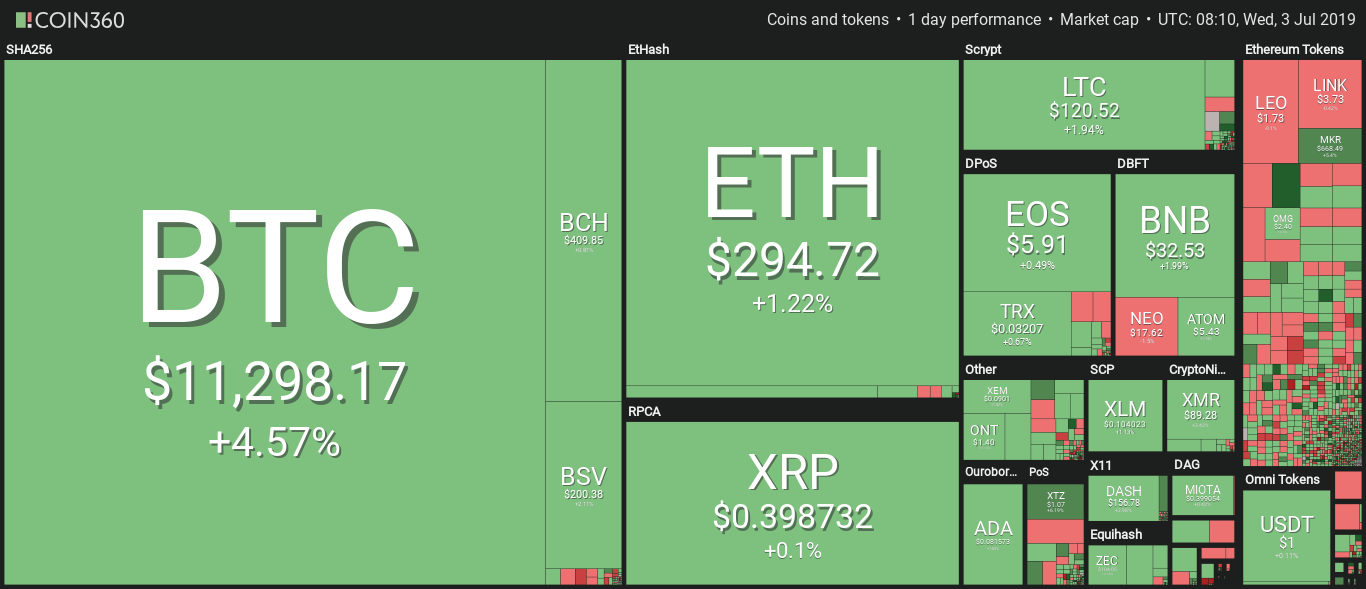

July 1st was a nightmare for the crypto market. Bitcoin was the flag bearer leading the other altcoins to a massive downtrend. Bitcoin bled hard as its price plunged to $9,863 which is a 30% dip from 2019’s ATH. However, bitcoin and most of the altcoins seem to be regaining stride and are recording small gains in the last 24 hours.

Historically, Tether is synonymous with controversy. In the past, tether has been accused of tampering with the price of bitcoin. In 2017, there were suspicions about tether manipulating the prices of bitcoin by printing USDT, a highly traded crypto asset. These suspicions were quickly cleared as researchers said that USDT is merely used as an on-ramp by some investors to acquire bitcoin.

This year, the supply of tether has more than doubled. During the month of June 2019, close to $600 million of tether stablecoin was printed. As we all remember, bitcoin’s price skyrocketed from $3,150 to $11,000, allegedly coinciding with the increased tether.

As of now, USDT is the major source of value flowing into bitcoin in the last 24-hr period according to Coinlib. Additionally, according to CoinMarketCap, most BTC trade was through the BTC/USDT pair on all top 14 cryptocurrency exchange platforms. Analysts are now eyeing a possible correlation between the price of bitcoin and the amount of tether in circulation.

Technically, this correlation is plausible since USDT is issued when Tether’s treasury has an influx of capital then used by investors to buy bitcoin and other cryptocurrencies from various exchanges.

Will Harborne, the founder of Ethfinex explained this saying that when there’s an inflow of tether, often times it means that some investors have “preordered batches of tethers” to purchase large quantities of bitcoin before prices pump.

Jesse Powell, the CEO of Kraken cryptocurrency exchange has however refuted the claims that bitcoin’s price surge is boosted by tether supply saying, “I don’t feel that Tether is artificially inflating the price of bitcoin, he added, “The stablecoin is only a small part of fiat supply among all the exchanges. Tether’s printing is actually reflective of the total fiat money coming into the system.”

More Tether Indicates An Impending Bitcoin Recovery, Nevertheless

On 1st July, bitcoin alongside other cryptocurrencies faced big blows as prices plummeted. On the same day, a popular twitter data aggregator known as Whale Alert reiterated the news of $100 million USDT minted at the Tether Treasury via a tweet.

By the aforementioned correlation, the recent minting of tether indicates that in the coming days or weeks, bitcoin will likely bounce back from the not long past pullback witnessed.