Without a doubt, the Ethereum blockchain underpins the largest and most well-known stablecoin by market cap. These stablecoins include Tether (by far the most established, with a $3 billion market cap), DAI, TUSD, PAX, and others.

As other blockchain platforms like Tron, Neo, Stellar and EOS are gradually catching up with Ethereum in terms of adoption, the number of DApp users, and functionality, native stablecoin solutions emerge on their foundations as well.

The decentralized nature of EOS favors the development of community-driven projects. Some successful EOS stablecoin projects like EOSDT and PIZZA.live share this value, providing their communities with self-service gateways and decentralized governance tools.

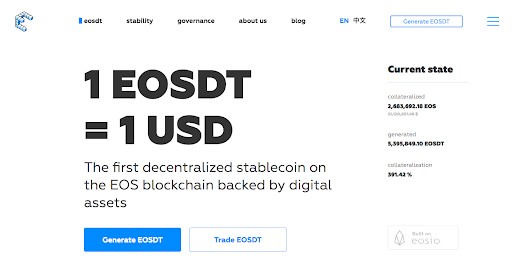

Developed by Equilibrium, the EOSDT stablecoin has steadily gained traction both within and outside the EOS community by bringing much-needed stability and liquidity to the market.

Equilibrium’s website shows that there are more than 2.7 million EOS tokens locked in as collateral on its platform, a figure that exceeds $21.1 million. With the framework’s collateralization currently standing at 391%, this means there is a total of 5.4 million EOSDT in circulation.

This lets users hold and leverage their EOS for EOSDT without selling their collateral. These users are essentially lending themselves a stable USD-pegged cryptocurrency. It’s a quick and efficient way to add stability to a crypto portfolio in a bear market and hedge against volatility.

Trading isn’t the only factor driving the mass adoption of crypto. A wide range of varied EOS services and decentralized applications, from decentralized finance to gaming and gambling, stand to benefit from the introduction of a robust stablecoin option to the ecosystem.