Cryptocurrencies are not localized and are also not controlled by any particular bank or financial institution. For travelers who happen to change locations, possibly moving to regions with varying currencies, spending cryptocurrency could become a very convenient transaction model once the proper mechanisms are put in place. In this article, we will be considering how tap will transform international payments for the traveler.

First of all, let us explain what we mean by tap and how it applies to payment solutions.

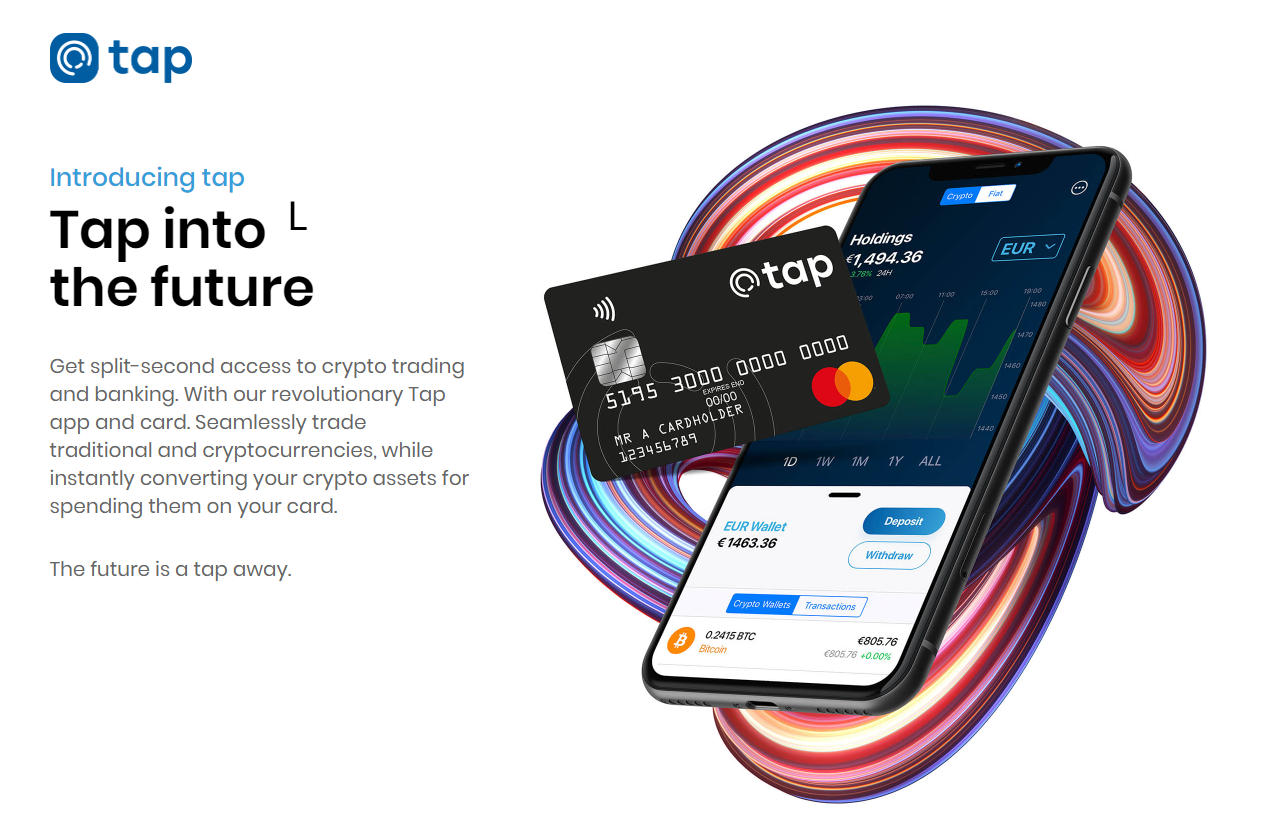

What is Tap?

In its simplest description, tap is a blockchain transaction settlement platform that enables cryptocurrency holders to spend their coins directly from their wallets at mainstream merchants. In essence, by using the tap app or card, anyone can actually make purchases online, in a supermarket, in a gas station or anywhere else without needing to convert their coins to local fiat.

This is a much-desired solution especially for travelers who have always struggled with local exchanges around their travel destinations. First of all, a traveler in an unfamiliar environment may not be very comfortable in looking for local exchanges. Also, the inconvenience of trying to change funds at every spending instant or across installments isn’t what a lot of people would fancy.

So with tap, a convenient solution has been devised that is powered by global settlement network, Mastercard. This system ensures that users’ transactions are executed seamlessly, ensuring secure and appropriate value exchange in real time. The system works across all top exchanges to achieve the best price for users when spending their cryptocurrencies. There is no restriction with regards to location when talking about how tap will transform international payments for the traveler.

Who Can Use tap?

Cryptocurrency application in most cases demands some significant knowledge of the internal workings of the ecosystem. This has been a discouraging factor when it comes to adoption and implementation of emerging technology. By regularizing the implementation processes, tap provides a system that can be easily adopted by any level of user.

- New Investor

People who are new to cryptocurrency are usually faced with the complex processes involved in going through exchanges to purchase coins of their choice. This barrier has been eliminated by tap as users can simply fund their cards directly with fiat and trade internally to purchase any crypto that they want.

- Familiar Investors

People who are conversant with how things happen in the cryptocurrency ecosystem understand that speed of execution could be the difference between profit and loss. Trades within the tap platform is executed within seconds. This guarantees that traders will not be stuck with chasing the market as a result of delays in the transaction.

- Crypto Adopters

People who want to hold crypto assets and build their portfolios are hereby provided with a secure and instantly accessible platform where their assets are held in cold storage and insured by Lloyd’s of London.

- Globetrotters

This is the group that is particularly concerned with this article. Using the tap app or card will enable a traveler to instantly convert cryptocurrency to any of the fiat currencies that is needed at a given point in time. This provides unmatched convenience and emphasizes how tap will transform international payments for the traveler.