For some time, various popular entities in the crypto world have been trying to understand the real short term and long term implications of the current lull in crypto prices. One of the people trying to make sense of the situation is Ross Ulbricht. Ross is the infamous founder of Silk Road who is currently serving double life imprisonment + 40 years without the possibility of parole in a US prison.

Ross has been offering his crypto analyses from prison. Currently, he thinks the current market dynamics don’t exactly favor Bitcoin in the short term but could be great in the long term. Ross shared his thoughts in a post on Medium.

Bear Market To Extend

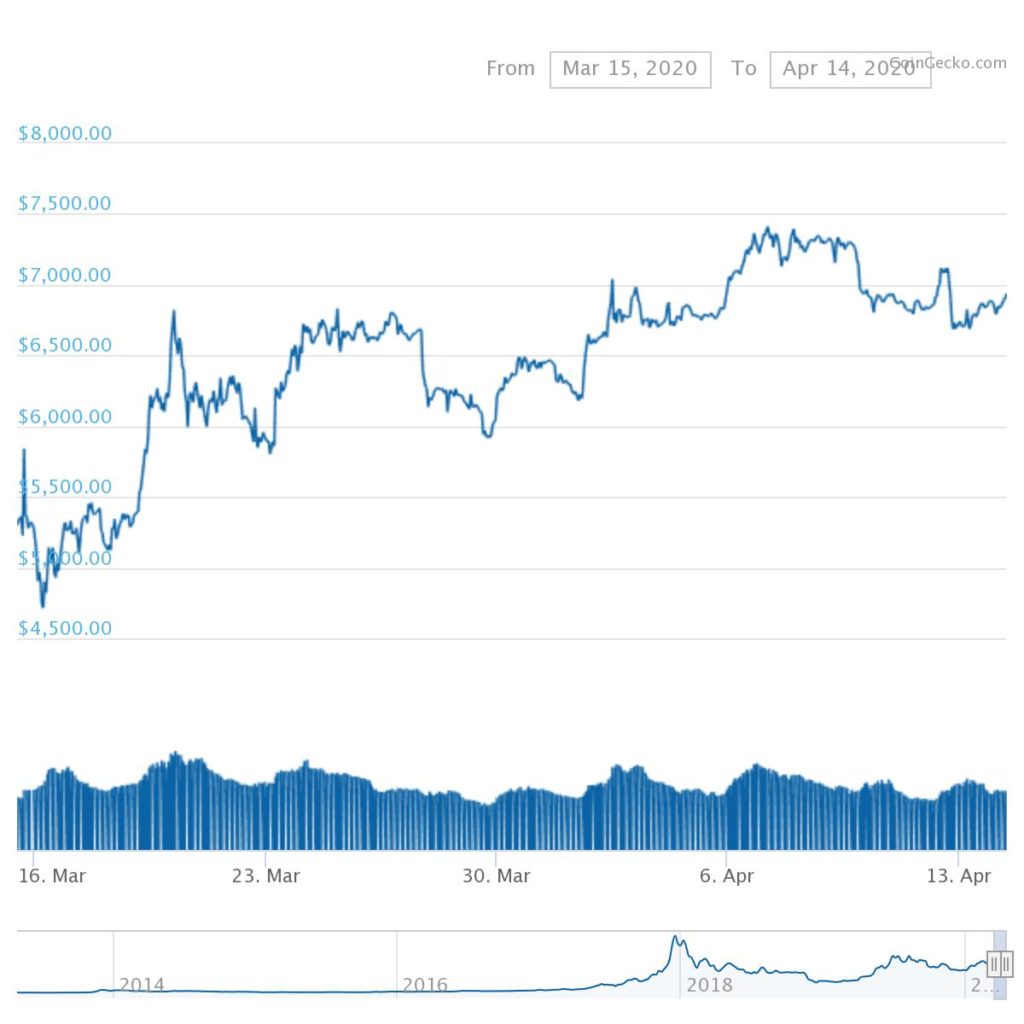

According to Ross, Bitcoin could experience a bearish pull fueled by the current market volatility, saying that if this continues, the top coin could drop to as low as $3,000 range. However, Ross expects Bitcoin to finally bottom out at around $3,200 and the bear market to last through June and July 2020.

While his prediction may be taken as a short term projection, Ross admits that the bear market could extend into the next year. Given the uncertain nature of the crypto space, this is possible depending on the market dynamics playing out at any given time during the bear market.

New Highs Worth It

However, it’s agreeable that, although the bottom figure capping at $3,200 could be hard-biting especially to those who have bought during the highs, the bear market isn’t set to last forever. It will end, and anyone who will have bought during the lows will reap good returns.

In fact, according to Ross, the coming bullish energy will make the 2017 bull cycle look like a small footprint in the crypto history. Either way, Ross’ analysis seems like a call to action for daring investors to hold onto their assets and buying more. Time will tell.