Key takeaways

- Bitcoin’s surge in October has warranted a lot of explanations.

- The latest from cryptocurrency exchange Kraken is that the surge is due to a “supply shock.”

- Kraken points to long term holders accumulation, growing on-chain activity and miner accumulation to be behind the supply shock.

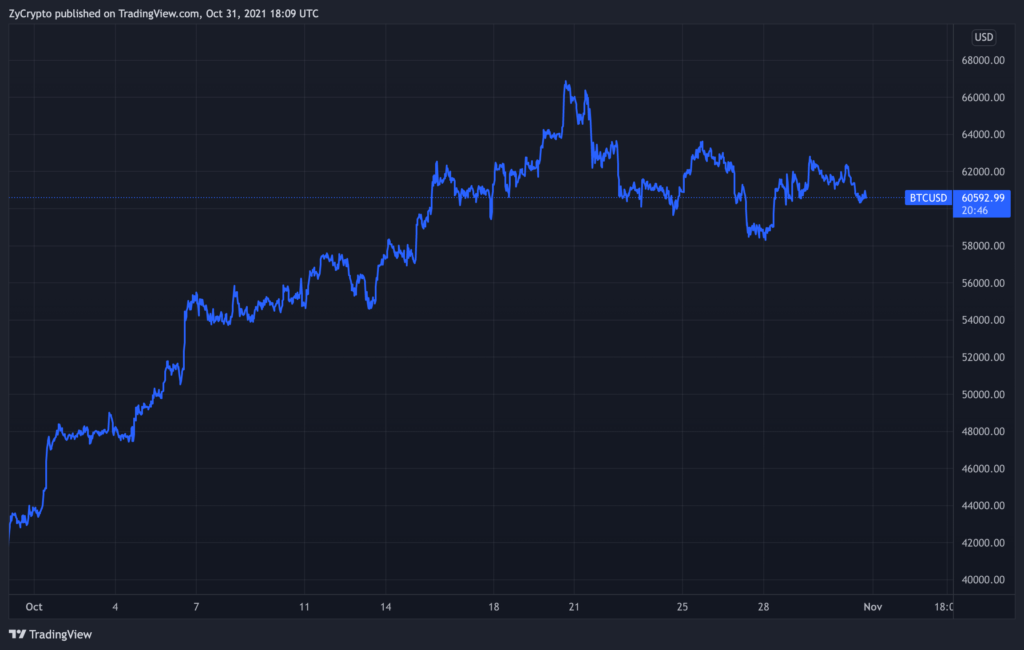

September, to the expectations of seasoned market observers, was extremely bearish for the Bitcoin market. This year was no exception for Bitcoin history of bearish September as the month saw Bitcoin open around $46,000, reach a high of over $52,000, and dip to below $40,000. It eventually closed the month around $43,000 with returns down 7.34%.

In October however, the market took off substantially with the return of very bullish sentiments. While prices are currently down as Bitcoin is trading at around $60,500, down 4.79% in the last seven days, the benchmark cryptocurrency has set a new all-time high of $66,936 and is up 39% so far in the month.

The October surge has been attributed to many different reasons by analysts including inflation concerns, increasing regulatory clarity, and the recent Bitcoin futures ETF approval by the SEC. However, the most recent insight into the impressive performance has however come from cryptocurrency exchange Kraken who noted that on-chain data they were monitoring indicates that the surge was due to a “supply shock” in the market.

A supply shock, which is an event that suddenly increases or decreases the supply of a commodity or service, or of commodities and services, in general, that affects the price of the asset, may as well be in play in the current Bitcoin market as Kraken went on to argue in their October 2021 Crypto On-chain digest which they titled “Shocktober.”

In the report, the crypto exchange pointed out that Bitcoin long-term holders had done very little profit taking but were instead accumulating more, thereby fueling the supply shock positively and leaving market observers to “believe that long term holders see further upside heading into the new year.”

“New data shows that long-term holders continue to contribute to the supply shock even through BTC’s new record highs,” the report adds.

This action by hodlers has also been at the back of the breakout that is now evident in other metrics that are bullish according to the report which noted that even in the current market where prices are high, there is “renewed demand for Bitcoin” as can be seen in the increase in active addresses, transaction count, and velocity.

Another contributor to the supply shock was miners who were noted to be “stockpiling” their earned Bitcoin. This was not limited to institutional miners as the report also points out that small individual miners realized modest profits.