Crypto trading involves a new asset class that is fresh and exciting. By choosing the right trading strategy, one stands a better chance of generating a handsome return on their investment.

However, before getting started, there are a few factors one should consider to guarantee success.

They include:

1) Choosing a currency/currencies to trade on

New crypto traders should opt for the more established coins that boast a high market cap such as Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC) or even Ripple (XRP).

2) Choosing a reliable crypto exchange that supports the currency of your choice

A cryptocurrency exchange is a platform that supports various digital currencies.

This is where traders will buy, sell, and trade the crypto-coins of their choice.

Some of the popular crypto exchanges include Binance, Coinbase, Kraken, Bitstamp, and many more.

3) Doing your own research

This is the number one rule when doing any investing and more importantly when it comes to cryptocurrencies.

New traders need to research the virtual currencies they intend to buy and ensure the coin meets their investment goals.

4) Diversify your portfolio

There are over 2800 coins currently listed on coin market cap, which gives one plenty of options when choosing the coins to invest in.

However, just like with stocks, it’s vital to have some safe bets mixed with a few riskier investments.

5) Avoid the fear of missing out (FOMO)

Given the enormous amount of hype that surrounds cryptocurrencies, it’s easier to buy into it.

This can lead to one buying tokens at a high price only to lose money when the coin’s value drops.

So, it advisable to do your own research before investing in any coin as opposed to buying the currency based on the buzz that surrounds it.

6) Different Crypto Trading Strategies To Consider

1. Day Trading

This is a short-term trading strategy that involves holding an asset for just a few seconds to a couple of hours.

It involves buying an asset low and selling high ensuring you make a quick profit within a day.

It’s important to use stop limits to ensure you scale in and out of trades.

Many exchanges will allow you to set a stop-loss that will help you to automatically exit a trade when it gets to a specific price.

Imagine buying a coin at $100, and you intend to keep a large chunk of the investment.

You can decide to set your stop loss at $80, and if the price falls to that level, it will automatically sell the coin and preserve 80% of your original investment.

Another concept associated with day trading is the limit sell order which automatically will close a trade if the coin’s price gets to a specific set high price.

This works in a scenario where the price of a coin is on an upward trend, and a trader wants to ensure they get out of the trade at what they perceive as a top for example at $120.

So, once the coin’s price gets to that level, the limit sell order will automatically sell it.

Crypto trading bots is something else to explore when day trading.

However, it essential to note that a bot’s trading is only as suitable as its programming.

Once a trader has gained significant experience with trading they can explore bots.

2. Scalping

A crypto trading scalper usually uses technical analysis and even news to find small price movements that allow them to profit quickly.

Ideally, the trader makes many quick trades aiming to make small constant profits.

For example, a scalper can buy ETH at $800 and sell at $805 then buy again at $802 and sell at $805.

In both cases, the trader can decide to set a tight stop to let’s say at $798, or they can even decide to scale out of their position by hand in case the trade goes against them.

This trading strategy requires constant focus, and if one is good at it, then they can make quick money easily.

It also involves some level of risk management and considerable skill and luck.

3. Binary options

Binary options represent a type of option where traders can place trades that can turn into fixed amounts at a specific time frame, or they can turn to nothing within the same period.

This trading strategy allows traders to predict the volatility of assets based on whether the price will rise or fall at a specified period.

If the prediction is correct, then traders earn the profit. However, if it’s wrong, then the trader will incur a loss on their investment.

Binary options involve all or nothing bets.

The industry has been rigged with various fraud schemes, including false identities, web client manipulation, and even tampering with the process of option purchases.

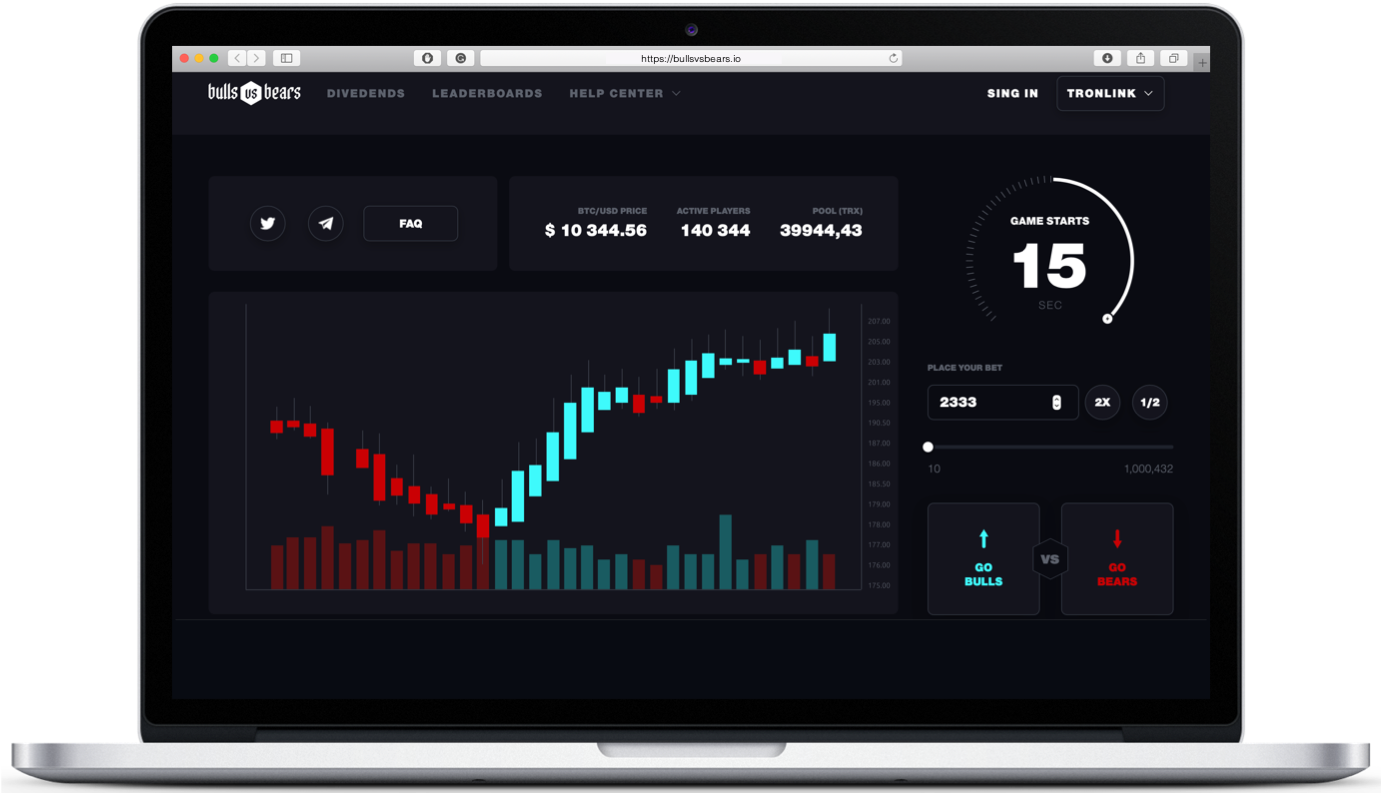

However, there are platforms like Bulls vs. Bears that use blockchain to bring the much-needed transparency and fairness to the binary options field. Traders stand a chance to win 500 TRX tokens by subscribing on the platform.

4. Intra-day trading

This trading strategy is similar to day trading. However, it allows the trader to hold positions for more than a day.

Since the crypto market never closes, technically there is no rule on when a trading day is over.

By use of software, a trader can automate positions, and just because the clock strikes a specific time, no rule says they should close their short position.

5. Swing trading

Swing trading is where one trades various altcoins by holding positions longer than a day.

Here the trader will open a position based on what they calculate to be the local bottom and then hodl the position all the way to what they believe to be their local top sometimes by gradually scaling out of their position to lock in profits.

It’s the reverse of shorting where the trader will aim to short the top of the forming trend all the way to the bottom.

Generally, this trading strategy is carried out over days or even weeks.

For the trader with a good sense of analyzing trades who can analyze patterns and even detect possible support and resistance levels, it makes sense for them to focus on swing trading.

Since crypto goes up and down in waves, this strategy is all about finding the bottom and then riding it to the top usually with long positions.

Traders that effectively carryout swing trading using long and short positions always tend to do well, and they usually do little work.

However, with that said, the ability to detect patterns, stay calm, and the willingness to use loose stops will require some guts.

6. Position trading

This trading style is like a zoomed-out version of swing trading or even better, a trading version of investing.

Here the trader will try to build their position by taking long position low or even a short position high and then sticking to it for weeks, months, and even years.

It’s the simplest form of trading. However, it requires a lot of discipline.

Imagine an individual that has been long on BTC since it was at $4,000 or short since it was $18,000.

The price of bitcoin has moved to the low $4,000 from $20,000 and to the top of $13,000 from that $4,000 low.

In such a scenario, a disciplined trader calmly sat through both events, but there is a chance that they scaled out of some positions and even reopened new positions.

So, this trading strategy is more like investing since its long term, but it differs from the latter in that the end goal is making a killer long-term trade that is based on overarching trends.

Investing

For some reason investing is not the same as trading. Since trading involves taking positions with the goal of making profits.

But investing, on the other hand, is all about having ownership of an asset that stores value with the general goal of increasing the value of the asset over time.

Legendary investor Warren Buffet considers buying stock to owning a part of the company.

An individual that owns stocks of a fortune 500 company doesn’t aim to take profits when their value goes up, what they seek for is seeing more growth.

A real investor is a HODLer who doesn’t need to look at the price charts daily.

Who isn’t likely to set a stop loss. As long as the reason that made them invest in the asset in the first place is true, then they are likely to stick with it in the long run.

Two factors that drive the price of cryptocurrencies

1] Market volatility

This can take you by surprise if you are new to digital assets. It’s not uncommon to see swings of 20-30% in the value of a coin within a few days.

2] The technology behind the cryptocurrencies is new and evolving

The value of cryptocurrencies is driven by sentiment around the industry.

Since blockchain technology which powers virtual currencies is new and evolving, it acts as a critical factor that drives the volatility of the coins.

As the value of the technology to industries that are outside of the crypto market increases, so does the value of various currencies.

Conclusion

Contrary to what one might think, developing a crypto trading strategy alone doesn’t guarantee success.

However, by staying up to date on the changing market by feeding all the relevant news, and by implementing your strategy regularly, you stand to make informed decisions when executing trades.

Disclosure/Disclaimer: This article is paid for and produced by a third-party source and should not be viewed as an endorsement by ZyCrypto. Readers are urged to do their own research before investing or having anything to do with the company, goods and/or services mentioned in the above article.