.

The Electronic Transaction Clearing (ETC) had been charged by the Securities and Exchange Commission SEC in March 2018, for continuously endangering customers assets. The SEC revealed that the ETC, a Los Angeles based registered broker-dealer had risked over $25 million worth of customer’s fund in a bid to safeguard its personal operations.

Although the broker-dealer who neither agreed nor disregarded the allegations had later accepted to $80,000 as penalty, it was initially charged for two occasions, the first of wish involved a deposit of $8 million from a customer which the company had used to clear up its debt for margin requirements, the other allegations revealed that the firm had used another customer’s $17 million as a collateral for a loan.

An interesting fact to note is that the Coinbase custody is yet to be regulated by the Securities and Exchange Commission (SEC)

And while this is an important stage required to guarantee stability for the firm, it comes as no surprise that services have already begun taking place, which is credited to the fact that firm’s partner ETC is already operating as a custodian for institutions.

Upon the launch of Coin base broker-dealer, its product lead official Sam Mclngvale announced that it is soon to unveil its word-class clients which includes leading Exchanges, ICO teams and Crypto hedge funds.

Explaining more about its mission he further said

“Coinbase Custody’s mission is to make digital currency investment accessible to every eligible financial institution and hedge fund in the world. We’ll achieve this by striving to become the most trusted and easiest-to-use crypto custody service available. Coinbase Custody is a combination of Coinbase’s battle-tested cold storage for crypto assets, an institutional-grade broker-dealer and its reporting services, and a comprehensive client coverage program.”

Future plans for coinbase / coin base custody.