We are glad to announce that we have signed a business partnership with Coinrule. Soon, Coinrule will be providing Daneel’s data to its users. Crypto traders will be able to monitor the market through Daneel’s streamlined news flow and get market insights such as trends and sentiment analysis. A first market sentiment indicator will be available by August.

Coinrule is a platform for building automated trading rules based on various market factors. The tool developed by Coinrule is intuitive and allows beginner and intermediary level users develop their strategies easily. Moreover, if users don’t feel like creating their own trading rules, they can pick template strategies proposed by the platform.

Cryptocurrency Trading

In trading, data is power. The more reliable your news and the faster you get it, the better. But in the crypto industry, this can sometimes still be not enough. Indeed, cryptomarkets are highly sensitive. In addition to technical analysis, social media can give great information to traders. The feelings expressed by the community on social media is an indication for the future market trends. FOMO (Fear of Missing Out), FUD (Fear, Uncertainty, and Doubt), Panic Selling and Greedy Buying are typical psychological patterns that have a significant impact on Cryptocurrencies prices every day.

Without long-standing records and the influences that regulate fiat trading activity, confidence in any cryptocurrency needs quantifying. And with in-depth research out of the questions for many impatient traders, automating the process of analyzing market sentiment is the natural answer.

Market sentiment indicator

Sentiment indicators track how bearish or bullish the market is regarding one or more coins. For decades now, in traditional financial markets, polls and surveys among consumers and manufacturers were considered the best leading indicator of the mood of investors. For example, two of the most closely watched monthly data releases are the PMI (Purchasing Managers’ Index), and the Consumer Confidence Survey.

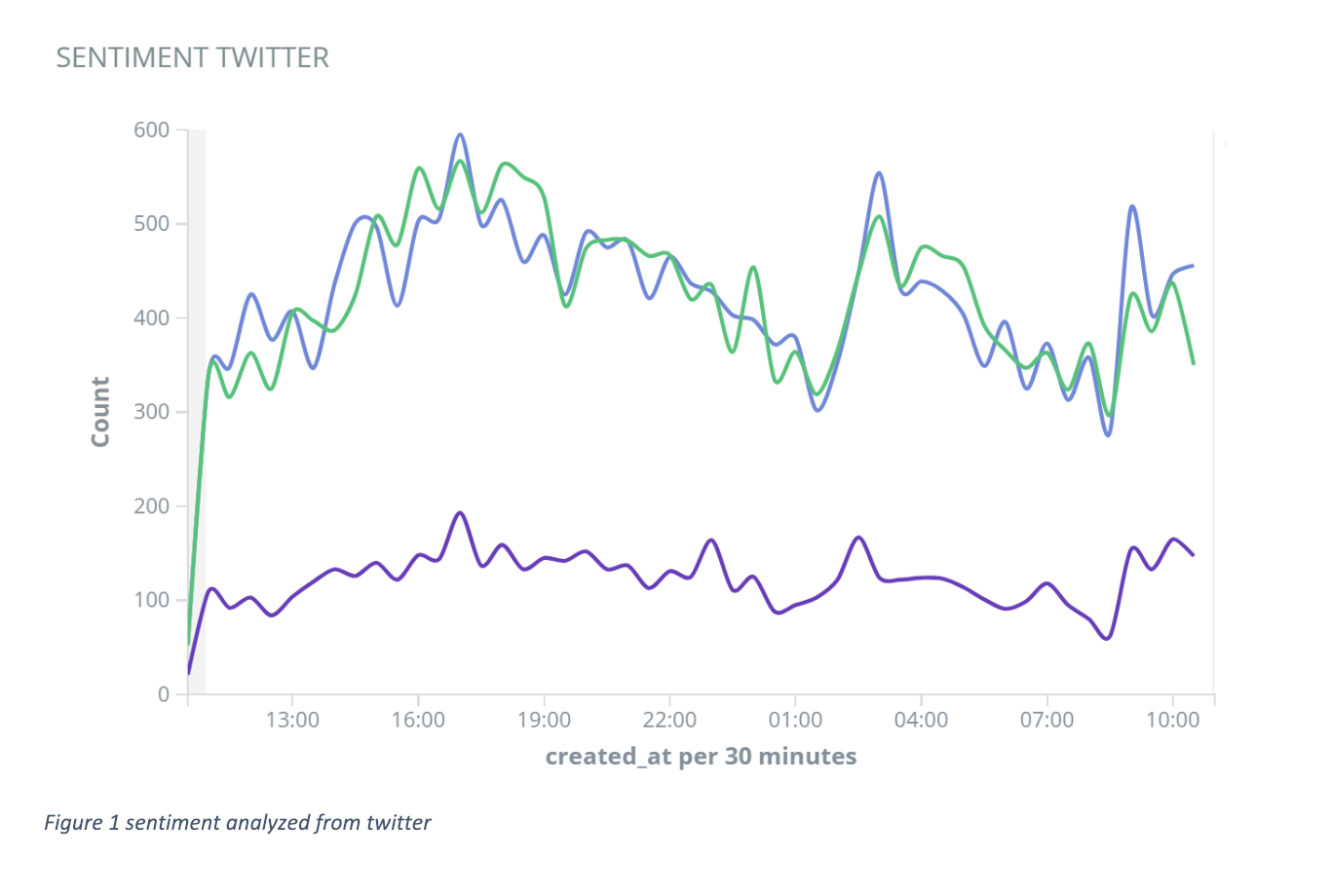

At a time where all the essential and price-sensitive news flows across social networks 24/7, using real-time analysis of these sentiments guarantees an instant snapshot of the mood of the market and that can be a valuable tool for any trader to take more precise decisions.

This is where Daneel comes in by computing a market sentiment grade for each cryptocurrency. To do so, the AI behind the system collects more than 2M data points from social platforms such as Twitter, Reddit, Bitcointalk, and Facebook. Then it evaluates the sentiments with Machine Learning algorithms and Natural Language Processing (NLP). Finally, that information is compiled and processed to create a market score related to a particular cryptocurrency or for the global market.

How to interpret market sentiment indicators?

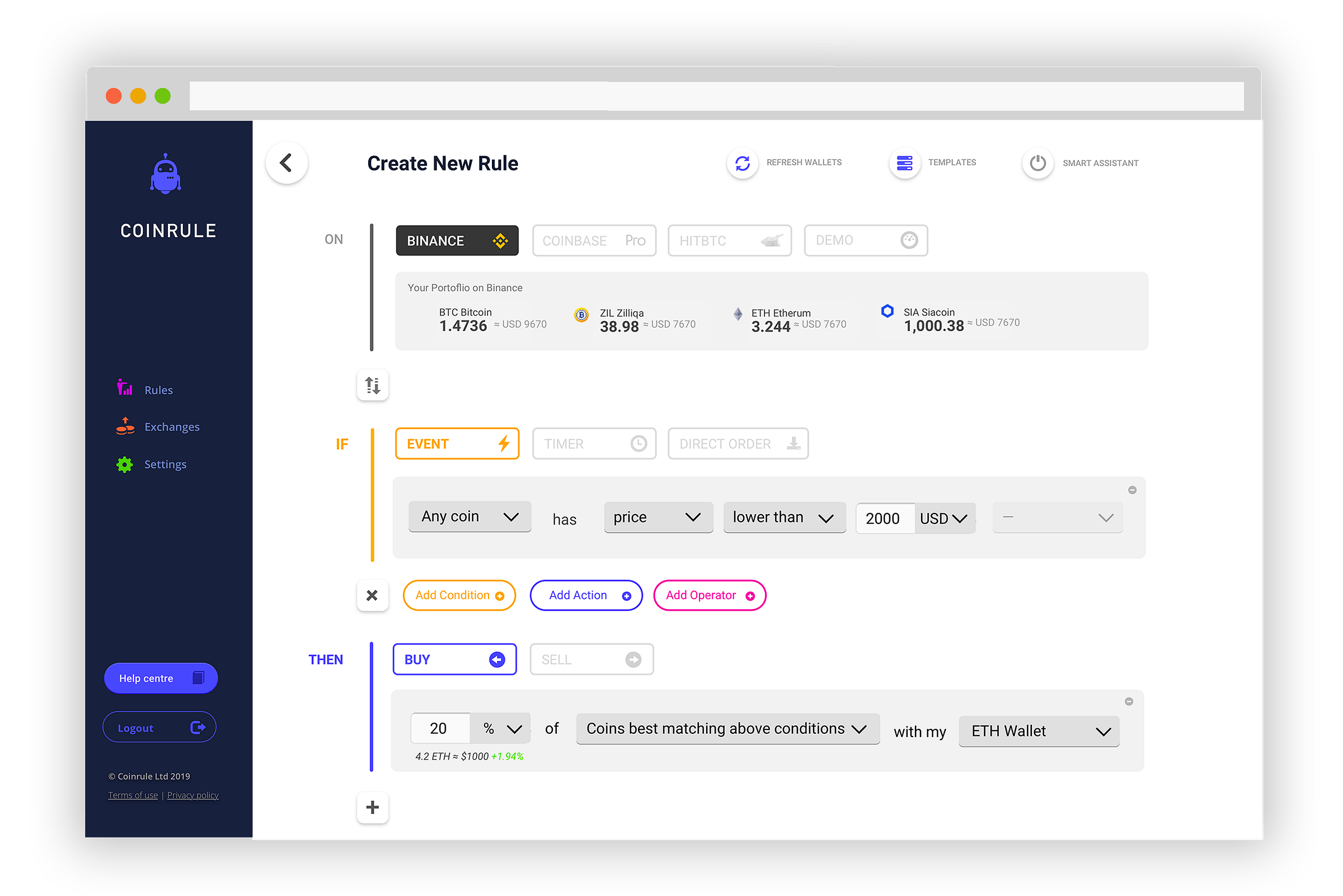

Using the Sentiment Analysis tools provided by Daneel, it will be simple to recognize when the market mood is positive or negative and to use that info to adjust your automated trading strategy. Coinrule’s users will be able to develop advanced automated trading strategies based on the sentiment of the market.

There will be a maximum level of flexibility for the rules. Example:

“BUY Bitcoin if the price is below 7000 USD, AND the Sentiment Score is POSITIVE.”

or

“SELL Bitcoin if the price increase is 5%, BUT the Sentiment Score is negative.”

The Sentiment Score can be used to validate a market view or a study based on technical analysis indicators, or it can be used as a contrarian indicator. Usually, just like the market price, also the market sentiment moves in cycles. Periods of excitement are followed by disillusion and then fear and despair with a direct impact on the price. Catching the times of extreme market sentiment is a smart way to anticipate market rallies and prevent price drops.

Conclusion

On one hand, this partnership illustrates Coinrule’s desire to propose a wide range of data and tools to its users, making their trading strategies more and more precise and giving its users an edge over other traders.

On the other hand, it illustrates Daneel’s leadership on market sentiment data. After Blackmoon and NapoleonX, Daneel signs a new key commercial partnership.