It has been an interesting year for Bitcoin with the top cryptocurrency amassing over 200% gain in price. This has led many to believe that another bull market is here following the crash from 2017’s all-time high of $20,000. Many also believe that Bitcoin is about to hit a new all-time high, possibly in 2019.

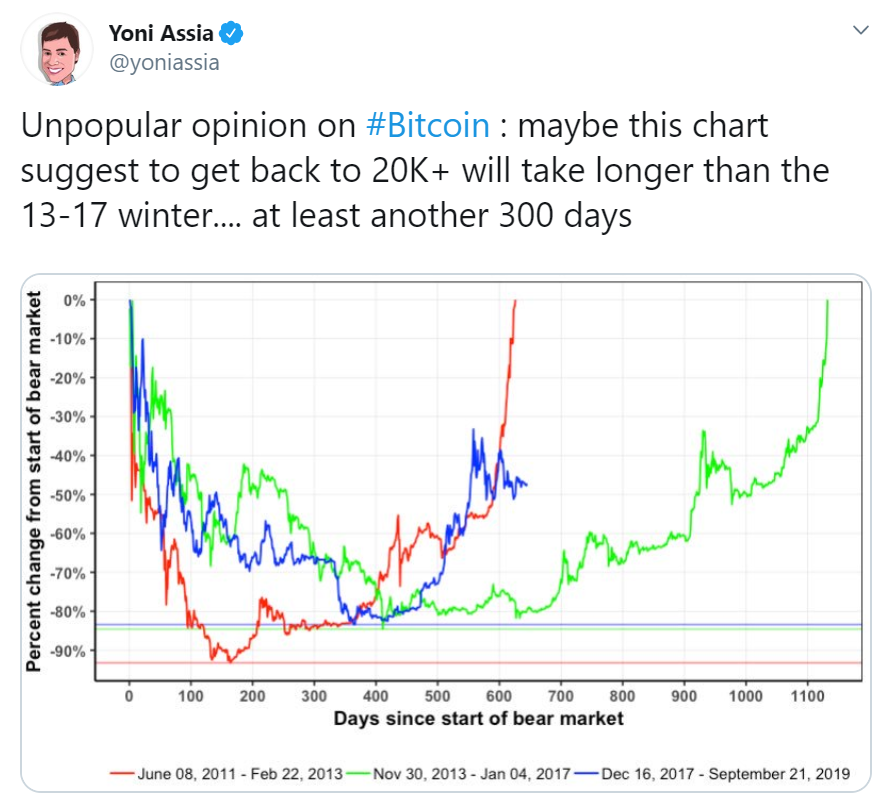

However, the Founder and CEO of social trading platform eToro, Yoni Assia, says Bitcoin may take at least another 300 days to hit a price above the current all-time high of $20,000.

Trends show increasing lengths of bear markets

There have been two bear markets for Bitcoin so far, the third of which started in 2018 and was believed to have ended in 2019 with the huge bullish move recorded. One glaring pattern in the data, although for just two bear markets, is that Bitcoin bear markets seem to be longer than the last one. For instance, the 2011 to 2013 bear market lasted nearly 600 days, followed by the 2013 to 2017 bear market which lasted over 1000 days.

The bear markets also show significant price losses, with the first crashing to over 90% and the second crashing by over 80%. Bitcoin has already met this condition by losing over 80% of its price in the 2018 bear market. This is fine, despite the fact that it lost more than 90% in the first bear market since the pattern also suggests that the extent of the crash reduces with successive bear markets. However, there is one condition that has not been met.

Bitcoin still at 600 days

Although Bitcoin has made significant recovery from the 2018 bear market, the data suggests it is yet to mature as it has only reached 600 days which it took to recover from the first bear market. The price surge occurred just after 500 days but the price has dipped slightly, probably because the condition has not been met.

Going by the trend, Bitcoin may have to consolidate or even crash further for another 300 days according to Assia as it has to last longer, or at least as long as the last bear market.

If this data is anything to go by, a major Bitcoin bull run may be some distance from now. Major events expected to boost the market such as Bakkt are coming into place and the halving is coming next year. Does it mean Bitcoin will defy all these factors and continue to move sideways?