Bitcoin has recorded leaps and falls in its price in the past few weeks and the BTC/USD market is more volatile in comparison to how it began early this year. Skew Markets asserted that bitcoin volatility is back like old times.

Restored Bitcoin Volatility Levels to That of 2017’s End

According to Skew’s tweet, Bitcoin’s current volatility is back to levels which were not seen since the end of the 2017’s bull market. This was when bitcoin surged to an all-time high of $20k, having a market capitalization of over $300 billion.

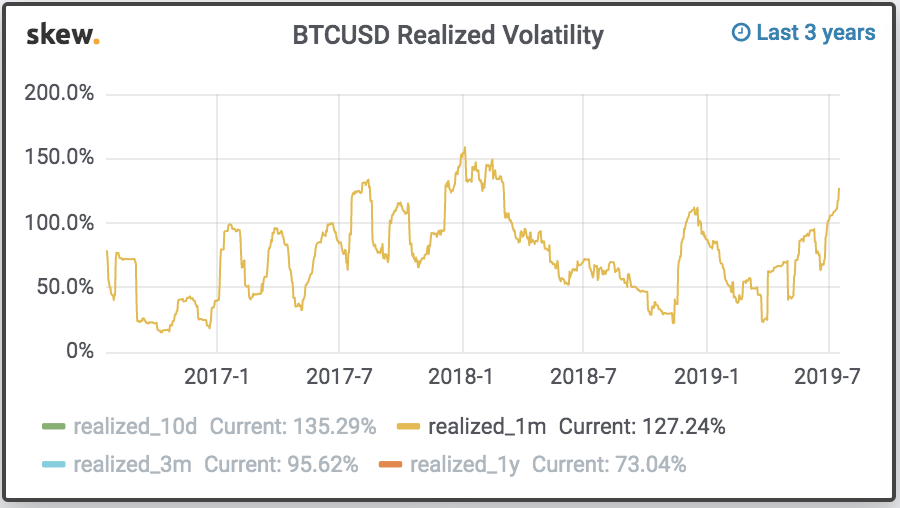

Skew also attached a chart which shows that BTC/USD realized volatility towards 2017’s end was above 100 percent. In early 2018, it went as high as 150 percent before gradually declining below 100 percent which it was throughout most of 2018.

However, Bitcoin’s price fluctuated a lot towards 2018’s end which is evident in the chart as it moved above 100 percent again.

Nonetheless, the level was not maintained given that early this year, bitcoin’s volatility declined to less than 50 percent. There were no significant leaps or dump in price until a few months ago. Based on Skew’s chart, Bitcoin’s volatility in the current month has surged to almost 150 percent.

Low Volatility Followed by Traders Unwillingness

It can be recalled that when there was less volatility in the market, most traders were unwilling to trade. Cryptocurrency exchanges like Binance, OKEx, Coinbase, and Gemini had reported lower trading volumes in comparison with 2017 and 2018.

For instance, a study by Diar, a Blockchain research unit revealed that as of January 2019, Binance had recorded a 40 percent loss in its Bitcoin/USD trades in comparison to December 2018. Specifically, its BTC/USD market had a trading volume of $3 billion in January 2019 which differs from almost $6 billion around November and December 2018.

Generally, increased volatility in the market would mean more fees for these exchanges since more people are willing to trade. It could also do a lot to impact on Bitcoin’s price with more money entering the crypto space.

Bitcoin’s Volatility is Positive, Not Negative

Anthony Pompliano, Morgan Creek Digital Assets cofounder on June 27, 2019, said Bitcoin’s volatility is not negative but positive because the asset will not attain a global reserve status by trading sideways. A similar opinion is held by Spencer Bogart, General Partner at Blockchain capital who on June 28, 2019, said:

“Bitcoin’s volatility is a byproduct of absolute scarcity (coupled with fluctuating demand) and a reflection of the nascence of Bitcoin’s onboarding phase.”

Disclaimer: The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of ZyCrypto. none of the information you read on ZyCrypto.com should be regarded as investment advice, Every investment and trading move involves risk, you should always conduct your own research before making any investment decision.