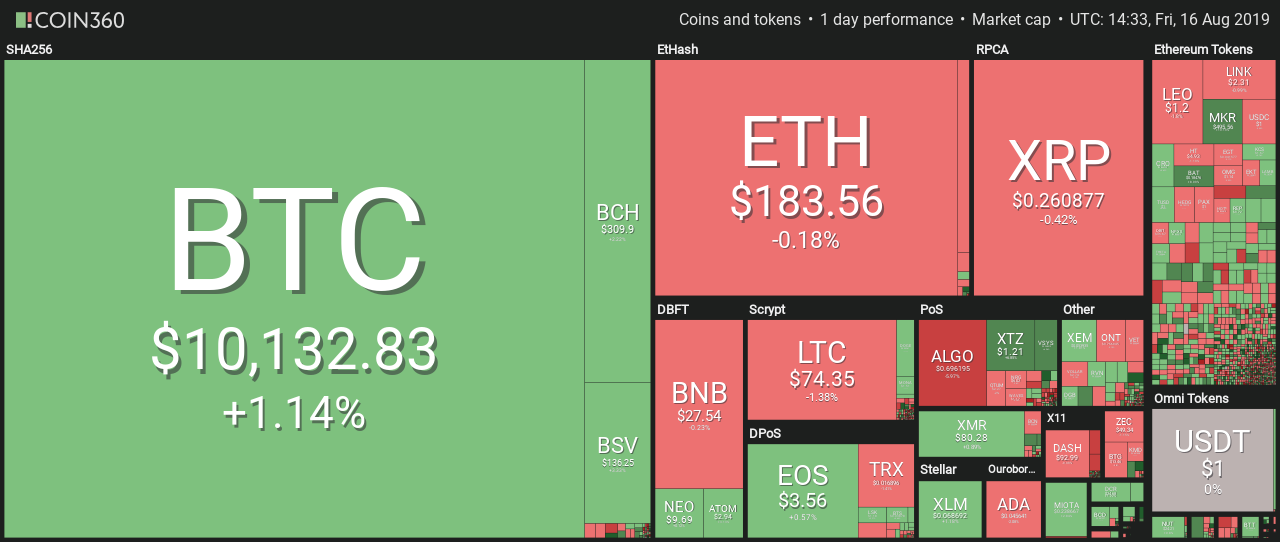

The market has in the last 24 hours changed trend and turned bullish. This follows a market plunge that saw more than $20 billion wiped out in a couple of hours.

The plunge saw Bitcoin crash below $10K, before finding support just above $9,600. Other top cryptocurrencies that suffered massive drops included Ethereum which dropped below $180 and XRP which tested the $0.26 support.

When these coins found their short-term bottom a reversal was expected almost immediately. Bitcoin began by bouncing back above $10K. This allowed it to secure this very important psychological support.

Bullish Or Bear Trap?

Although the climb back up was expected to be slow, Bitcoin has in the last few hours been showing aggression. In the early hours of Friday, Bitcoin was rallying as high as $10,400.

This raw potential has been alarming and simultaneously a sign that the next rally will be a big one. In a bullish case, this shows that investors have been accumulating during the recent dip. This drives prices up as demand increases.

In a more bearish case, this could be a bear trap and could be an attempt by the whales to create hype by buying more before eventually dumping when prices rally. The market has seen this before, making current movements very critical. In case the recent aggression has been driven by a bear trap, Bitcoin could suffer more losses and retest recent bottoms.

Despite recent dips and potential for a bear trap, sentiments remain bullish. For starters, Bitcoin has climbed back above its psychological bullish level. Trading volume has also spiked in the last 24 hours.

For Bitcoin, this has climbed above $21 billion. Dominance has also climbed above 68% since altcoins began bleeding two days ago. The top cryptocurrency is looking bullish for the mid-term and its rally will likely inspire altcoins to rally with it.

Brian Armstrong Talks About Institutional Investors

Coinbase CEO has also been offering positive news. Following the announcement of Coinbase acquiring XAPO, Armstrong has revealed that cryptocurrency demand from institutional investors has been on a high.

The CEO revealed that there is $200-400M a week in new crypto deposits coming in from institutional customers. This is strongly bullish and a signal that institutional investors are bullish on the future of crypto.