Just so you know, if you bought bitcoin or mined and stored them since the start, by now, your holdings should have increased by over 838 million percent.

Apart from the founder, known as Satoshi Nakamoto, who until now has his bitcoin intact, we do not know anyone else who still has his bitcoins untouched for that long – over ten years.

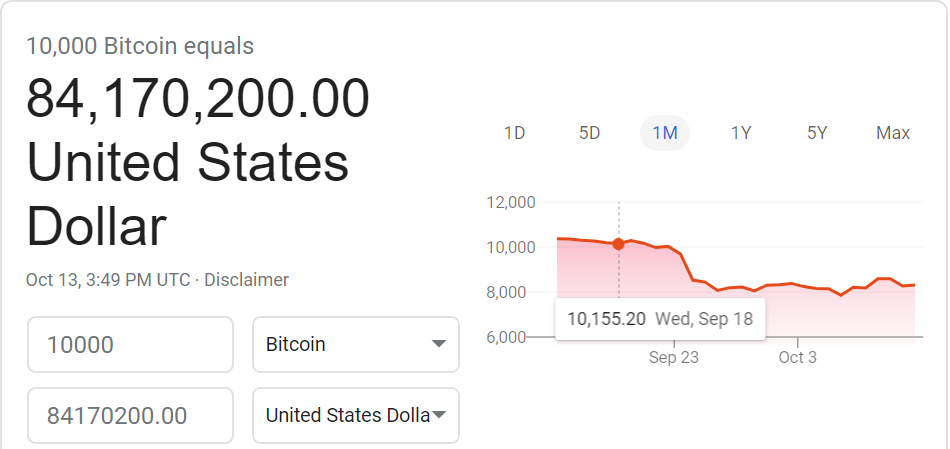

The first story we must have heard about bitcoin in his early days would be the Bitcoin for Pizza story. On the 22nd of May 2010, Laszlo Hanyecz was reported to have paid 10,000 BTCs for two Papa John’s pizza deliveries. By today’s value, that would be $84,170,200 for the pizzas.

However, Saifedean Ammous, a bitcoin enthusiast, who authored The Bitcoin Standard, brought something new to everyone’s notice of recent. He said that what we knew as the first transaction using bitcoin (BTC) really isn’t. According to him, 5,050 BTCs were sold for $5.02 in the first market transaction for bitcoin. Sharing the transaction details, Saifedean Ammous indicated that the said transaction would be worth $42,171,792.50 today.

Ten years ago today, 5,050 btc were sold for $5.02 in the first market transaction for bitcoin.

Today, they’d be worth $42,171,792.50.

A rise of 838,078,685%. https://t.co/yCvJ9TrrSn

— Saifedean Ammous (@saifedean) October 12, 2019

Bitcoin Survived It All

If there’s any cryptocurrency that has faced the most backlash, it would be bitcoin. Bitcoin has gotten strong adverse reactions from individuals, financial giants, and political leaders.

Jeremy Grantham, a co-founder of the GMO investment management, could be said to be one of those who have zero love for bitcoin. He called bitcoin a bubble. While referring to what a bubble is, Mr. Grantham said;

“Having no clear fundamental value and largely unregulated markets, coupled with a storyline conducive to delusions of grandeur, makes [Bitcoin] more than anything we can find in the history books the very essence of a bubble. Anyone around in 1999 and early 2000 has had an early primer on these signs.”

JPMorgan’s boss and the world-famous billionaire Warren Buffet isn’t left out as well. He called bitcoin a “bubble” several times. In one of his statements, Buffet said;

“You can’t value bitcoin because it’s not a value-producing asset…it’s a real bubble in that sort of thing. It doesn’t make sense. This thing is not regulated. It’s not under control. It’s not under the supervision [of] any…United States Federal Reserve or any other central bank. I don’t believe in this whole thing at all. I think it’s going to implode.”

That’s not all, the 63-year-old CEO of JPMorgan Chase, Jamie Dimon, has also referred to bitcoin has a “fraud,” which “stupid people” invests in. However, Mr. Dimon has since regretted his actions and taken back his words.

What’s Next For Bitcoin?

Despite the negativity around bitcoin, it has continued to grow. There have been several predictions around bitcoin too.

Out of many, John McAfee, American software developer turned crypto enthusiast, is well known for his positive predictions on bitcoin. Mr. McAfee predicts bitcoin to hit $1m before the end of 2020. He has also clarified his statement saying, he doesn’t mean bitcoin will be at $1m at the end of 2020, but meant that sometime in 2020, bitcoin would trade for $1m.

Also, Tim Draper, the famous American venture capital investor, predicted a $250,000 price value for bitcoin (BTC) by 2022. However, Mr. Draper believes that his prediction would still be tagged at “understating the power of bitcoin.”