In the early days, the idea of venture capital didn’t match well with crypto or maybe it did but potential venture capitalists were largely reluctant.

There were a thousand and one different ways one could easily justify the reluctance but after a few years, the venture capitalists that disregarded the cryptocurrency sector eventually became disregarded by the same sector, forcing them to run back either because they now saw that it was a hit or simply for FOMO.

However, there still were quite a few of these VCs who bought into the sector and are still smiling today.

Predicted Altcoin Pop

However, a recent tweet from ‘Trading Room’, drew a parallel between venture capital funds and a predicted pump in altcoin value.

According to the tweet:

Do you know

In June 2018, ALTs dumped for entire May and whole of June until 29th June

June 30th and July 1st were big pumping days

Remember June is half yearly closing for #crypto VC funds

Expect unusual pops this week across VC backed ALTs after Friday#Bitcoin $BTC

— Trading Room (@tradingroomapp) June 25, 2019

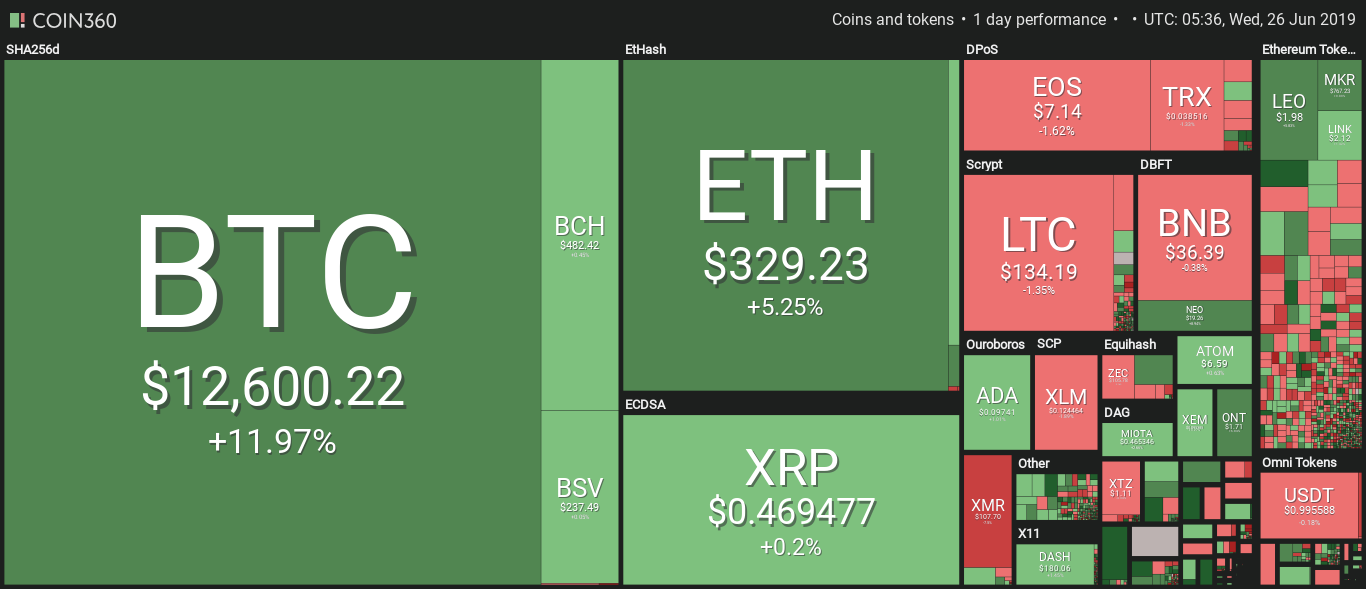

Around the middle of last year, the value enjoyed by the altcoins backed by venture capitals and even the crypto market, in general, began to change, ending a two-month dump period. Trading Room suggests that this might not be unconnected to the annual half-year closing for these VC supported funds.

How’s the Near Future Looking?

At the moment, most of the major altcoins are performing satisfactorily even if there are brief moments when they trade in the green. However, that could change anytime soon. If last year’s trajectory is to be considered, these enticing altcoin bubbles just might burst sometime within the next week.

However, the most certain part of the cryptosphere is uncertainty. There’s a chance, however slim, that these pops don’t happen in the space of a few days and the bubbles are enjoyed a bit more.

On one hand, altcoins currently look good and don’t portend any doom at all. On the other, however, history is not to be easily discarded and some analysts and traders like Trading Room are known to have helped give investors a soft landing with forecasts especially when it supports a pattern being formed, however slowly.

Generally, even if the pops may not last, it would be very wise to expect them soon.