From the lows recorded in mid-March, bitcoin (BTC) is up by a whopping 120% at the time of publication. Even so, the cryptocurrency has not staged a steady uptrend. In fact, BTC has been stuck in a bout of sideways trading over the last three-plus months despite showing signs of a bull trend as it galloped to $10,000.

Now, well-known on-chain analyst Willy Woo is noting that the COVID-19 crisis that has ravaged the world was the key factor that brought the BTC rally to a standstill. But it’s not all doom and gloom; Woo believes we are not so far away from another bull market.

COVID-19 Stopped The Bitcoin Rally Right On Its Tracks

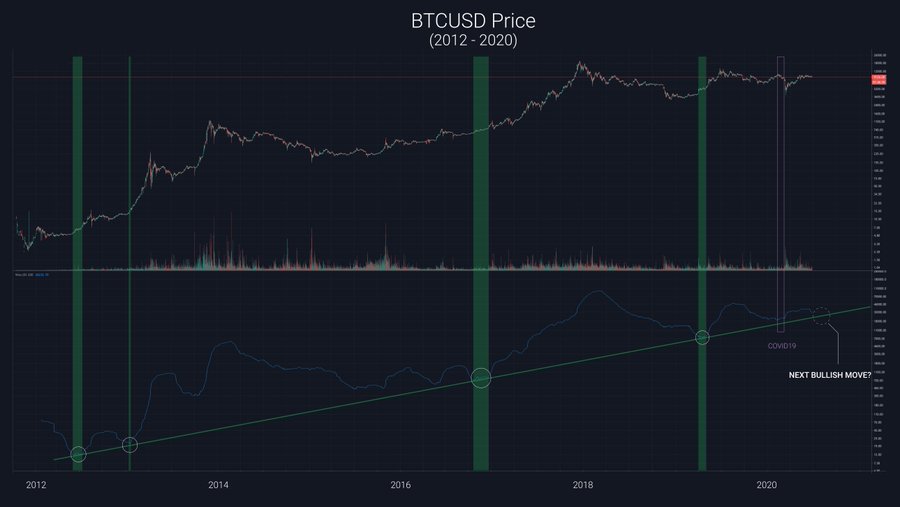

In a Twitter thread on June 27, Willy Woo unveiled a new model that can identify the start of massive bull runs. He goes on to posit that BTC was setting the stage for an exponential bull run before the coronavirus pandemic “killed the party”.

However, the model also suggests that we are very close to another bull run. In particular, BTC could have just one more month of consolidation before the next full-blown bull market phase commences.

The Longer The Consolidation, The Higher The Next Peak Price

Woo also quipped that BTC being contained within a narrow trading range is not completely bearish. On the contrary, a long sideways accumulation band is actually a good thing. He explains that the longer it takes before the new bull market arrives, the greater the chance of a higher peak price.

To quote him directly:

“The longer this bull market takes to wind up, the higher the peak price (Top Cap model). A long sideways accumulation band is ultimately a good thing.”

With Willy Woo’s analysis predicting more BTC consolidation before breaking out in a month’s time, investors should brace for a severe bout of turbulence in the near-term. Simply put, when the next price crash occurs, they should capitalize on the fear and panic-selling by accumulating as a mammoth rally will likely ensue.