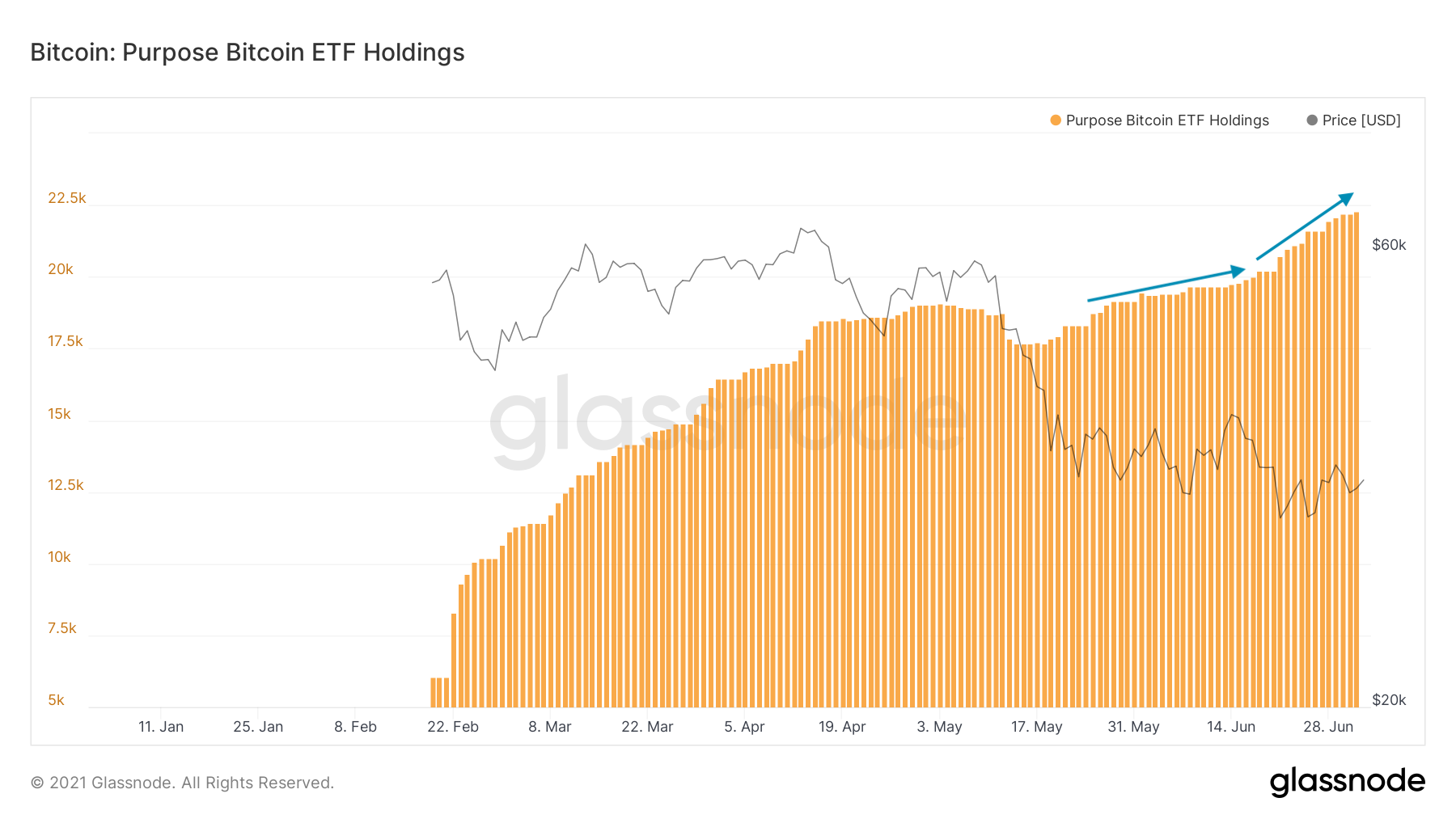

Institutional investors in Canada are accumulating more and more shares of the recently approved Bitcoin Exchange Traded Fund or ETF, which is creating more demand for Bitcoin. This is according to data released by Glassnode, which shows that the ETF has added nearly 30% of Bitcoin invested in it in less than two months.

The Purpose Bitcoin ETF, which was approved by Canadian financial regulators in February and is the first of its kind in the country and entire of North America, now has more than 20,000 Bitcoin invested by institutions. This is happening even as Bitcoin price has tanked by nearly half from its April high.

When it ignited, the ETF recorded a huge positive start with over $400 million in AUM invested in it, but then dropped sharply in mid-May when the crypto price started falling sharply from the April highs. However, the data from Glassnode proves that the ETF is now seeing renewed demand.

This means institutional investors are confident that the ETF serves their need for convenient and safe access to cryptocurrencies and exposure to Bitcoin investment, said the founder and CEO of Purpose ETF Som Seif. It also attests to the maturation of Bitcoin as an investment asset in North America.

The increased interest in ETF investments comes even as some officials in the US expressed frustration that the country was late in approving a Bitcoin ETF. Security Exchange Commissioner Hester Peirce said recently that the country would have approved “one or more” ETFs if standards were applied to it as are applied to other investment products.