Speculation still remains the number one use case for cryptocurrencies. The launch of stablecoins, especially USDT, led to an explosion in spot crypto-to-crypto trading. Delta-Exchange believes that its USDC (a Circle backed stablecoin pegged to the US Dollar) settled futures will have similar impact on the leveraged or margin trading of cryptocurrencies such as bitcoin.

Currently, most futures exchanges offer bitcoin or altcoin margining and settlement. This exposes traders’ margin and non-trading balances to bitcoin price volatility. The crypto price risk is completely eliminated by keeping the margin in USDC. This innovative approach makes trading bitcoin futures almost identical to trading futures on traditional stock exchanges like NYSE. That is, you start with a USD or USDC balance which goes up and down because of your trade’s profit or loss.

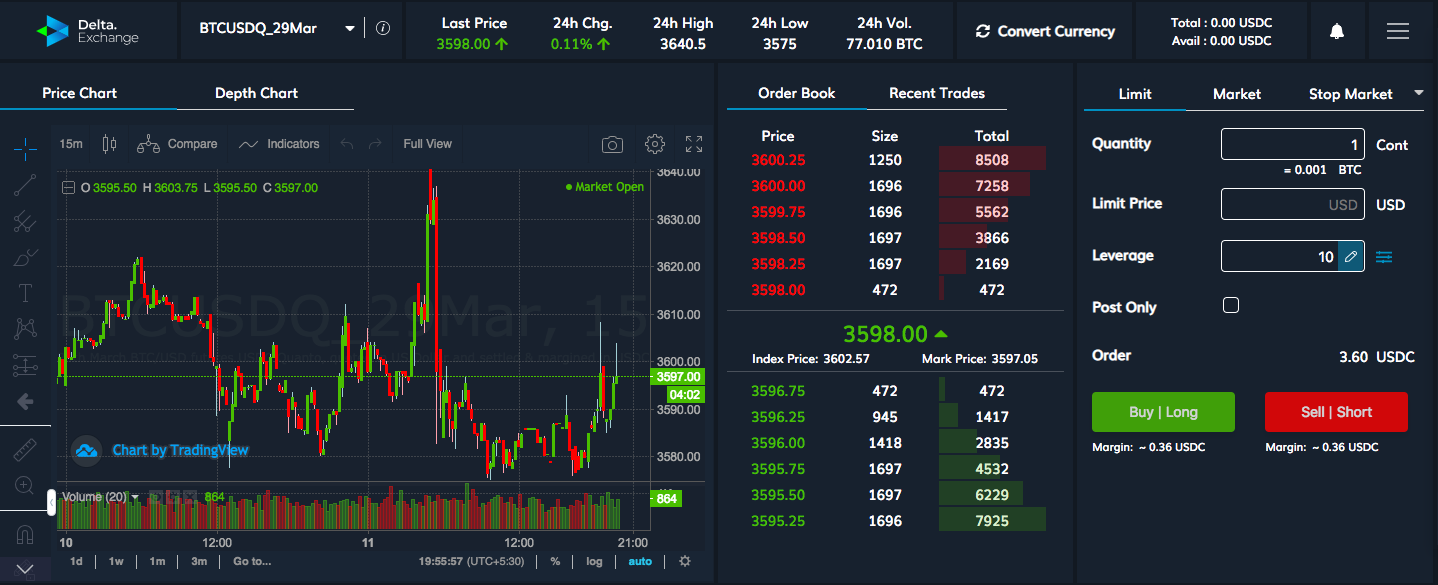

Details of the USDC settled futures on Delta Exchange

Delta Exchange has listed stablecoin settled futures contracts on BTC, ETH and XRP. These are a special class of futures known as quanto. In a quanto futures, the quote currency is separate from margin and settlement currency. The details of the Delta Exchange’s quanto futures are as follows:

| Futures | Symbol | Max leverage | Quote Currency | Margin/ settlement currency |

| BTC Quanto | BTCUSDQ_29Mar | 100x | USD | USDC |

| ETH Quanto | ETHUSDQ_22Feb | 50x | USD | USDC |

| XRP Quanto | XRPUSDQ_22Feb | 20x | USD | USDC |

These futures contracts are priced in USD, but the margin is kept in USDC and the profit/ loss too is denominated in USDC.

How To Trade the USDC settled futures

Deposits into and withdrawals from Delta Exchange can only be done in bitcoin. After signing up and depositing BTC to your Delta wallet, you would need to change BTC to USDC to start trading the USDC settled quanto futures. The sequence of steps that needs to be followed to trade the quanto futures on Delta Exchange is listed below:

- Create an account (Sign Up Link)

- Deposit BTC To Your Delta Wallet

- Automatically earn first deposit bonus of up to 0.01 BTC

- Use the currency converter, to change BTC to USDC

- Make your first trade in BTC/ETH/XRP quanto futures

Other attractive features of Delta Exchange

- 100% first deposit bonus: Delta Exchange currently offers 100% bonus of up to 0.01 BTC on the first deposit made by a trader. This deposit bonus is paid out automatically and can be used as margin for trading. Details of the deposit bonus offer are available here.

- Delta Referral Program: Delta Exchange has one of the strongest affiliate programs among cryptocurrency exchange. An affiliate gets 25% share for 1 year, followed by 10% share for lifetime of the trading fees paid by his referrals. The referred users enjoy 15% trading fee discount for 6 months, in addition to the first deposit bonus. Complete details of the referral program are available here.

About Delta Exchange

Delta Exchange is a cryptocurrency derivatives exchange that offers futures on Bitcoin (BTC), ether (ETH), ripple (XRP) and Stellar lumens (XLM). While the exchange is fairly new (launched in August 2018), it has found favour among professional crypto traders because of its innovative products, reliable liquidity and high speed matching.

The team behind Delta Exchange has backgrounds in Wall Street and high-tech startups. The founding team has worked with bulge-bracket banks like Citigroup and UBS and have raised money from the likes of Sequoia and Softbank for their prior entrepreneurial ventures. The Delta Exchange team is well supported by a team of industry stalwarts including Prof. Bhagwan Chowdhry (who also advises Stellar Foundation) and Stani Kulechov (who is the founder and CEO of ETHLend).

- Delta-Exchange Website: https://www.delta.exchange/

- Twitter: https://twitter.com/Delta_Exchange

- Telegram: Updates & Community