After performing moderately well in April, albeit all the FOMO and regulatory scares, Bitcoin stepped into May with its head down, dropping over 5% during the first half Monday, May 1st.

Over the past six or so weeks, the largest cryptocurrency by market capitalization has had difficulties pushing above the $30,000 resistance range despite showing a lot of strength in the first week of April as such price has been trapped in a tight squeeze.

Various market pundits have been trying to project Bitcoin’s behaviour this month, even as the cryptocurrency’s fundamentals continue improving. According to seasoned markets analyst Peter Brandt, Bitcoin currently sits on a “huge significance” level. On Saturday, Brandt noted that the price had reached the upper band of a range pattern, stating that a decisive break out of a particular range could significantly impact Bitcoin’s future.

According to Brandt, the current range pattern suggests that there is a certain price level that Bitcoin has struggled to surpass in the past two years. However, if Bitcoin breaks above this level, it could signal a major shift in the market.

“The confining range has been in place for some time now, but a decisive breakout would have huge significance, “he said, adding, “My bias is that Bitcoin will bury all pretenders eventually. There will be only one ‘King of the Hill’, and it will be Bitcoin.”

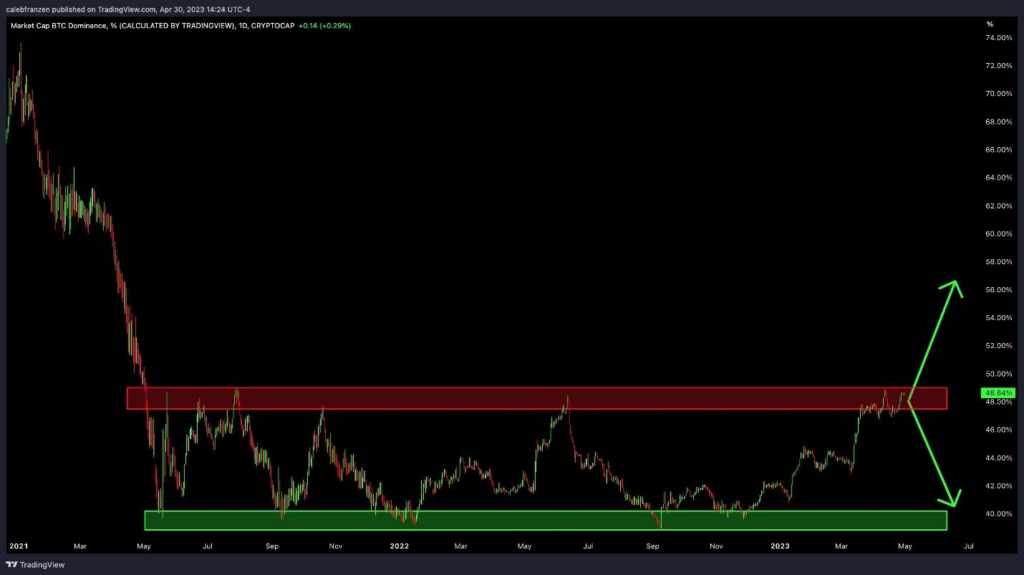

And Brandt is not alone in his analysis. Caleb Franzen, a research analyst at Cubic Analytics, also noted that Bitcoin needs to break out decisively or get rejected at its current range before he can make any major decisions.

“People are predicting that Bitcoin dominance will skyrocket. Here’s my take: I don’t know yet b/c we haven’t seen a decisive breakout or rejection on this range. Once we get clarity around this major resistance level, I’ll listen to what the market is telling me,” Franzen tweeted Sunday.

Today, crypto pundit “Titan of Crypto” shared a Bitcoin % Dominance chart, forming a monthly “W bullish structure”. According to him, the structure suggests dominance could soon break out of the range. He further noted that if April’s monthly candle closes above the range (which it has), Bitcoin’s dominance could increase, tagging along with the price. He, however, warned that as Bitcoin’s season starts, “alts might suffer a bit.”

Meanwhile, as the week starts, some analysts expect Bitcoin to falter further due to the upcoming Federal Open Market Committee (FOMC) meeting Wednesday, which will likely raise interest rates by 25 basis points.

At press time, Bitcoin was trading at $28,110, down 4.45% in the past 24 hours, as per CoinMarketCap data.