In May, —no one knows exactly what day— the BTC community will witness its third “Halving”. This event will reduce the amount of bitcoin that goes into circulation every 10 minutes from 12.5 coins per block to 6.25, an event many believe will increase the price of Bitcoin.

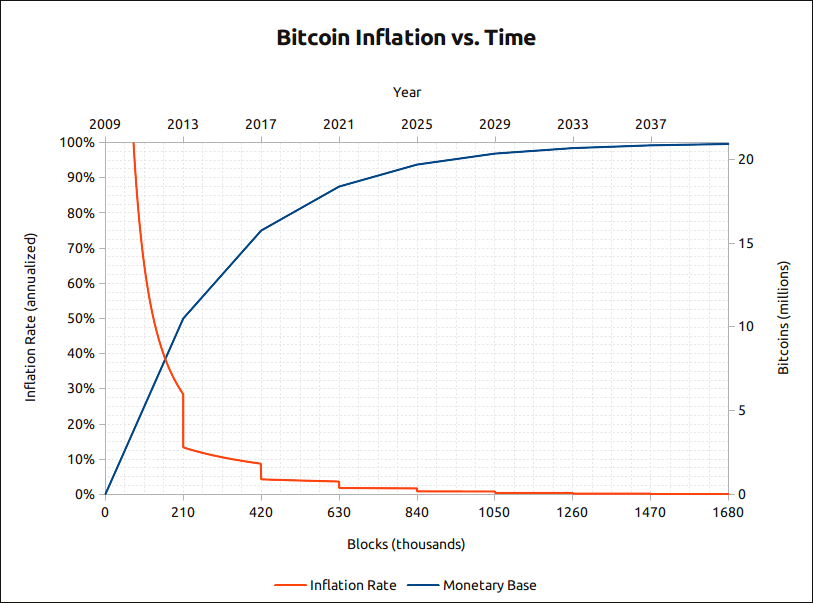

Miners have always been rewarded with a certain amount of bitcoin every time a new block is created. Initially, the rewards were 50 per block. This reward decreases every 210,000 blocks -approximately every 4 years- and will keep decreasing until the reward per block falls to 0, approximately by the year 2140.

The Bitcoin Hashrate experienced a 15.95% decline, wich its the second-largest decrease in history. These reductions in rewards have raised concerns about the future of the miners, some who share their enthusiasm for bitcoin don’t care about whether their earnings are lower than before, and will continue to explore in repose, while others simply don’t care about the tech but do care about the cash flow.

The halving could make mining less profitable by increasing hash rates, decreasing the number of miners who would operate the network, and even forcing many to close their farms and sell their BTC, looking for cash flow. This large supply, and little demand, would lower the price of the bitcoin along with the hash rates, driving a price drop known as a downward reset.

This may be happening in advance of the halving as Charlie Morris, Founder & Chairman ByteTree says:

“Miners sold 2,788 against 1,588 mined, Slamming the market and That is bullish.”

Data that can be checked through the Miner’s rolling inventory (MRI), created by ByteTree -crypto markets data company – to measure inventory fluctuations.

“MRI measures the changing bitcoin inventory levels held by the miners. An MRI above 100% means miners are selling more than they mine and running down inventory. Conversely, an MRI below 100% means the miners are hoarding bitcoins.”

The bitcoin will be issued over time in a programmed and controlled manner, so it will not experience the inflationary behavior of fiduciary coins.

Bitcoin was designed as a deflationary currency so that within a few years, as it decreases in issue and becomes more limited, it will increase in price, unlike the dollar which can be printed by the government with almost no limitations, causing inflation and decreasing the purchasing power of the people.

Bitcoin is currently priced at $6,199 and is undergoing a stinging drop, just like almost all assets in the financial market. So perhaps it would be a good idea to wait and see how bitcoin miners respond to the incoming halving.