Cryptocurrency trading requires nonstop attention because the cryptocurrency market doesn’t have a closing bell like a conventional stock exchange. Thus, trading bot becomes a favorable platform that lets traders manage transactions without the need to watch price fluctuations. In order to acquire the greatest benefit of cryptocurrency trading bot, it is necessary to choose a platform that can perform correctly.

What is the best crypto trading bot?

Introduction

A crypto trading bot is a program that places buy and sell orders in crypto exchange on behalf of traders. It utilizes market data to make a decision, which is generated by an application programming interface (API) and other relevant information. Traders can program the bot with basic rules, such as sell and buy at a certain price point.

Advantages and disadvantages of trading bots

A few significant issues have to be considered when traders decide to give partial decision-making process to crypto trading bots. As it is – indeed – an assistant robot, it has a different characteristic from human traders.

Advantages

- Bots are Emotionless

Human emotion can affect the performance of the portfolio. Humans often make decisions based on greed or disappointment. Bots, on the other hand, do not have emotions. The bot will follow the rules that were set up by the trader.

- Bots don’t have time and space limitation

A bot doesn’t have time and space limitation. It can trade in as many as ten exchanges continuously 24 hours a day.

- Bots are faster than a manual trader

The trading bot also can execute the trading faster than a manual trader. This is really a big advantage for a high-volatile cryptocurrency market.

Disadvantages

Understanding the system behind trading bots requires advanced knowledge. If the bot is not tested properly, it can result in a big financial loss for the trader. Traders have to be careful about choosing crypto trading bots because some bots can be a part of a scam. Security is also an important point to consider since traders have give the bot access to the API key.

Bitcoin trading bots: pros and cons

A trading bot can enhance a trader’s potential to reach the maximum gain in crypto trading. With the right strategy, a trading bot can help the user realize a rewarding profit. However, there is some criticism towards trading bots, because their actions could create a crash in the market, an interruption in the system or other technical problems and computer issues that could be very costly to traders.

Safety tips using trading bots

Since additional security risks do exist when using trading bots, there are a few guidelines to help traders keep their crypto safe:

Traders are not supposed to share account usernames/passwords or 2FA authentication to trading bots. The robot does not need these to access the exchange account. It will require an API key instead.

Traders should clearly understand the definition of an API key and how it is used. If traders decide to set up an API key, they have to create a new key every time they switch bots or forget the keys. This will revoke the account’s access granted by the previous API key. The exchange lets the trader easily create new ones.

Traders should restrict fund withdrawal access to the bot. This feature will allow the bot to only buy and sell coins and protect against scam-bots trying to withdraw money and perform an exit scam. For extra security, traders can restrict access only to a list of authorized IP addresses.

3commas Crypto Trading Bot

Having a clean interface, it is easy to navigate and use the 3Commas trading bot platform. A user can see all of the trades on the dashboard and have access to additional features, such as stop losses and copy trading. It currently has 33,000 traders using the service with daily trading volume exceeding $10 million. Utilizing 3Commas, users can perform trading on 12 exchanges, including Coinbase, Binance, and Bitfinex.

Users of 3Commas can keep up with various orders on different exchanges, develop more informed trading behavior, and apply stop losses or take profit trading strategies. 3commas is notable with its stop-loss advantage. This considers the volatility of cryptocurrencies. If you have a clear notion of price movements in respect of the cryptocurrency you are trading, with 3 commas, you can fix your stop-loss at a given percentage. For example, if you bought BTC early in the day at $4,000, and the price has continued to surge, you can set the stop loss at 10 percent. In other words, once the price drops to the $3,600 mark, your BTC will be automatically sold off. While this might lead to loss of profits, it considerably shields you from losses.

A unique feature of 3Commas is a model portfolio set-up, where traders can analyze and test the portfolio until it is perfect. It is also possible to perform a traditional transaction on 3Commas.

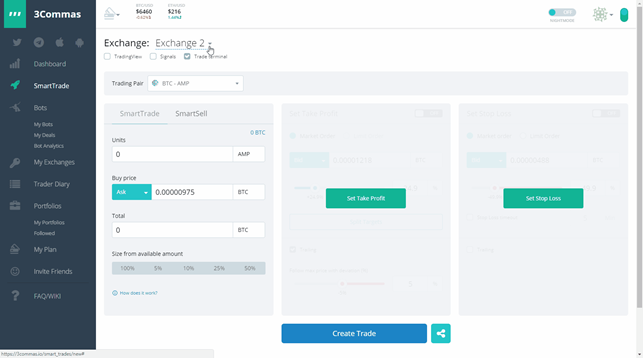

Meanwhile, the SmartTrade feature helps the user set a price point to sell and take a profit or a price point to stop a loss. The setting can be applied even for exchanges that are not supported by 3Commas.

3Commas Smart Trade dashboard

The platform has three different bot types: simple, composite and Bitmex bots. A user can set up long bots using TradingView signals or choose from multiple timeframes and use a ‘composite’ signal. There are short bots that use the QFL method, and other bots that can be customized based on unique trading strategies. Additionally, 3Commas has a copy feature that allows a user to track the activities of top traders. Users can then freely choose if they want to implement the same method in their portfolio.

In terms of pricing, 3Commas offers three different schemes: Starter, Advanced, and Pro. Starter costs $29 for one month, $145 for six months, and $290 for a year. The plan lets the user access the 3Commas Smart Trading terminal, giving them an unlimited number of exchanges and notifications for errors and cancelations, but it does not include trading bots service. The Advanced plan ($49 for one month, $245 for six months, or $490 for a year) gives the user access to simple bots, custom TradingView signals, and the ability to manage the portfolio. For the most sophisticated individual, the Pro plan ($99 for one month, $495 for six months, or $990 for a year), will gain the user access to simple, composite, and Bitmex bots and have full portfolio management. However, 3Commas charges an additional commission of 0.25% on certain trades, including Smart Trade (Buy) and Smart Trade (sell) orders.

Conclusion

Trading bots are a tool that will help crypto traders to gain the most profit possible. With this tool, you can set up specific parameters. But, keep in mind that the crypto market grows and changes rapidly. Therefore, traders should update their strategy on trading bots continuously.

If you are still unsure of whether to use one or not, you can always try the free trial provided by 3Commas. The site requires no payment data and you do get to choose to continue after the trial period at a 10% discount. Signing up for 3Commas for the first time, you will also receive a signup bonus of $10 and that bonus can be used to cover commissions. By using the tools wisely, you will be able to increase your potential for a return and reap the most profit from cryptocurrency trading.

Disclosure/Disclaimer: This article is paid for and produced by a third-party source and should not be viewed as an endorsement by ZyCrypto. Readers are urged to do their own research before getting involved with the company, goods and/or services mentioned in the above article.