As far as broker sites go, City Index is as thorough as it gets. Forex trading and CFD trading are made easy by this company founded in 1983. Now available and regulated in various countries around the world, City Index is one of the leading brokers in spread betting, and today they are also leaders in offering cryptocurrency trading. Let’s take a look at some of the core details of the City Index brand.

Licenses

UK – Financial Conduct Authority (FCA)

Dubai – UASE Central Bank

Singapore – Monetary Authority of Singapore (MAS)

Australia – Australian Securities and Investments Commission (ASIC)

Platforms

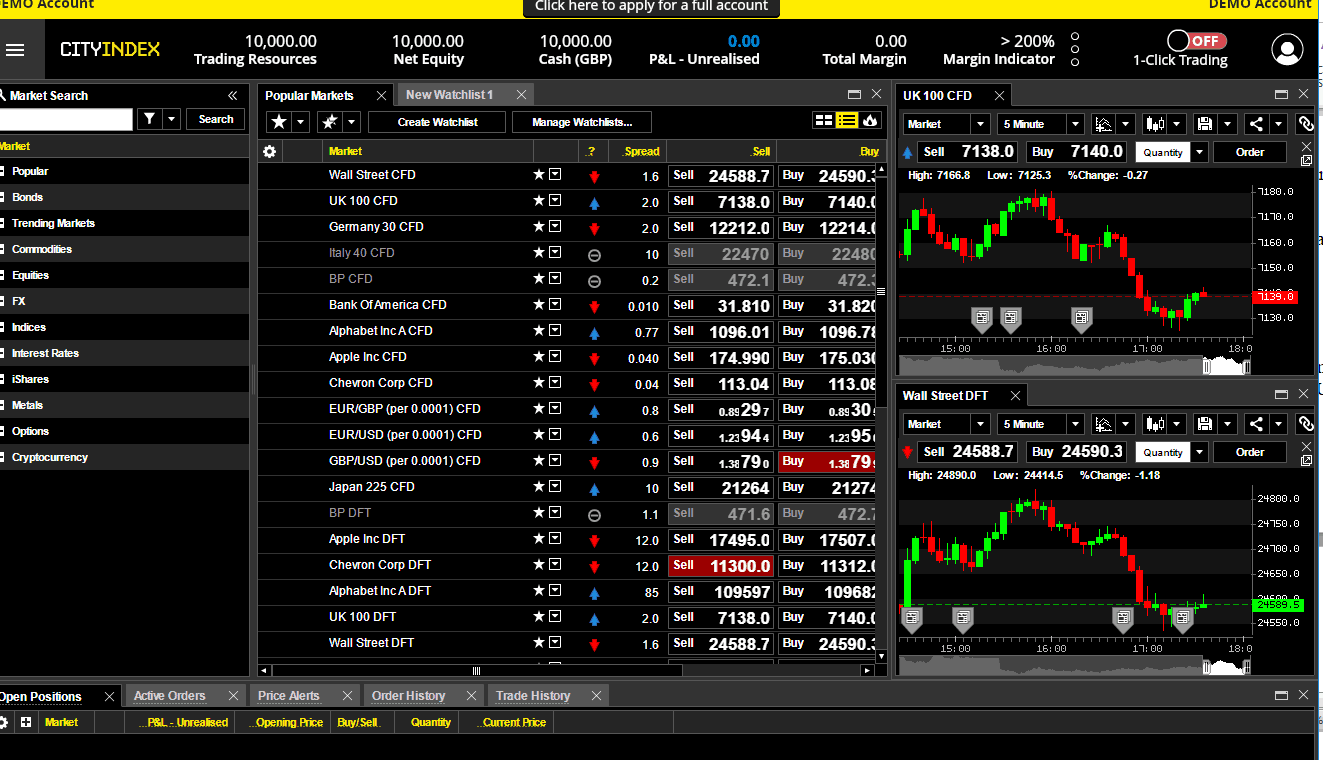

Traders will have access to the Advantage Web platform. Traders find this platform convenient due to its browser-based functionality. It also allows users to build multiple watch lists and offers various risk management tools to avoid putting high levels of risk on potential clients.

For traders who are taking things to expert levels they also have the choice of the AT Pro Platform where testing against historical data is possible, and the MetaTrader 4 Platform, which is highly recommended in the Forex trading industry. There is also a mobile platform that has been made available – the Advantage Mobile Trading App. Not as intricate as the computer-based platforms, it still serves effectively for traders-on-the-go.

Trading Instruments

City Index is known for having a wide selection of spread betting markets, as well as spot market trading. Traders have a massive selection of instruments to trade with at their disposal, including cryptocurrencies, currency pairs, metals, global shares, bonds, indices and commodities.

Commissions

There is no commission charged for CFD trading and spread betting, however a minimum commission of 25 pounds will be charged for equity CFD’s. If Forex is what you prefer you will be starting at 0.5 points for the standard EUR/USD.

Accounts

The first account choice you have is the Standard Account. To open one of these you’ll need to deposit a minimum of $100, and for this you will have access to trading CFD’s, Forex and spread betting. The VIP account is not as easy to set up. These are invite-only accounts and come with various perks. City Index also offers demo accounts, which are free and contain virtual currencies. If you’re new to trading and need to practice, then the demo account is a good place to get to grips with the service.

Banking

City Index is fairly straight forward when it comes to depositing and withdrawing funds. Users have the choice of credit cards, debit cards and bank wire transfers. You’ll need to withdraw to the same account you made your deposit from; however, the minimum withdrawal is 50 pounds. The maximum one can withdrawal is 20 000 pounds.

Extras

The educational factor provided by City Index is quite phenomenal. Beginners are in the best hands if a knowledge boost is required. Detailed explanations of various trading products and instruments are explained, while more complex details of intermediate to expert offerings are well explained.

Customer service is highly accessible, as users can make use of live chat, email or telephone.