The cryptocurrency market has recently experienced a striking downturn, causing concern among investors. Bitcoin, in particular, which three weeks ago topped $30,000 for the first time since June 2022, has dropped roughly 8%, despite its range bound price.

At press time on Monday, the leading cryptocurrency by market capitalization was trading at $27,877, down 2.74% in the past 24 hours. Overall, the global crypto market cap was down 2.17% to $1.15T, with about $134.10M worth of crypto being liquidated over the past 24 hours, according to data from Coinglass.

Bitcoin’s price decline coincided with a temporary closure of Bitcoin withdrawals on Binance, the largest cryptocurrency exchange, from Sunday until Monday Morning. Binance reported that the closure was due to the large volume of pending transactions, and their team is working on a fix to reopen withdrawals as soon as possible. Although withdrawals have since resumed, this incident caused widespread panic fuelling massive Bitcoin withdrawals from multiple exchanges.

Bitcoin’s Price Outlook

Despite the recent uncertainty, some experts remain optimistic about Bitcoin’s long-term potential. On Sunday, Ali, a well-known crypto analyst, highlighted the surge in Bitcoin fees, indicating a busier network due to full blocks and growing transaction demand. According to him, this could be an early indication of a shift in the macro trend, moving from bearish to bullish.

Earlier on Monday, the pundit shared his analysis of Bitcoin’s price, noting;

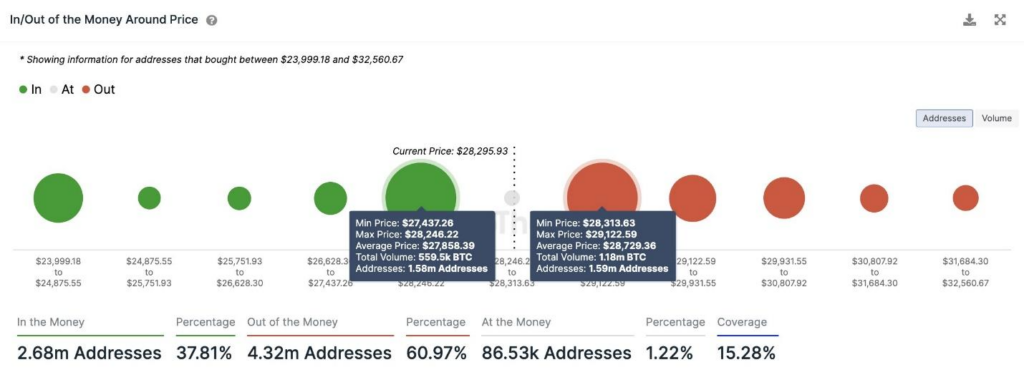

“The most significant support level for Bitcoin is between $27,430 and $28,250, where 1.58 million addresses bought 560,000 $BTC. This demand wall must hold to prevent a downswing to $24,000-$24,900. On the flip side, BTC needs to break above $29,150 to advance further.”

Benjamin Cowen, author of the Into The Cryptoverse newsletter, on the other hand, warned of Bitcoin dropping further as we head into summer.

Today, the analyst predicted that Bitcoin’s price would fluctuate within the range of $12,000 to $35,000 for the remainder of the year, but he clarified that he does not anticipate the price to reach either extreme. This projection is in anticipation of Bitcoin’s halving, which is scheduled for next year.

“Sometime as we get into the summer months, some of the interest will likely Wane, and in the second half of the year, it could be just a complete opposite of what we’ve seen in the first half of the year,” Cowen said on his youtube channel.

That said, investors will also be closely monitoring the upcoming release of the Core CPI on Wednesday and its potential impact on Bitcoin’s price. Recently, Bitcoin’s movements have been influenced by speculation about the U.S. Federal Reserve ending its year-long trend of raising interest rates. If Wednesday’s figures come lower than expected, they may support dovish sentiments, potentially driving Bitcoin’s price higher.