For a prolonged period of time, Bitcoin has not gone through a significant price change. Whilst still failing to break out of the $10,000 level, it has been hovering around $9,200 for the past two months.

There are many predictions as to how the Bitcoin price will behave next; but in almost all cases, analysts agree on one thing – it will not stay the same for long.

Bearish or Bullish?

While it is still unknown if Bitcoin will take a higher wave or plunge deeper into the lows, crypto pundit Cole Petersen has every reason to believe that BTC is on the brink of seeing better times.

And his theory does not lack a foundation. There are several trends that indicate the positive future macro trend for Bitcoin.

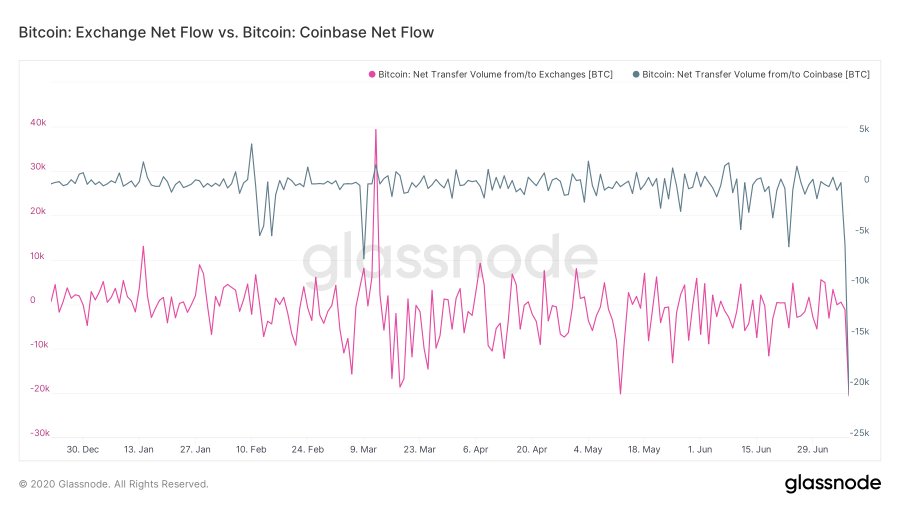

#1. Exchange Outflows

Crypto investors are moving their BTC away from centralized exchanges at a rapid pace. The tendency of investors to flee away from public exchanges is a clear indicator of high confidence in long-term progression. By moving away from exchange wallets, they are placing their preference in favor of HODLing in a secure offline cold storage.

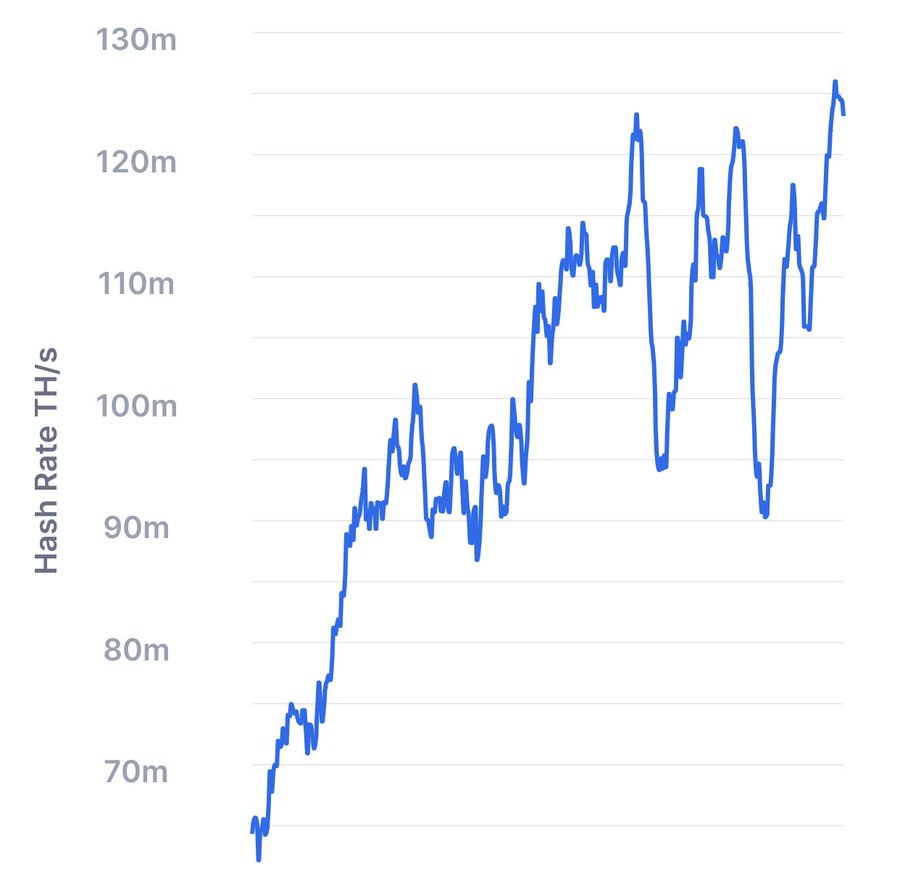

#2. Rise in network activity

Bitcoin’s hash rate is booming and recently hit an all-time high of 126 million TH/s. This is not expected to falter any time soon, especially as more countries are becoming increasingly interested in crypto mining farms.

#3. Weapon against inflation

Largely provoked by the pandemic, all anticipations are now linked with the inflation level rising to even higher grounds.

For instance, some say that the value of the Fed balance sheet may augment by as much as 60% under the inflationary pressure. To save the situation, Bitcoin offers a reliable alternative to hedge against risk.

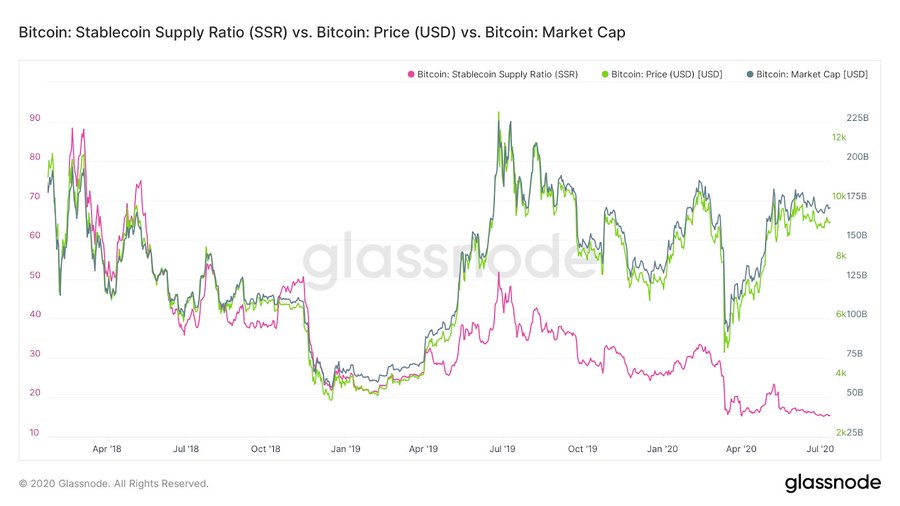

#4. Supply of stablecoins

The world of stable coins is characterized by a growing wave of interest, particularly in the face of the coronavirus pandemic.

Specifically, they attract those investors who are willing to bridge their portfolio to the world of traditional finance. However, this choice is often closely resonating with newcomers, who, as time goes, will turn their head to crypto – and Bitcoin in the first place.