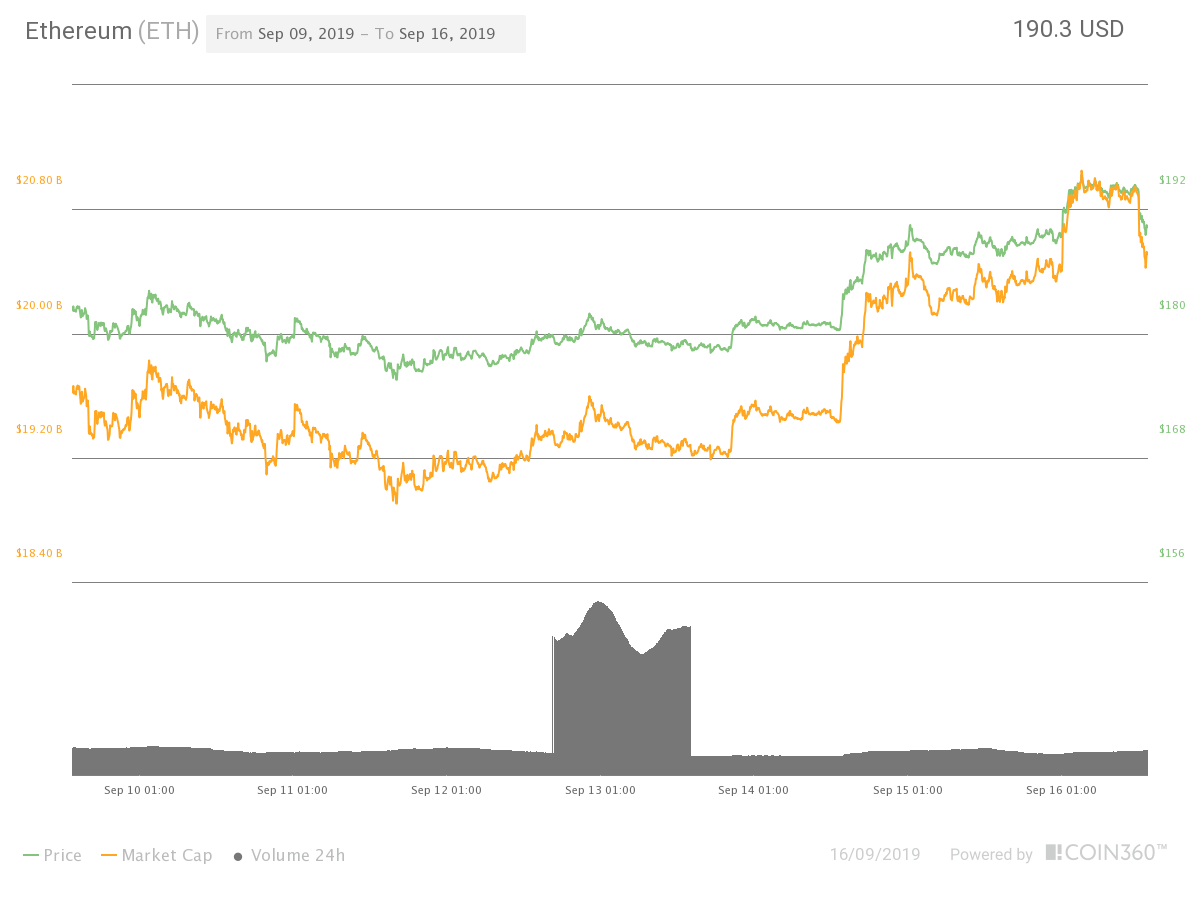

Ethereum, the second-largest cryptocurrency has stolen bitcoin’s thunder over the past few days by registering more gains than the king coin. ETH soared from recent lows below $170 to as high as $195 over the weekend. The fact that ETH has breached the $185 resistance level shows signs that ETH could be poised for a continued upswing.

This price surge comes as the overall health of the Ethereum network is showing signs of improving, which may push the price to $200. ETH is trading at $192.97 at press time but needs to hold above $186 on the day as falling below this level could lead to a breakdown.

8% Price Surge Over The Weekend

Ethereum has had a rough couple of weeks. On top of dealing with the increasing congestion caused by Tether, ETH price has been trading below $180 for the most part.

However, strong moves over the weekend pushed the price to the $190 zone. On the contrary, bitcoin plunged below the $10,300 and is currently trading at $ 10,251.54. Notably, this move by ETH seems to have disrupted bitcoin’s dominance as it currently stands at 69.5%, a drop from the 71% registered recently.

Over the past two days, Ethereum gained more than 8.30% to trade at $195. Moreover, Ethereum is presently the best performer among the top 10 cryptocurrencies with 1.72% gains on a daily scale as per CoinMarketCap. The bulls are eyeing $200 as the next barrier that needs to be breached for further upsides. Trader-cum-analyst Josh Rager noted that ETH/BTC closed above major technical indicator and this could signal a reversal in the near-term:

“Good news is that ETH/BTC price has finally moved and closed above the daily 20MA.

This has been a major indicator that has confirmed the downtrend for months.

We could be up for a nice reversal confirmation after price breaks the resistance cluster overhead.”

Another analyst who believes ETH is gearing for a strong uptrend is Zoran Kole. Captioning a chart, Kole opined that the next level to pay attention to is $220.

“$ETH Update: Moving along nicely through H6 kumo. Seems to have s/r flipped 187 for now. ETH/BTC chart supports the USD growth narrative. Sitting comfy long.”

Strong Fundamentals: Ethereum Total Daily Gas Usage Is At ATH’s

Ethereum is still down from its all-time high of around $$1,432 and as such, the network has been bombarded with a lot of criticism. Regardless, ETH seems ready to change the narrative with the recent price surge likely caused by the overall improvement of the network. The demand for Ethereum network recently hit an all-time high.

Partner at Placeholder Chris Burniske explained that ethereum’s total gas used daily reaching a new ATH means that the demand for Ethereum network is increasing rapidly:

“This can be read as: demand for #Ethereum’s world computer is at ATH.”

In addition, the transaction fees that miners at the Ethereum network receive have spiked in the past days, nearing $0.10. Consequently, ethereum miners have now called for an increase in the block size by increasing the gas limit. As Ethereum co-founder Vitalik Buterin observed, close to 50% of the miners support a gas limit increase:

“Almost exactly 50% of mines are upvoting the gas limit right now; it just broke 8.1 million for the first time.”

Is This A Bullish Sign?

As we’ve seen, ethereum bulls like Chris Burniske are of the opinion that the increasing transaction fees and total daily gas utilization is a bullish sign.

SetProtocol Product Marketing Manager Anthony Sassano, on the other hand, doesn’t think the gas spike is an indication that the price of ETH is trailing behind or will spike in future. He stated:

“The reason the gas usage is higher is because of more complex transactions (DeFi transactions aren’t just simple ether or token sends – they use a lot more gas).”

Nonetheless, the present health and robust growth of the network is bullish for the network in the long-term. Also, with the Ethereum 2.0 update coming up (slated for January 3, 2020) and the increasing Decentralized Finance (DeFi) applications, it won’t be long before traders see a resurgence of Ethereum as a steady uptrend develops.